Non-lethal weapons company Byrna (NASDAQ: BYRN) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 57.3% year on year to $26.19 million. Its GAAP profit of $0.07 per share was in line with analysts’ consensus estimates.

Is now the time to buy Byrna? Find out by accessing our full research report, it’s free.

Byrna (BYRN) Q1 CY2025 Highlights:

- Revenue: $26.19 million vs analyst estimates of $26.15 million (57.3% year-on-year growth, in line)

- EPS (GAAP): $0.07 vs analyst estimates of $0.07 (in line)

- Adjusted EBITDA: $2.77 million vs analyst estimates of $1.46 million (10.6% margin, 90.4% beat)

- Operating Margin: 6.5%, up from -1% in the same quarter last year

- Market Capitalization: $375.5 million

Management CommentaryByrna CEO Bryan Ganz stated: “We delivered a strong start to the fiscal year with 57% revenue growth and our second-highest quarter ever, only 6% below our record $28 million Q4, despite Q1 traditionally being our slowest seasonal period. The strong results reflect continuing sales momentum, increasing adoption of less-lethal self-defense options, and rising brand visibility. As expected, January sales softened due to post-holiday consumer fatigue and waning consumer confidence; however, we saw daily sales improve month-over-month in both February and March. Looking ahead, we believe our performance will continue to be supported by Byrna’s expanding retail footprint, growing Amazon presence, and sustained awareness-building efforts – all of which lay the groundwork for the upcoming Compact Launcher release.

Company Overview

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ: BYRN) is a provider of non-lethal weapons.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

