Furniture company Lovesac (NASDAQ: LOVE) reported Q4 CY2024 results beating Wall Street’s revenue expectations, but sales fell by 3.6% year on year to $241.5 million. The company expects next quarter’s revenue to be around $139 million, close to analysts’ estimates. Its GAAP profit of $2.13 per share was 13.7% above analysts’ consensus estimates.

Is now the time to buy Lovesac? Find out by accessing our full research report, it’s free.

Lovesac (LOVE) Q4 CY2024 Highlights:

- Revenue: $241.5 million vs analyst estimates of $230.2 million (3.6% year-on-year decline, 4.9% beat)

- EPS (GAAP): $2.13 vs analyst estimates of $1.87 (13.7% beat)

- Adjusted EBITDA: $53.87 million vs analyst estimates of $48.23 million (22.3% margin, 11.7% beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $725 million at the midpoint, beating analyst estimates by 0.8% and implying 6.5% growth (vs -2.8% in FY2025)

- EBITDA guidance for the upcoming financial year 2026 is $54 million at the midpoint, above analyst estimates of $49.65 million

- Operating Margin: 19.7%, up from 16.1% in the same quarter last year

- Free Cash Flow Margin: 16%, down from 19.8% in the same quarter last year

- Market Capitalization: $245.8 million

Company Overview

Known for its oversized, premium beanbags, Lovesac (NASDAQ: LOVE) is a specialty furniture brand selling modular furniture.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

