Global agribusiness company Bunge Global (NYSE: BG) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 71.6% year on year to $22.16 billion. Its non-GAAP profit of $2.27 per share was 15.3% above analysts’ consensus estimates.

Is now the time to buy Bunge Global? Find out by accessing our full research report, it’s free for active Edge members.

Bunge Global (BG) Q3 CY2025 Highlights:

- Revenue: $22.16 billion vs analyst estimates of $25.56 billion (71.6% year-on-year growth, 13.3% miss)

- Adjusted EPS: $2.27 vs analyst estimates of $1.97 (15.3% beat)

- Adjusted EBITDA: $998 million vs analyst estimates of $840.4 million (4.5% margin, 18.8% beat)

- Adjusted EPS guidance for the full year is $7.45 at the midpoint, beating analyst estimates by 2.5%

- Operating Margin: 1.7%, in line with the same quarter last year

- Free Cash Flow Margin: 1.7%, down from 7.5% in the same quarter last year

- Sales Volumes rose 4,990,800,000% year on year (2,595,900,000% in the same quarter last year)

- Market Capitalization: $17.28 billion

Company Overview

With origins dating back to 1818 and operations spanning both hemispheres to balance seasonal harvests, Bunge Global (NYSE: BG) is an agribusiness and food company that processes oilseeds, grains, and other agricultural commodities into vegetable oils, protein meals, flours, and specialty ingredients.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $60.11 billion in revenue over the past 12 months, Bunge Global is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To accelerate sales, Bunge Global likely needs to optimize its pricing or lean into new products and international expansion.

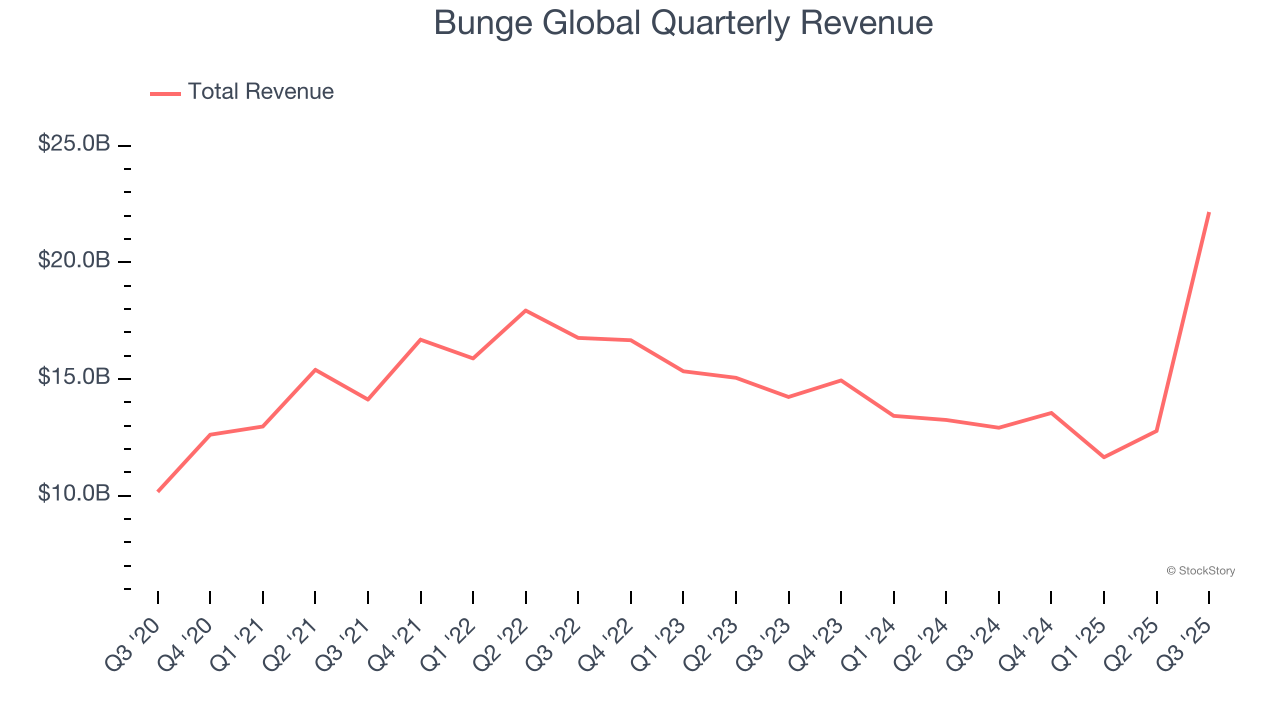

As you can see below, Bunge Global’s demand was weak over the last three years. Its sales fell by 3.7% annually despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Bunge Global achieved a magnificent 71.6% year-on-year revenue growth rate, but its $22.16 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 47.7% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping for a company of its scale and indicates its newer products will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Bunge Global’s average quarterly volume growth of 2,884,475,000% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Bunge Global’s Q3 2025, sales volumes jumped 4,990,800,000% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Bunge Global’s Q3 Results

We were impressed by how significantly Bunge Global blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed and its gross margin fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $89.89 immediately following the results.

So do we think Bunge Global is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.