Agricultural supply chain giant Archer-Daniels-Midland (NYSE: ADM) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 2.2% year on year to $20.37 billion. Its non-GAAP profit of $0.92 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy Archer-Daniels-Midland? Find out by accessing our full research report, it’s free for active Edge members.

Archer-Daniels-Midland (ADM) Q3 CY2025 Highlights:

- Revenue: $20.37 billion vs analyst estimates of $20.78 billion (2.2% year-on-year growth, 2% miss)

- Adjusted EPS: $0.92 vs analyst estimates of $0.85 (7.9% beat)

- Adjusted EBITDA: $954 million vs analyst estimates of $950.3 million (4.7% margin, in line)

- Operating Margin: 1.9%, in line with the same quarter last year

- Free Cash Flow Margin: 7.4%, up from 4.6% in the same quarter last year

- Sales Volumes rose 1,346,900,000% year on year (1,335,300,000% in the same quarter last year)

- Market Capitalization: $27.98 billion

“ADM again delivered a strong quarter in increasingly dynamic market conditions as we continued to adjust our business model to meet the evolving needs of our customers. Through targeted investments in innovation and a focus on efficiencies that align to our customers’ goals, we are strengthening critical partnerships and expanding our new profit opportunities to deliver additional shareholder value,” said Chair of the Board and CEO Juan Luciano.

Company Overview

Transforming crops from the world's most productive agricultural regions into everyday essentials, Archer-Daniels-Midland (NYSE: ADM) processes and transports agricultural commodities like grains and oilseeds while manufacturing ingredients for food, beverages, feed, and industrial applications.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $83.21 billion in revenue over the past 12 months, Archer-Daniels-Midland is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Archer-Daniels-Midland to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

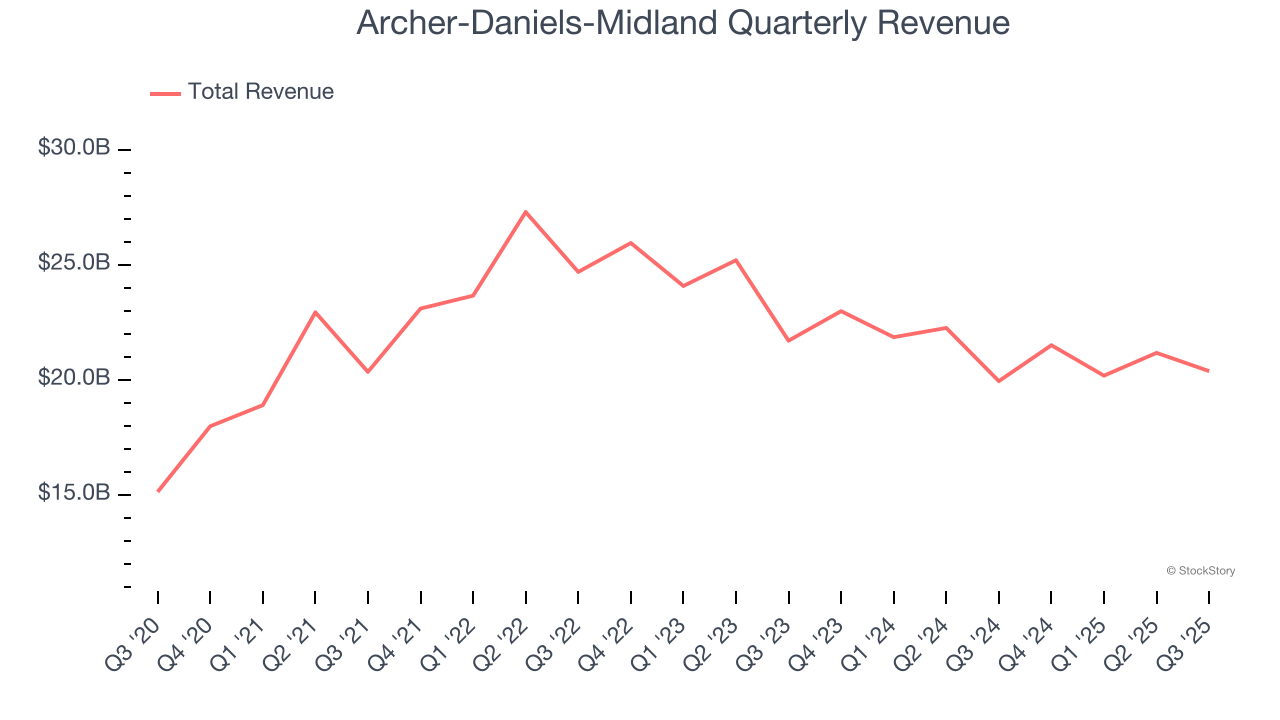

As you can see below, Archer-Daniels-Midland’s demand was weak over the last three years. Its sales fell by 5.5% annually despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Archer-Daniels-Midland’s revenue grew by 2.2% year on year to $20.37 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and suggests its newer products will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Archer-Daniels-Midland’s average quarterly volume growth of 1,357,800,000% over the last two years has beaten the competition by a long shot. This is great because companies with significant volume growth are needles in a haystack in the stable consumer staples sector.

In Archer-Daniels-Midland’s Q3 2025, sales volumes jumped 1,346,900,000% year on year. This result was in line with its historical levels.

Key Takeaways from Archer-Daniels-Midland’s Q3 Results

We were impressed by how significantly Archer-Daniels-Midland blew past analysts’ adjusted operating income expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its revenue fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $58.25 immediately following the results.

Is Archer-Daniels-Midland an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.