Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Ameresco (NYSE: AMRC) and its peers.

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 4 energy products and services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 5.6%.

Luckily, energy products and services stocks have performed well with share prices up 24.6% on average since the latest earnings results.

Best Q2: Ameresco (NYSE: AMRC)

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE: AMRC) provides energy and renewable energy solutions for various sectors.

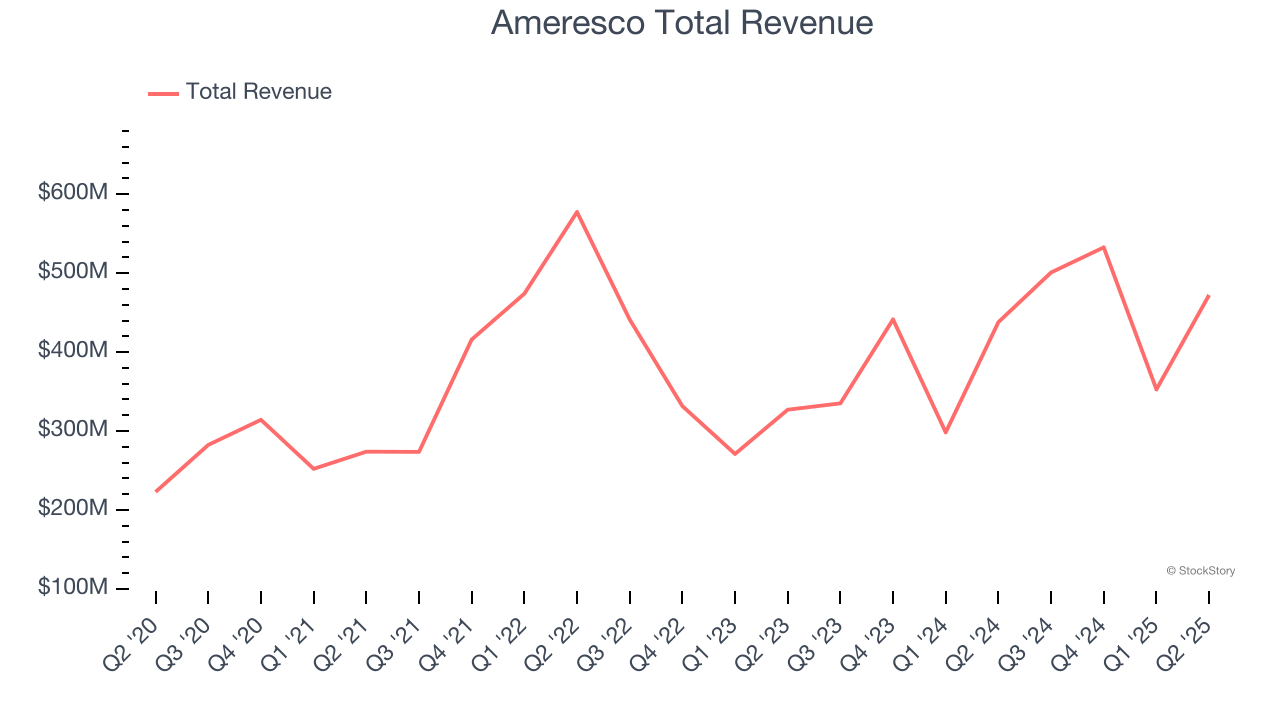

Ameresco reported revenues of $472.3 million, up 7.8% year on year. This print exceeded analysts’ expectations by 13%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

CEO George Sakellaris commented, “This was another strong quarter for Ameresco as the team continued its excellent execution across our broad operating footprint."

Ameresco delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 124% since reporting and currently trades at $37.53.

Is now the time to buy Ameresco? Access our full analysis of the earnings results here, it’s free.

Quanta (NYSE: PWR)

A construction engineering services company, Quanta (NYSE: PWR) provides infrastructure solutions to a variety of sectors, including energy and communications.

