WEBTOON has gotten torched over the last six months - since October 2024, its stock price has dropped 32.8% to $7.69 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now a good time to buy WBTN? Find out in our full research report, it’s free.

Why Does WEBTOON Spark Debate?

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ: WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

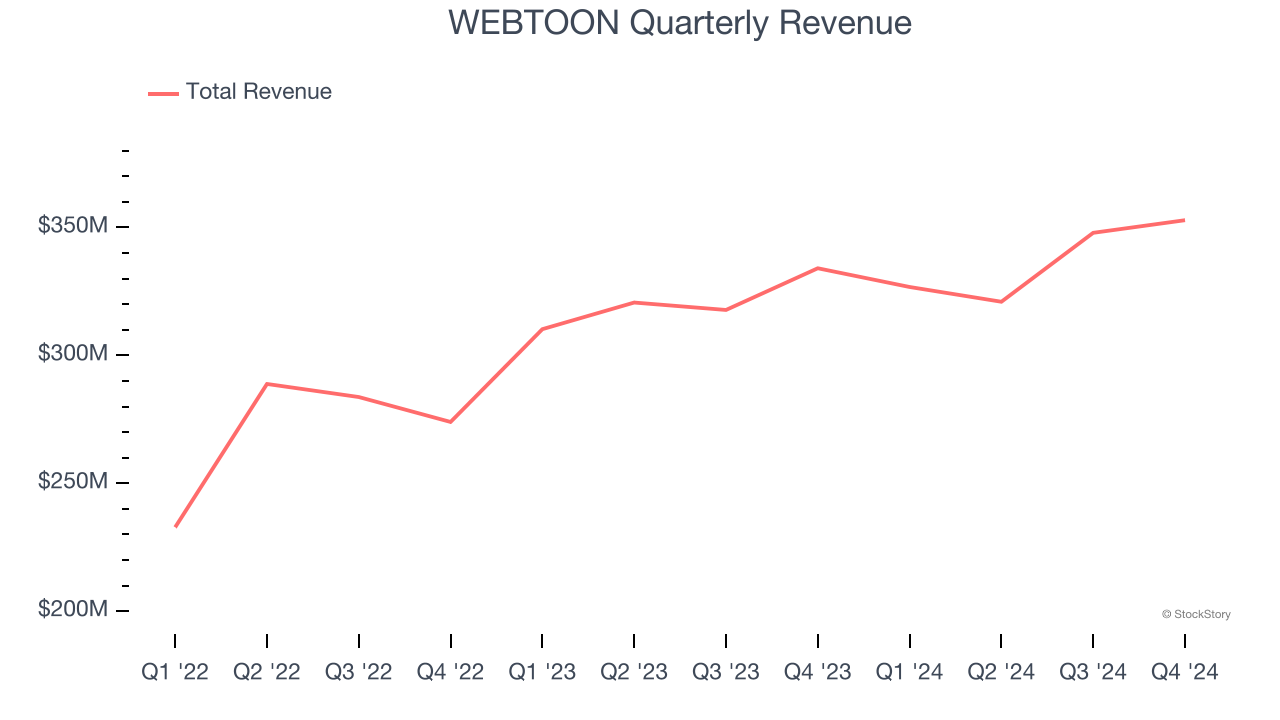

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, WEBTOON’s sales grew at an excellent 11.8% compounded annual growth rate over the last two years. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Outstanding Long-Term EPS Growth

