Magnite has gotten torched over the last six months - since October 2024, its stock price has dropped 20.6% to $9.72 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy MGNI? Find out in our full research report, it’s free.

Why Is Magnite a Good Business?

Born from the 2020 merger of Rubicon Project and Telaria, Magnite (NASDAQ: MGNI) operates the world's largest independent sell-side advertising platform that automates the buying and selling of digital advertising inventory across all channels and formats.

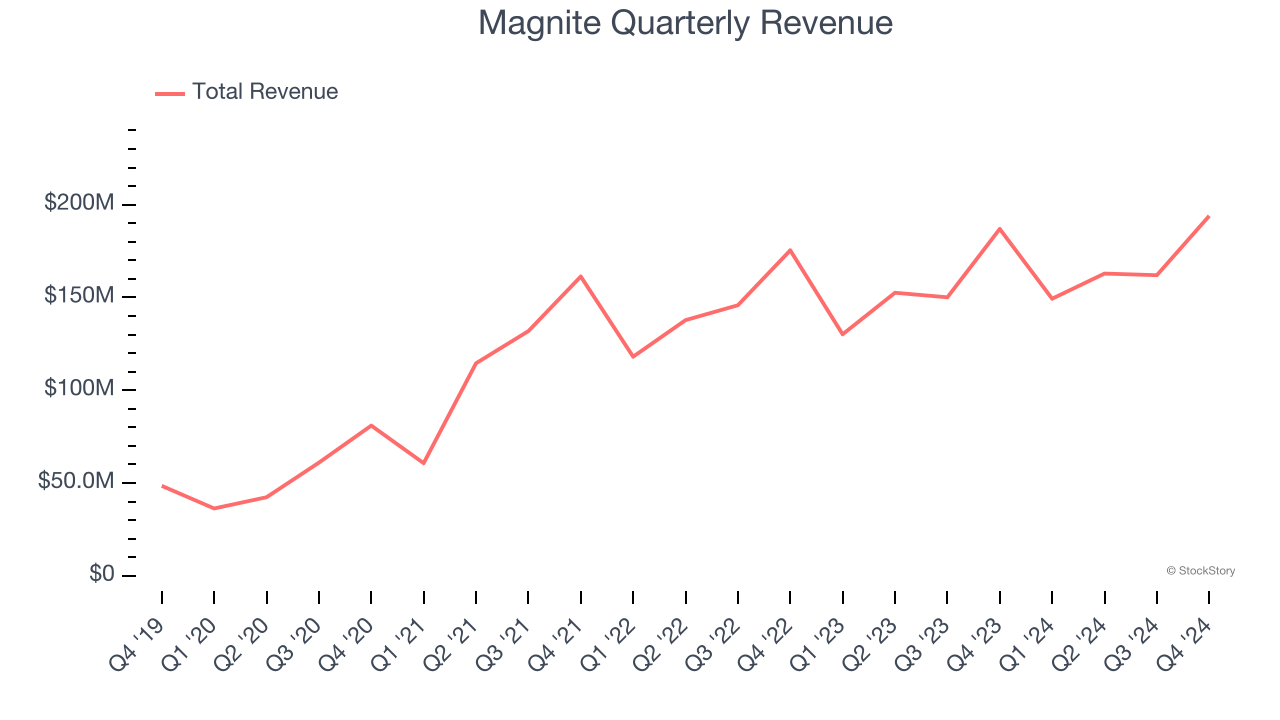

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Magnite’s 33.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average business services company and shows its offerings resonate with customers.

