Automotive retail giant AutoNation (NYSE: AN) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 6.9% year on year to $7.04 billion. Its non-GAAP profit of $5.01 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy AutoNation? Find out by accessing our full research report, it’s free for active Edge members.

AutoNation (AN) Q3 CY2025 Highlights:

- Revenue: $7.04 billion vs analyst estimates of $6.81 billion (6.9% year-on-year growth, 3.3% beat)

- Adjusted EPS: $5.01 vs analyst estimates of $4.84 (3.6% beat)

- Adjusted EBITDA: $404 million vs analyst estimates of $400.1 million (5.7% margin, 1% beat)

- Operating Margin: 5.3%, in line with the same quarter last year

- Free Cash Flow was $122.8 million, up from -$151 million in the same quarter last year

- Same-Store Sales rose 5% year on year (-13.7% in the same quarter last year)

- Market Capitalization: $7.68 billion

"We are pleased to report another quarter of strong performance, with robust growth across the business, including record profit in After-Sales and Customer Financial Services," said Mike Manley, Chief Executive Officer of AutoNation.

Company Overview

With a vast network of over 300 locations strategically concentrated in America's Sunbelt region, AutoNation (NYSE: AN) operates one of America's largest networks of automotive dealerships, selling new and used vehicles, parts, and services across multiple brands.

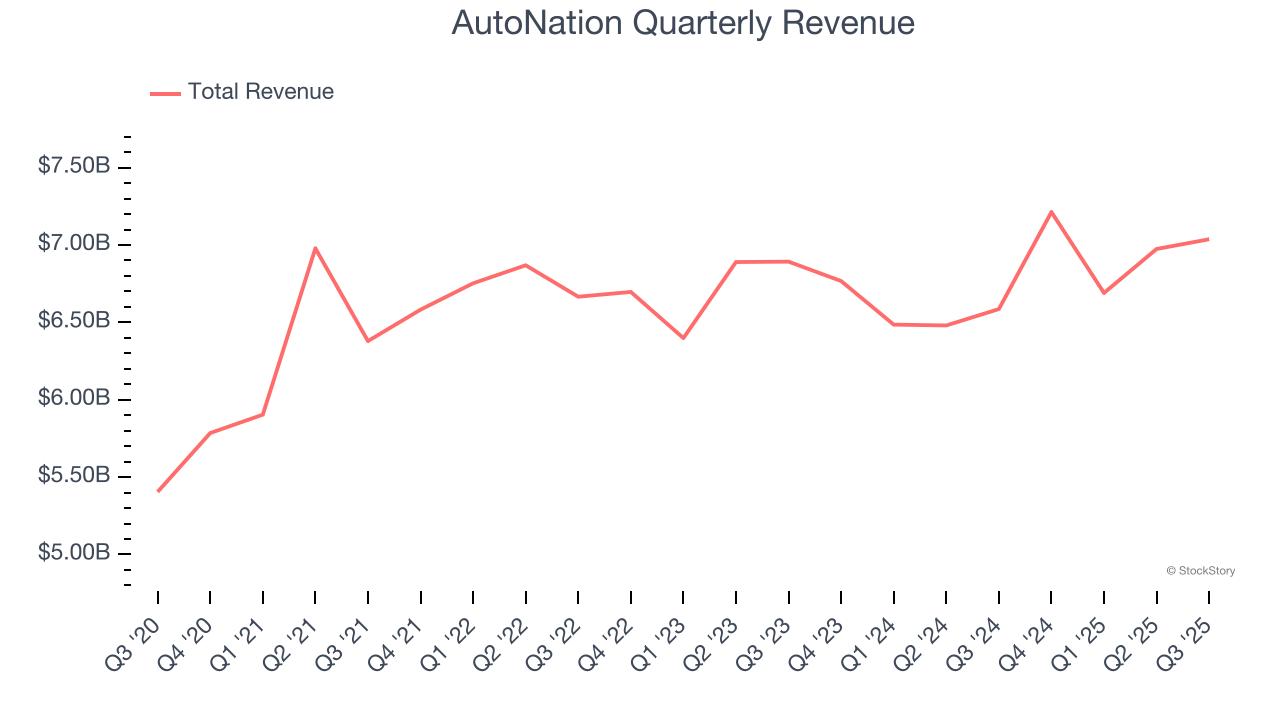

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $27.92 billion in revenue over the past 12 months, AutoNation is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. For AutoNation to boost its sales, it likely needs to adjust its prices or lean into foreign markets.

