Shareholders of B&G Foods would probably like to forget the past six months even happened. The stock dropped 23.6% and now trades at $5.99. This might have investors contemplating their next move.

Is there a buying opportunity in B&G Foods, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on B&G Foods for now. Here are three reasons why there are better opportunities than BGS and a stock we'd rather own.

Why Do We Think B&G Foods Will Underperform?

Started as a small grocery store in New York City, B&G Foods (NYSE: BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

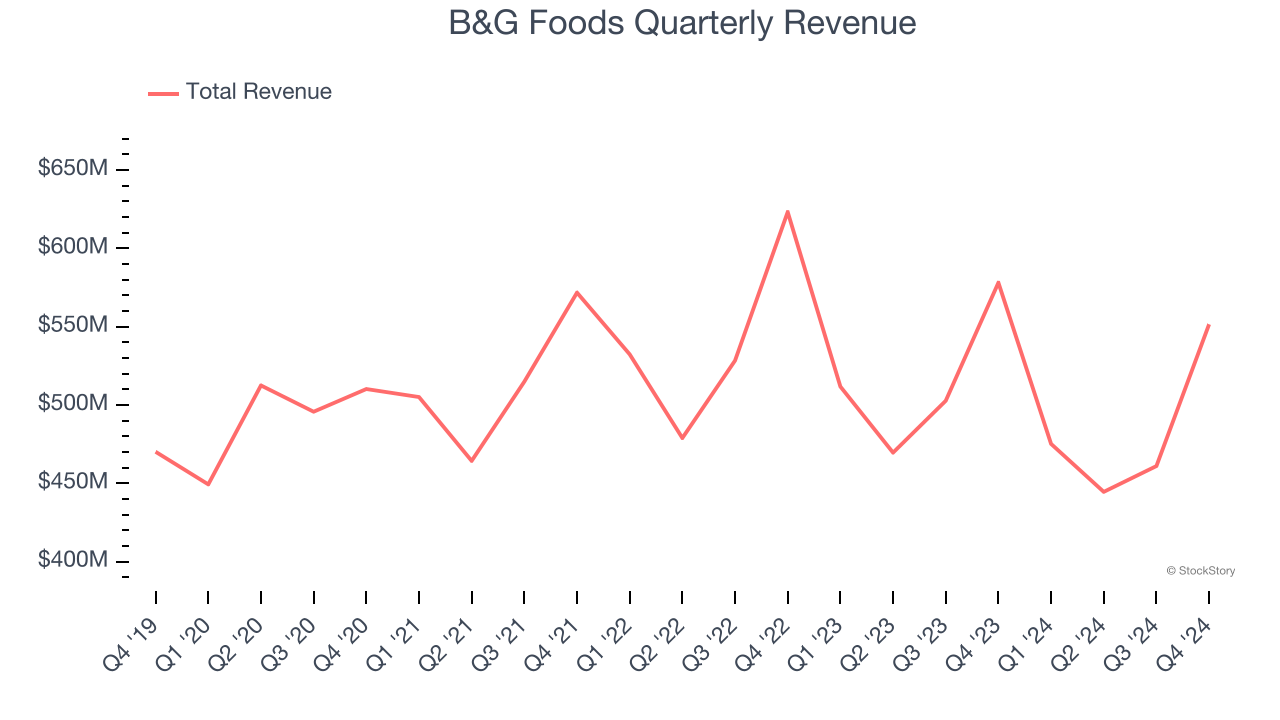

1. Revenue Spiraling Downwards

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. B&G Foods struggled to consistently generate demand over the last three years as its sales dropped at a 2% annual rate. This was below our standards and is a sign of poor business quality.