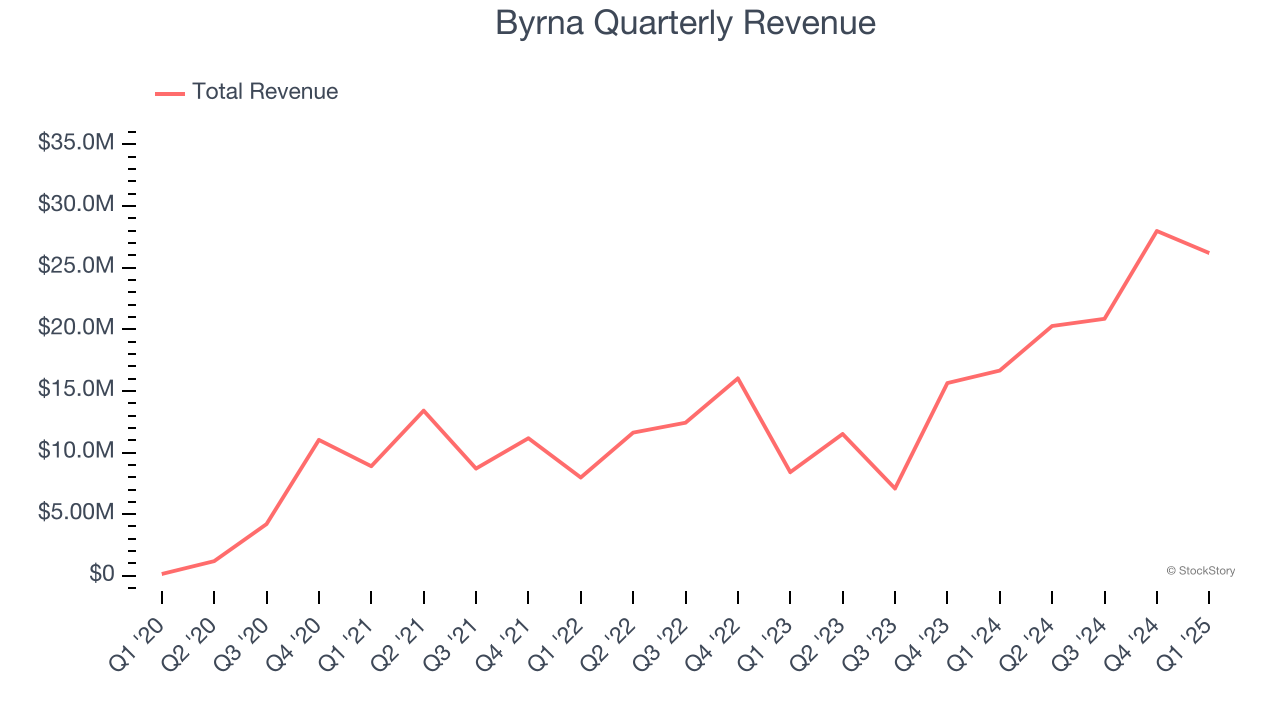

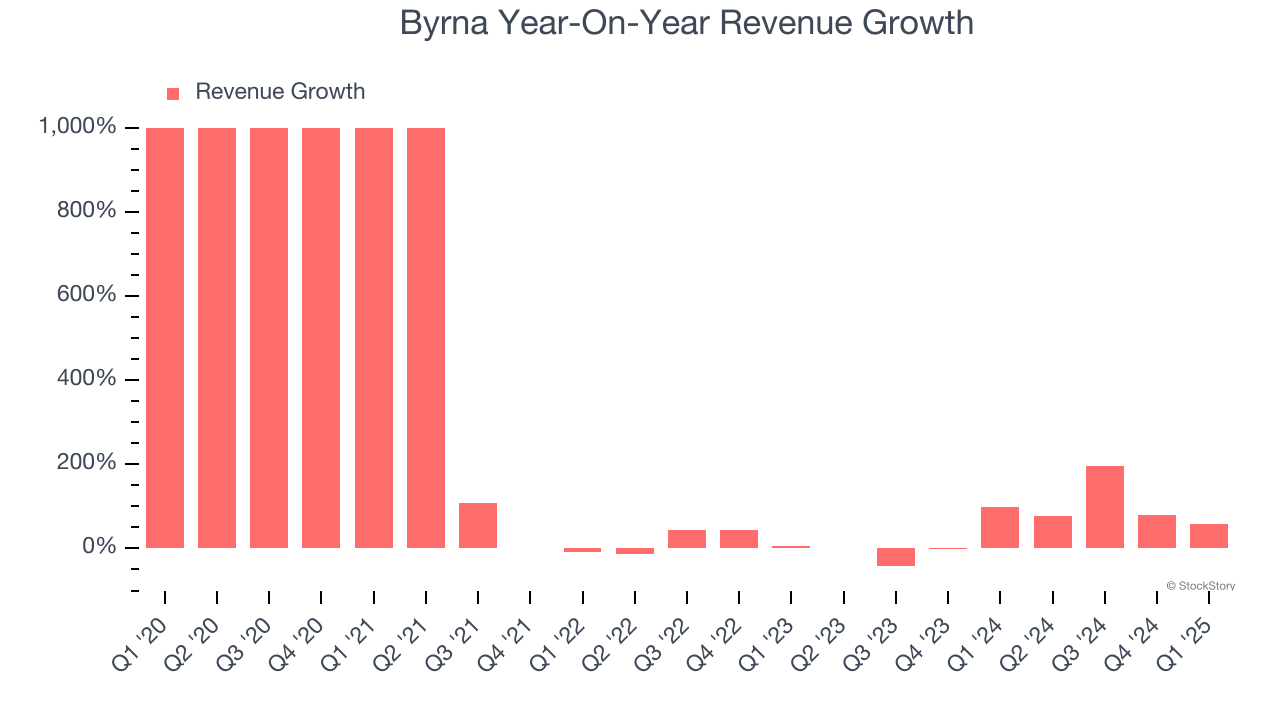

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Byrna’s sales grew at an incredible 146% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Byrna’s annualized revenue growth of 40.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand. We note Byrna isn’t alone in its success as the Law Enforcement Suppliers industry experienced a boom, with many similar businesses also posting double-digit growth.

This quarter, Byrna’s year-on-year revenue growth of 57.3% was magnificent, and its $26.19 million of revenue was in line with Wall Street’s estimates.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Byrna could be a hidden gem because it doesn’t get attention from professional brokers.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

