Let’s dig into the relative performance of Texas Instruments (NASDAQ: TXN) and its peers as we unravel the now-completed Q4 analog semiconductors earnings season.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.7% since the latest earnings results.

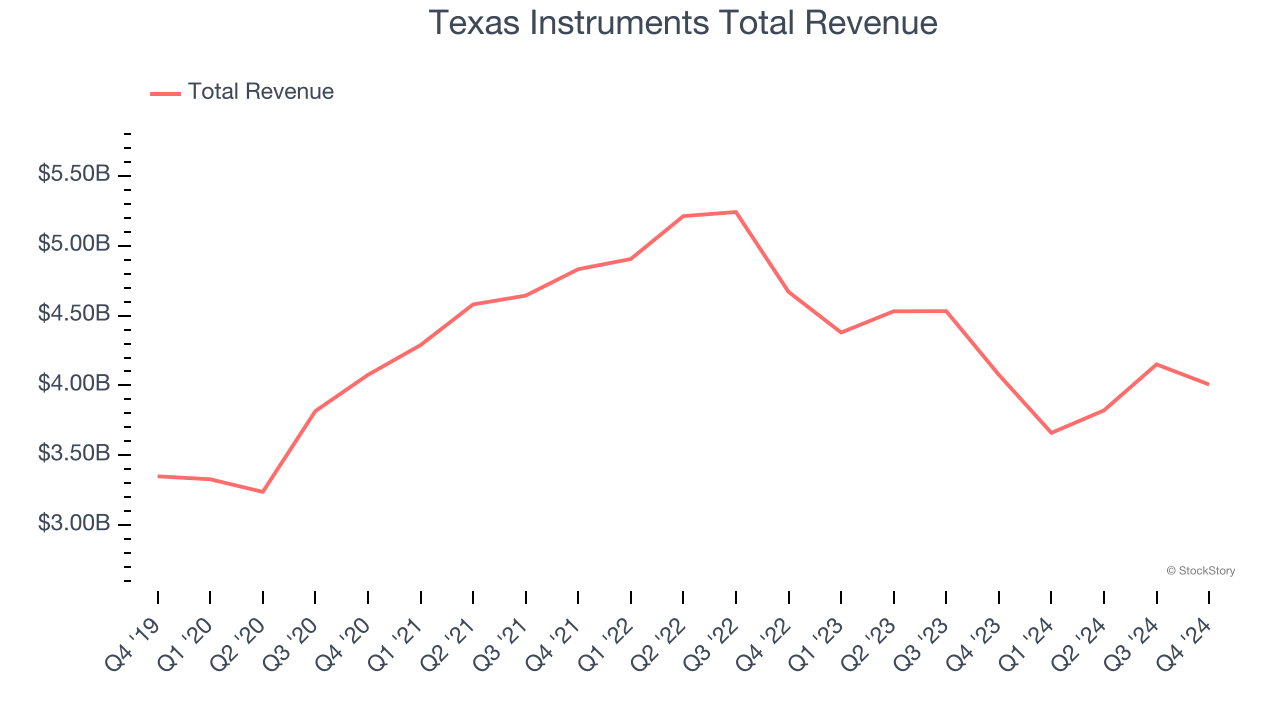

Texas Instruments (NASDAQ: TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.01 billion, down 1.7% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 10.3% since reporting and currently trades at $179.92.

Is now the time to buy Texas Instruments? Access our full analysis of the earnings results here, it’s free.

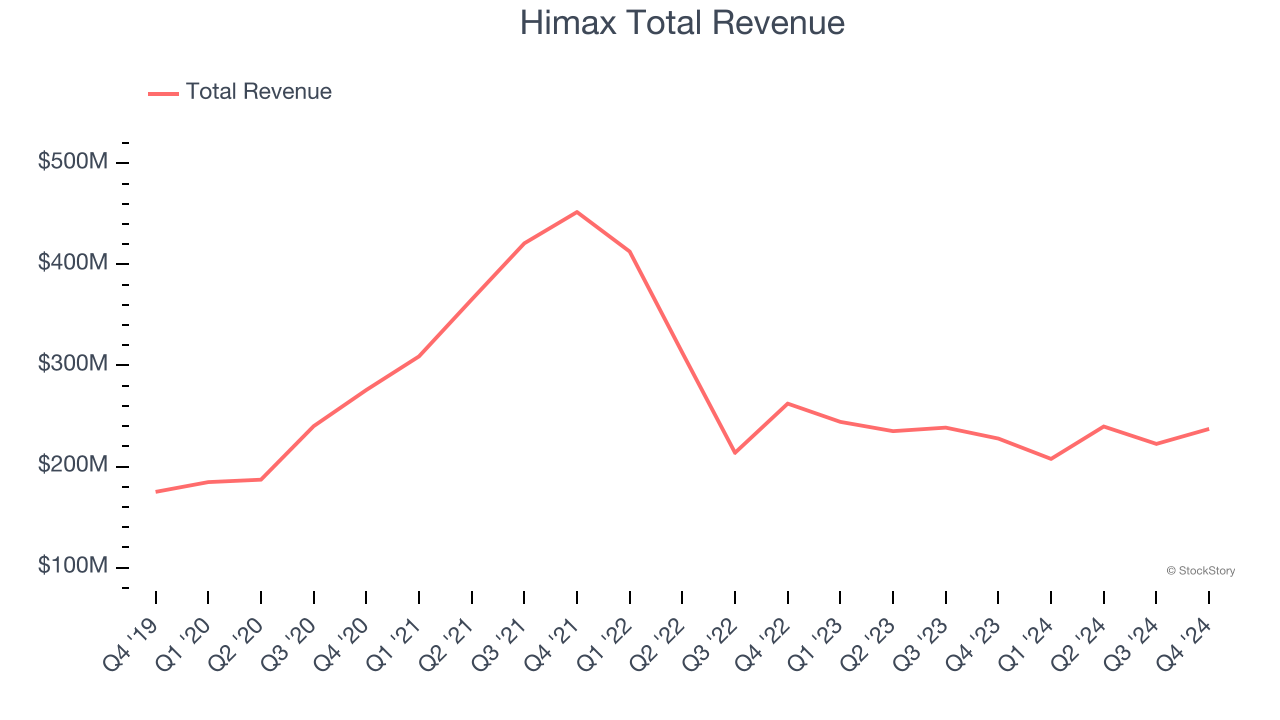

Best Q4: Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $237.2 million, up 4.2% year on year, outperforming analysts’ expectations by 7.3%. The business had a stunning quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 2.5% since reporting. It currently trades at $9.35.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $714.7 million, down 9% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Interestingly, the stock is up 3.6% since the results and currently trades at $17.21.

Read our full analysis of Vishay Intertechnology’s results here.

Magnachip (NYSE: MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE: MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $63.04 million, up 24% year on year. This print surpassed analysts’ expectations by 2.4%. It was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 1.5% since reporting and currently trades at $4.11.

Read our full, actionable report on Magnachip here, it’s free.

onsemi (NASDAQ: ON)

Spun out of Motorola in 1999 and built through a series of acquisitions, onsemi (NASDAQ: ON) is a global provider of analog chips specializing in autos, industrial applications, and power management in cloud data centers.

onsemi reported revenues of $1.72 billion, down 14.6% year on year. This number lagged analysts' expectations by 1.8%. Overall, it was a disappointing quarter as it also recorded a significant miss of analysts’ EPS estimates.

The stock is down 15.2% since reporting and currently trades at $43.42.

Read our full, actionable report on onsemi here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.