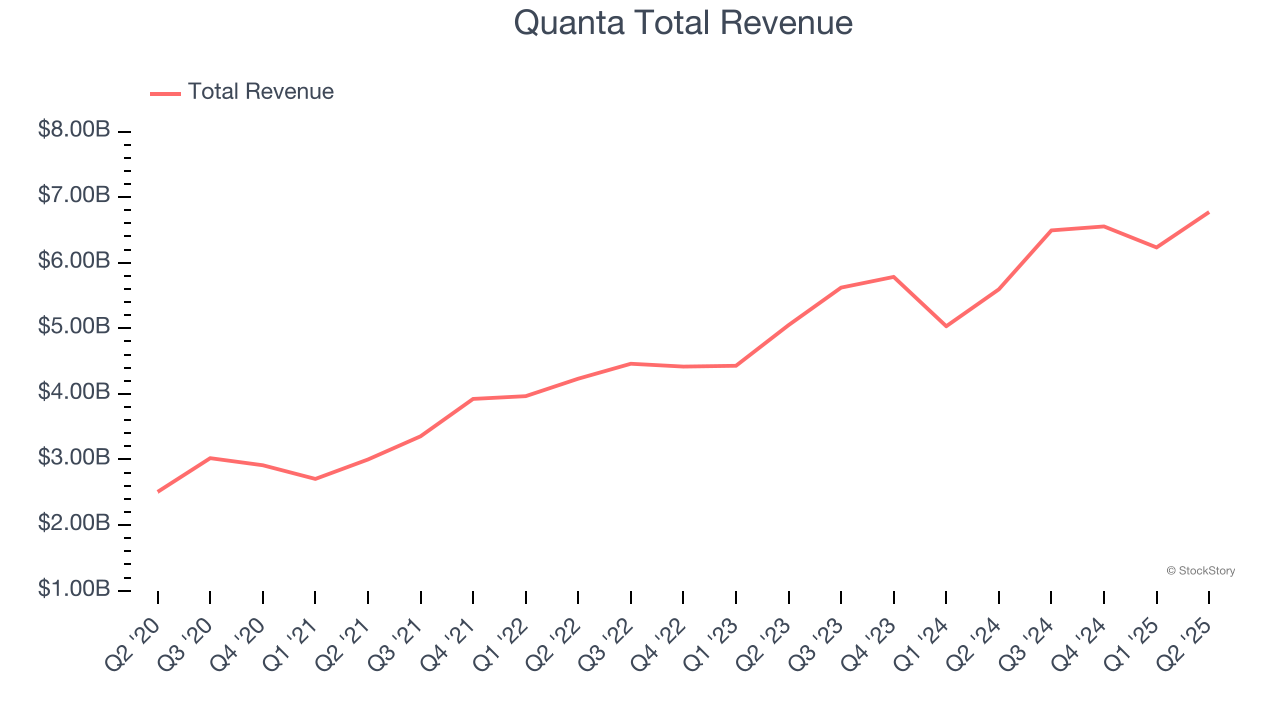

Quanta reported revenues of $6.77 billion, up 21.1% year on year, outperforming analysts’ expectations by 3.5%. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates.

Quanta achieved the highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 2.3% since reporting. It currently trades at $420.63.

Is now the time to buy Quanta? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: FTAI Infrastructure (NASDAQ: FIP)

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ: FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

FTAI Infrastructure reported revenues of $122.3 million, up 44.1% year on year, falling short of analysts’ expectations by 9.8%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

FTAI Infrastructure delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 26.5% since the results and currently trades at $4.59.

Read our full analysis of FTAI Infrastructure’s results here.

MDU Resources (NYSE: MDU)

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE: MDU) provides products and services in the utilities and construction materials industries.

MDU Resources reported revenues of $351.2 million, up 1.9% year on year. This print topped analysts’ expectations by 15.9%. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ EBITDA estimates and full-year EPS guidance missing analysts’ expectations.

MDU Resources delivered the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is down 1.7% since reporting and currently trades at $17.19.

Read our full, actionable report on MDU Resources here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.