As you can see below, AutoNation grew its sales at a sluggish 1.3% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts). This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, AutoNation reported year-on-year revenue growth of 6.9%, and its $7.04 billion of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and indicates its newer products will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

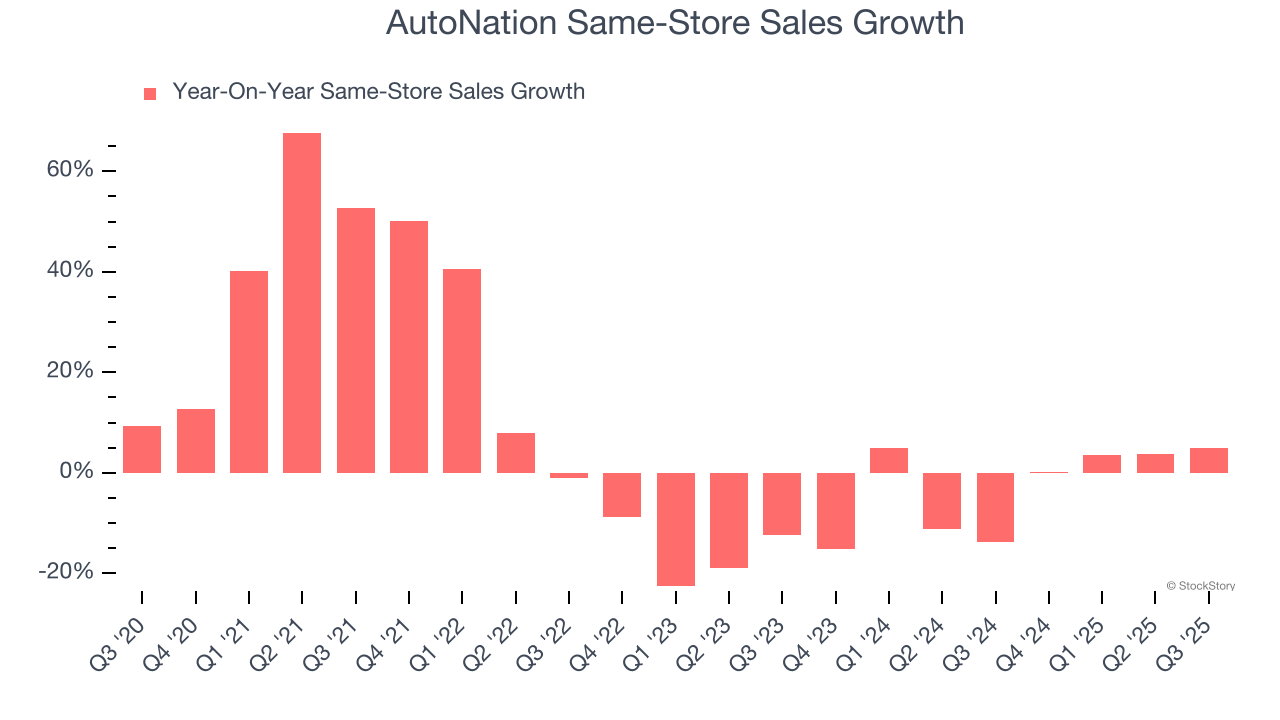

Same-Store Sales

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

AutoNation’s demand has been shrinking over the last two years as its same-store sales have averaged 2.8% annual declines.

In the latest quarter, AutoNation’s same-store sales rose 5% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from AutoNation’s Q3 Results

We were impressed by how significantly AutoNation blew past analysts’ same-store sales expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $209.54 immediately following the results.

Is AutoNation an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.