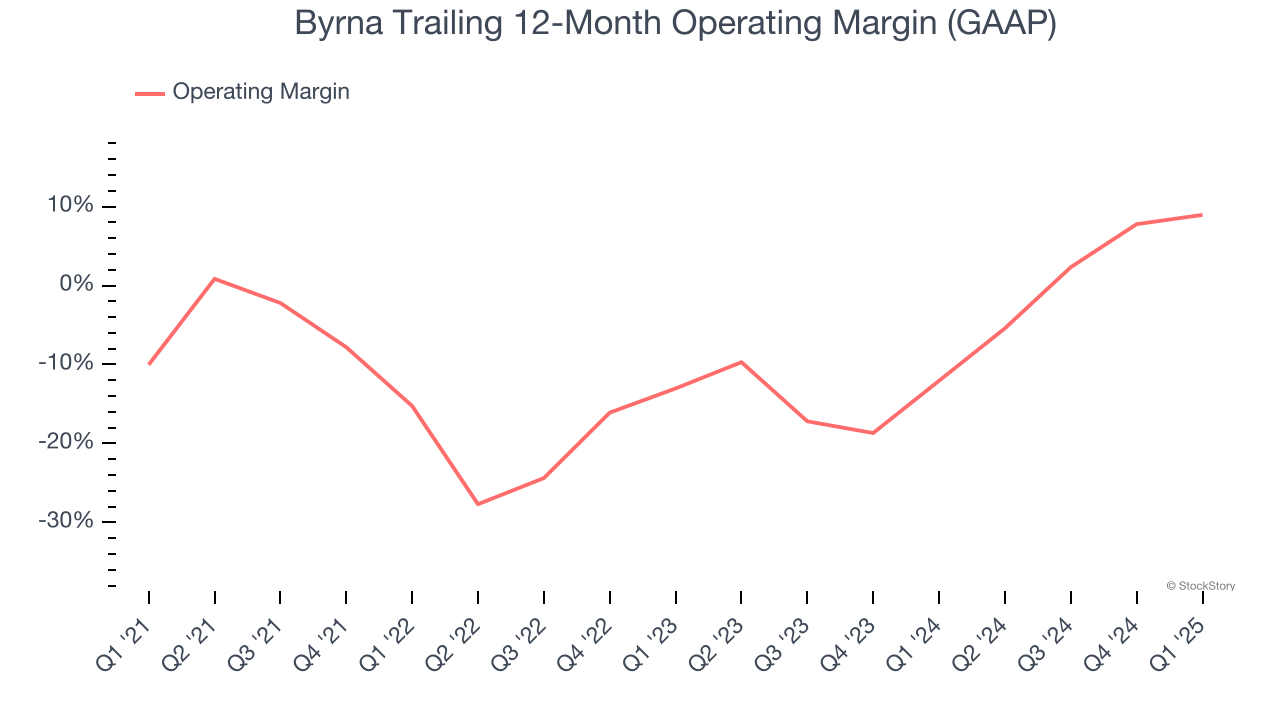

Operating Margin

Although Byrna was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 4.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Byrna’s operating margin rose by 19 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Byrna generated an operating profit margin of 6.5%, up 7.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

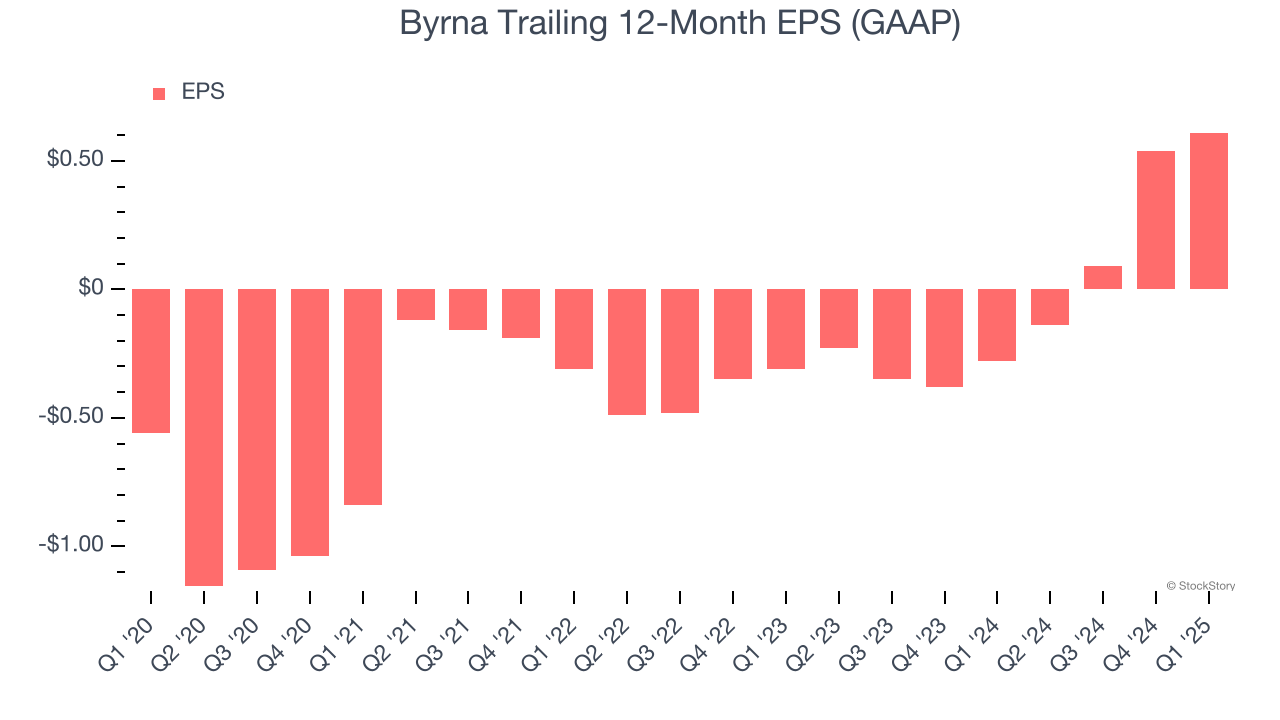

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Byrna’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Byrna, its two-year annual EPS growth of 99.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Byrna reported EPS at $0.07, up from $0 in the same quarter last year. This print was close to analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Byrna could be a hidden gem because it doesn’t have much coverage among professional brokers.

Key Takeaways from Byrna’s Q1 Results

We were impressed by how significantly Byrna blew past analysts’ EBITDA expectations this quarter. Overall, we think this was still a solid quarter. The stock traded up 2.5% to $17 immediately after reporting.

Byrna put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.