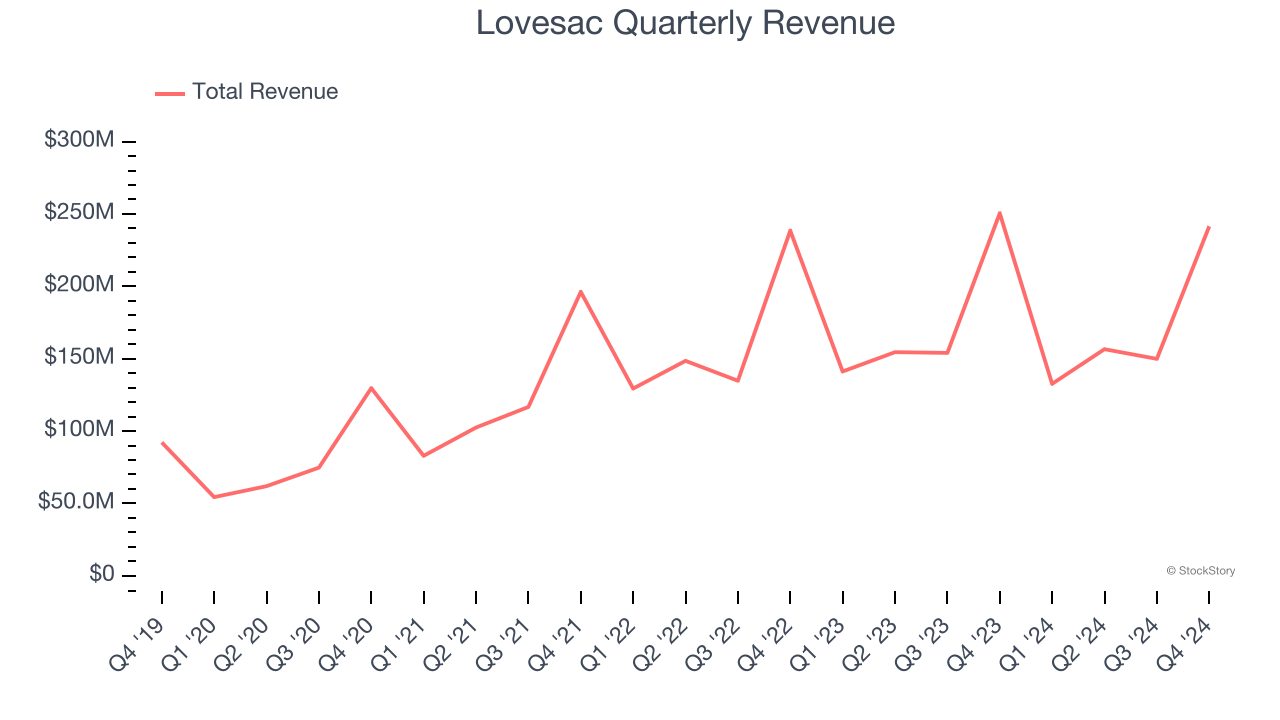

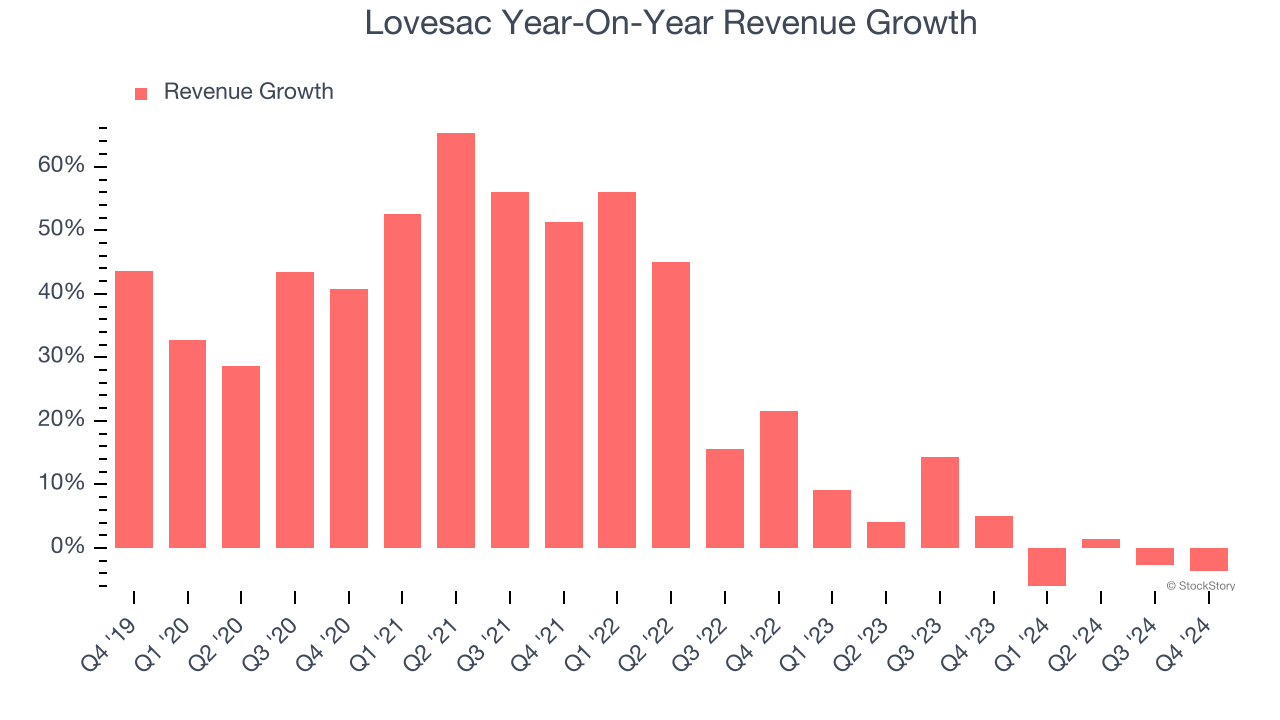

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Lovesac’s 23.9% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Lovesac’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.2% over the last two years was well below its five-year trend.

This quarter, Lovesac’s revenue fell by 3.6% year on year to $241.5 million but beat Wall Street’s estimates by 4.9%. Company management is currently guiding for a 4.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