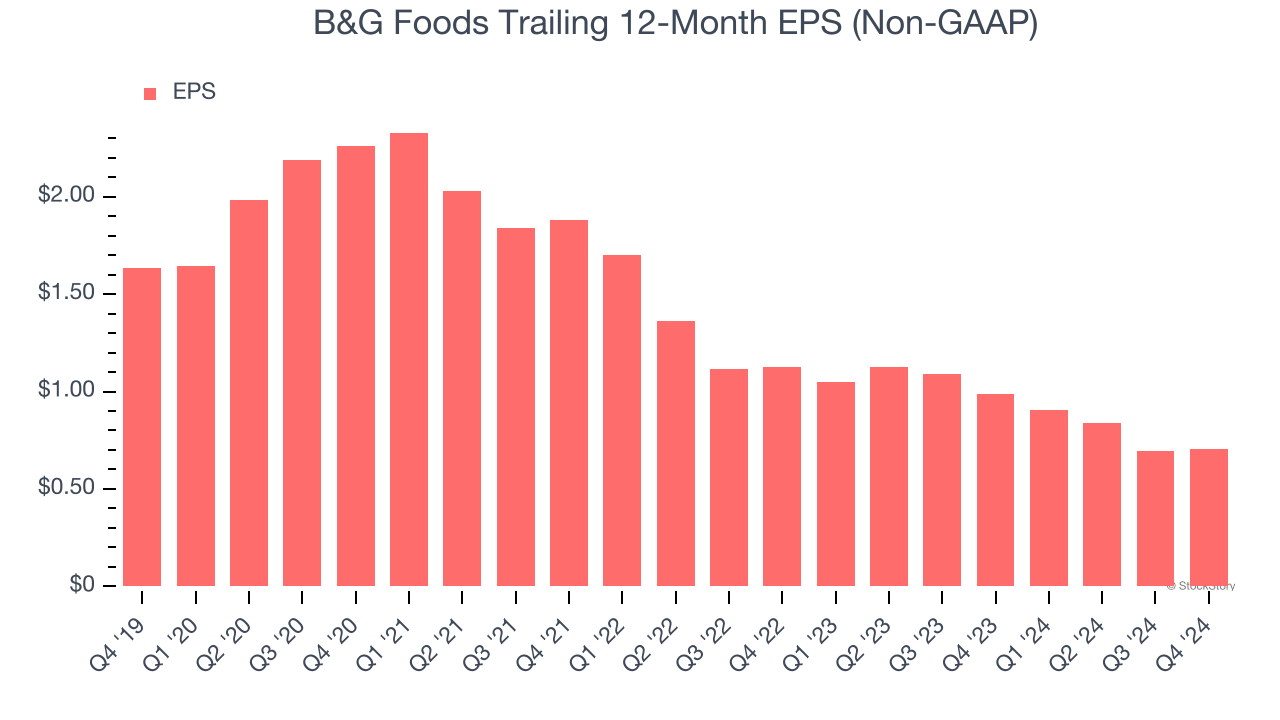

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for B&G Foods, its EPS declined by 27.9% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

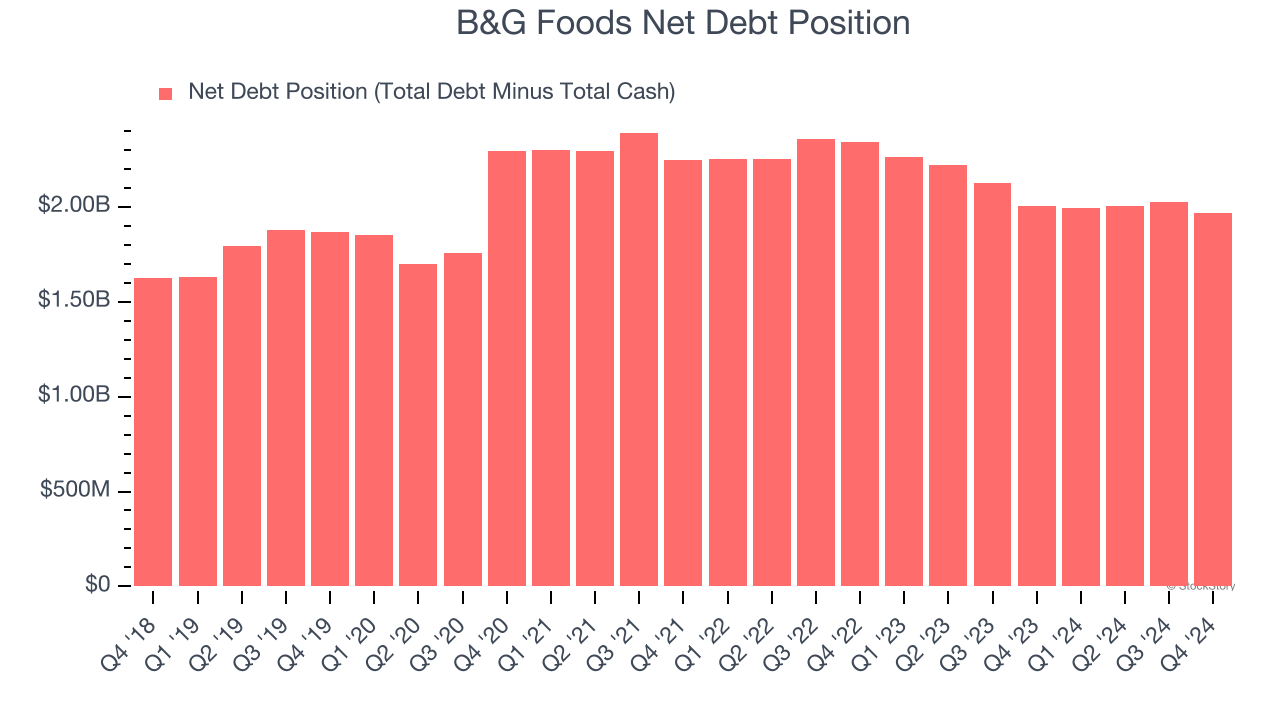

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

B&G Foods’s $2.02 billion of debt exceeds the $50.58 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $295.4 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. B&G Foods could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope B&G Foods can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

B&G Foods falls short of our quality standards. After the recent drawdown, the stock trades at 8.8× forward price-to-earnings (or $5.99 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of B&G Foods

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.