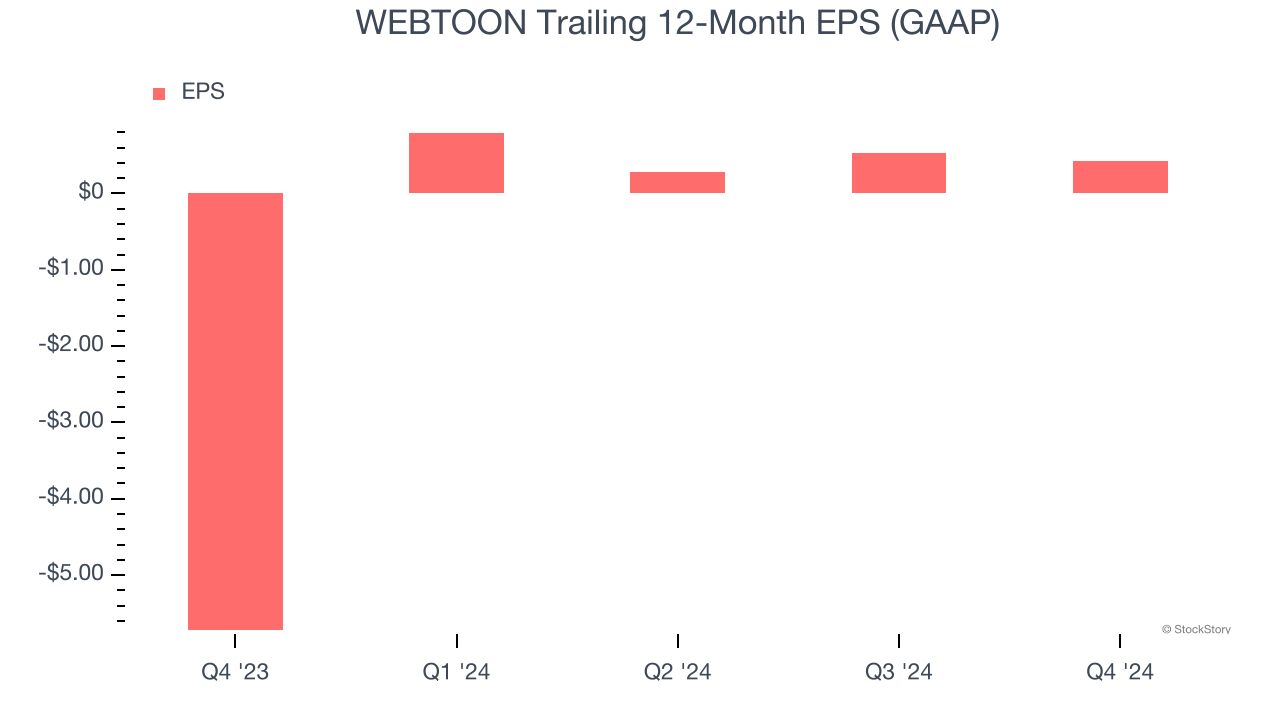

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

WEBTOON’s full-year EPS flipped from negative to positive over the last one years. This is a good sign and shows it’s at an inflection point.

One Reason to be Careful:

Decline in Monthly active users (MAU) Points to Weak Demand

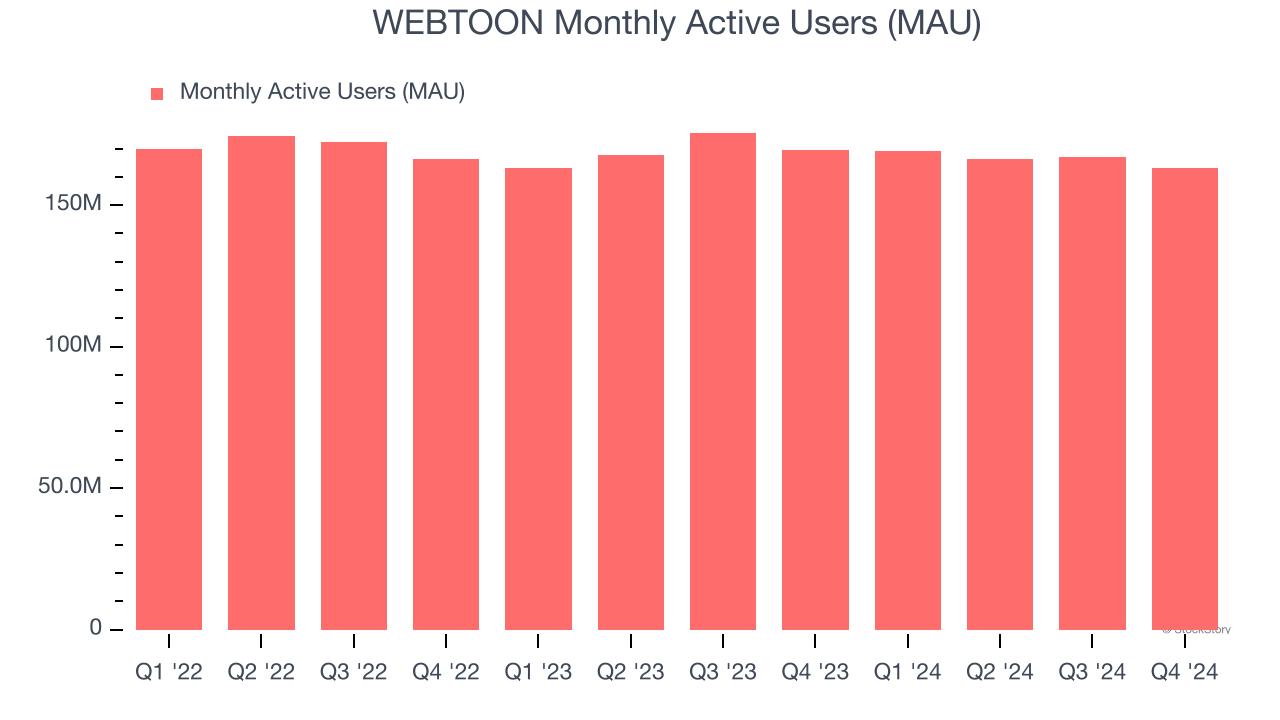

Revenue growth can be broken down into changes in price and volume (for companies like WEBTOON, our preferred volume metric is monthly active users (mau)). While both are important, the latter is the most critical to analyze because prices have a ceiling.

WEBTOON’s monthly active users (mau) came in at 163.3 million in the latest quarter, and over the last two years, averaged 1.2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests WEBTOON might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

Final Judgment

WEBTOON’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 8.2× forward EV-to-EBITDA (or $7.69 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than WEBTOON

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.