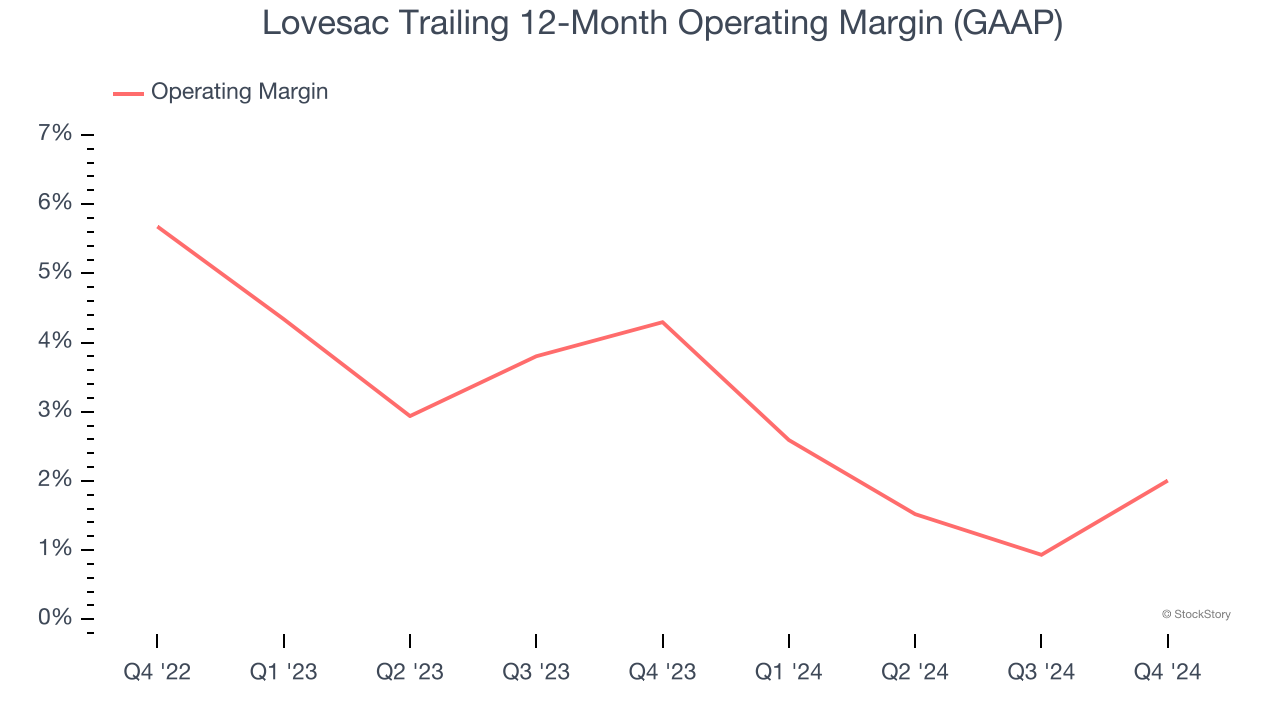

Lovesac’s operating margin has been trending down over the last 12 months and averaged 3.2% over the last two years. Although this result isn’t good, the company’s top-notch historical revenue growth suggests it ramped up investments to capture market share. We’ll keep a close eye to see if this strategy pays off.

This quarter, Lovesac generated an operating profit margin of 19.7%, up 3.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

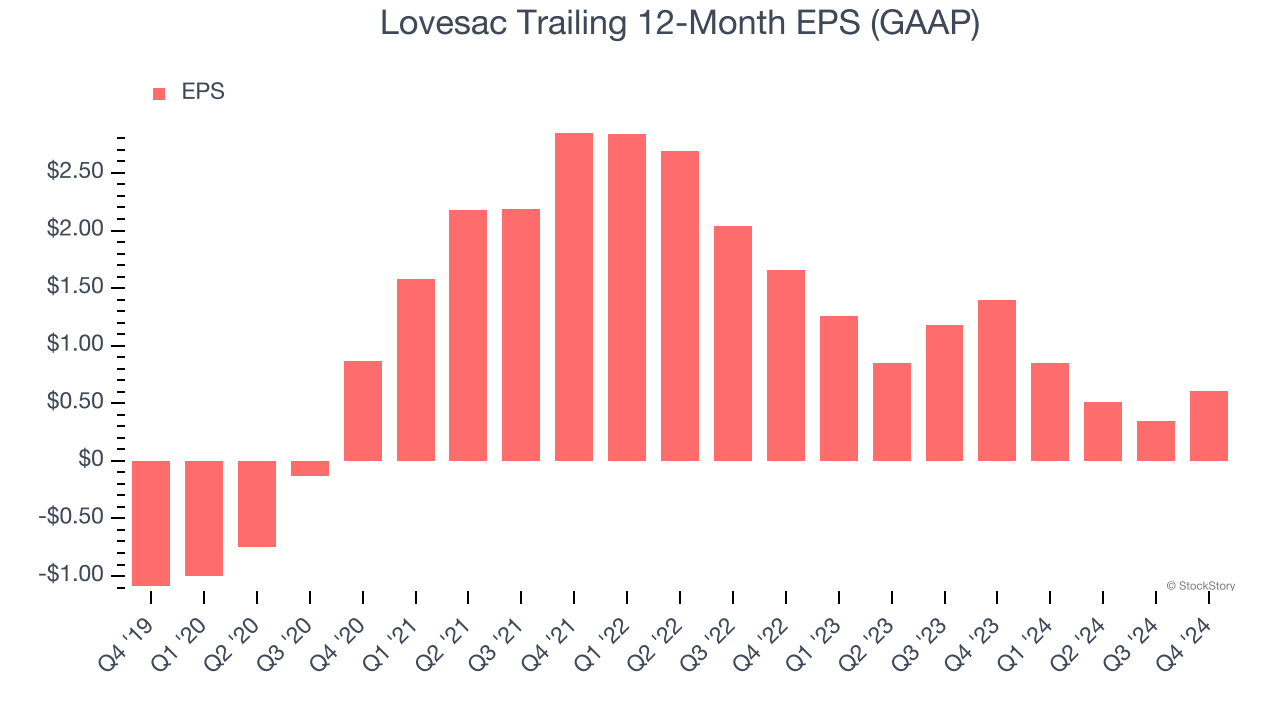

Lovesac’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Lovesac reported EPS at $2.13, up from $1.87 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lovesac’s full-year EPS of $0.60 to grow 72.4%.

Key Takeaways from Lovesac’s Q4 Results

It was impressive that the company beat across the board on revenue, EBITDA, and EPS despite a choppy macro. It was also great to see Lovesac’s full-year revenue and EBITDA guidance top analysts’ expectations. Overall, we think this was a very strong quarter with some key metrics above expectations. The stock traded up 9.7% to $17.45 immediately following the results.

Lovesac had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.