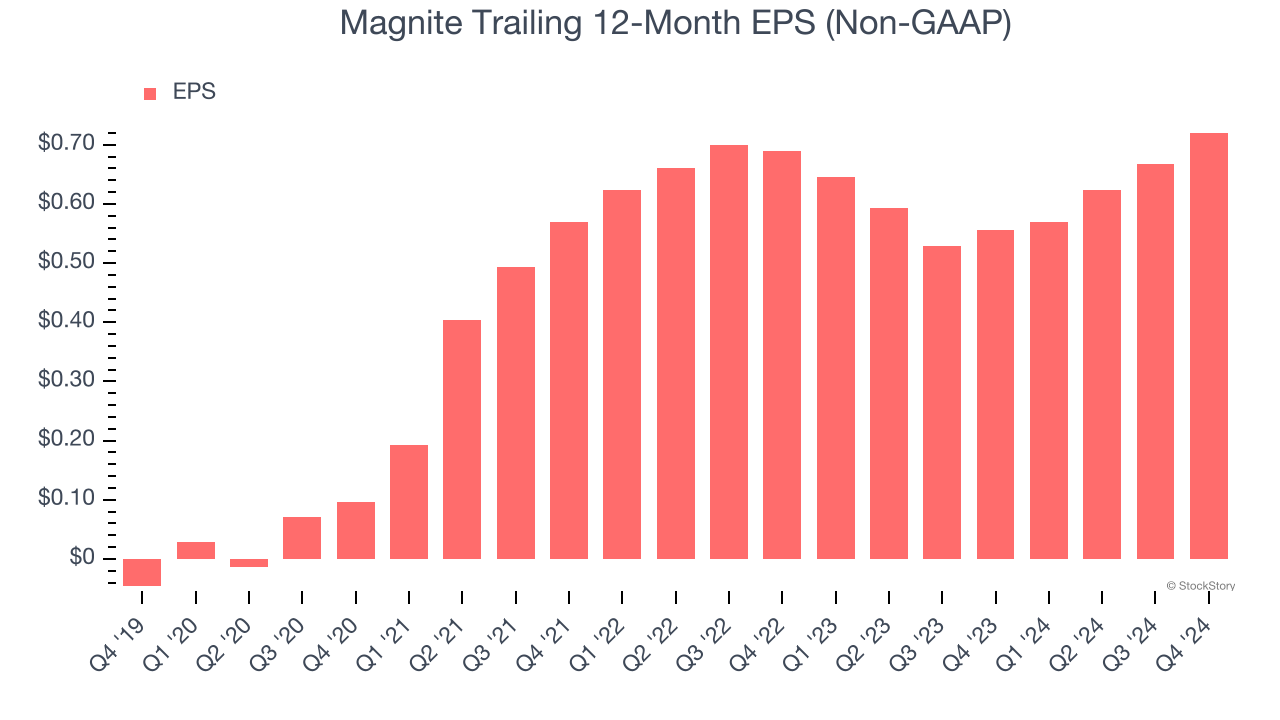

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Magnite’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

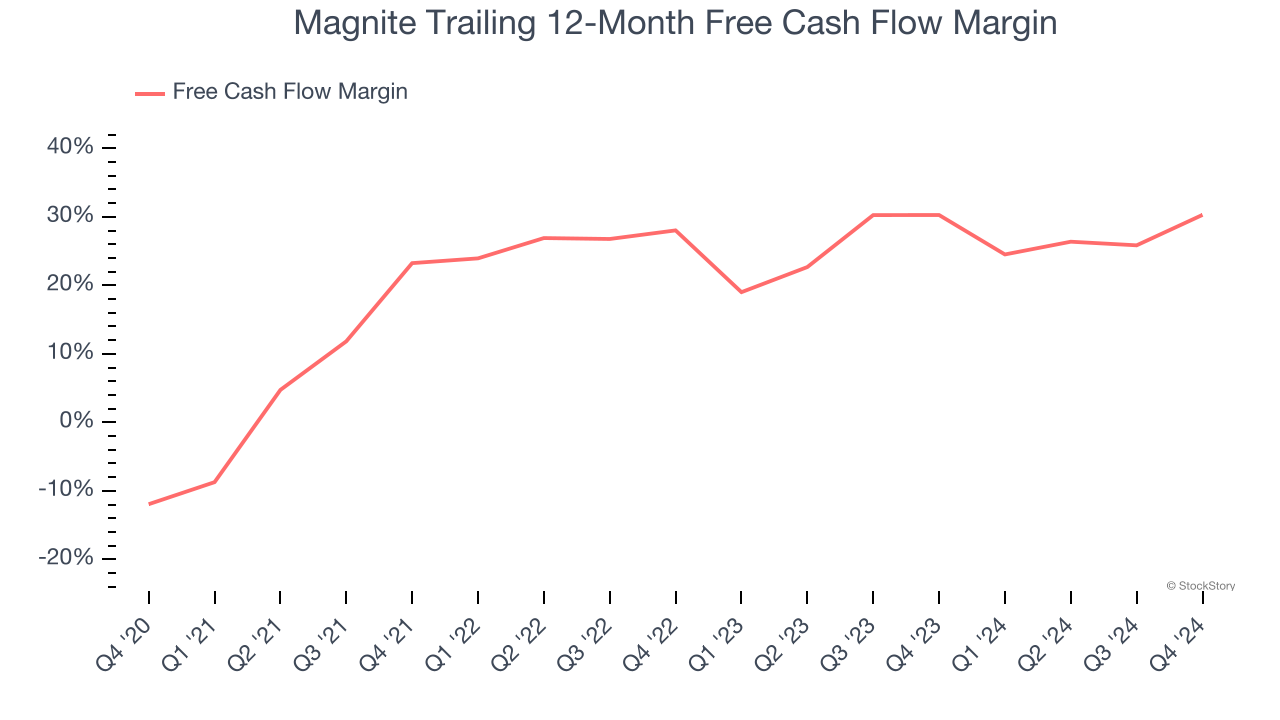

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Magnite has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 24.8% over the last five years.

Final Judgment

These are just a few reasons why we think Magnite is a great business. With the recent decline, the stock trades at 10.4× forward price-to-earnings (or $9.72 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Magnite

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.