Shareholders of E.W. Scripps would probably like to forget the past six months even happened. The stock dropped 22.5% and now trades at $2.14. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy E.W. Scripps, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we don't have much confidence in E.W. Scripps. Here are three reasons why SSP doesn't excite us and a stock we'd rather own.

Why Do We Think E.W. Scripps Will Underperform?

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ: SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

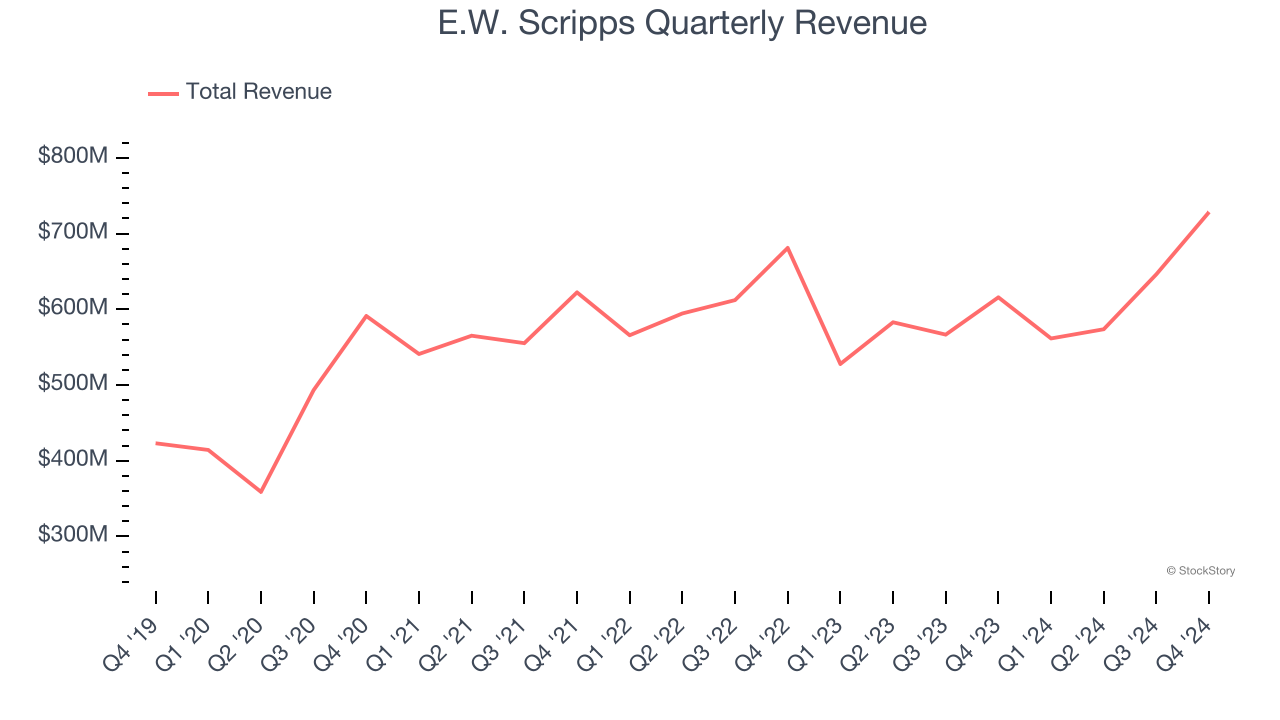

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, E.W. Scripps grew its sales at a 12.9% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

2. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict E.W. Scripps’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 12% for the last 12 months will decrease to 1.6%.

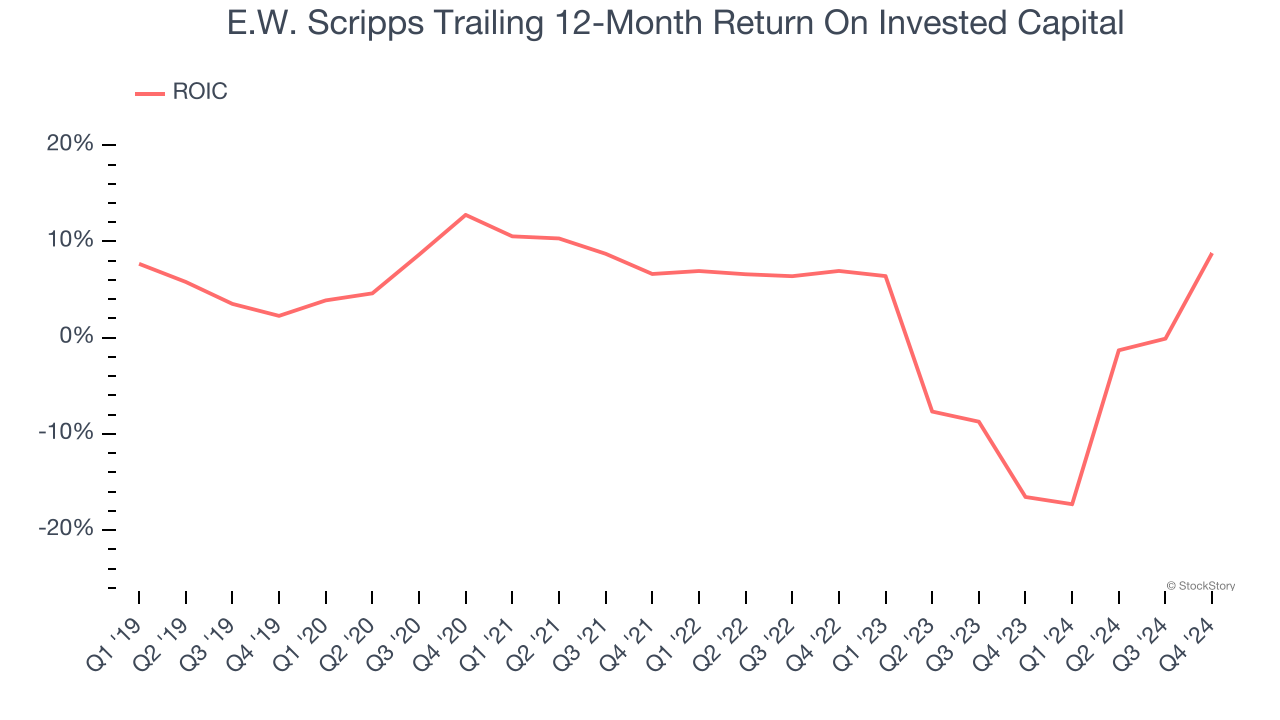

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, E.W. Scripps’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

E.W. Scripps doesn’t pass our quality test. Following the recent decline, the stock trades at 0.6× forward EV-to-EBITDA (or $2.14 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than E.W. Scripps

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.