Shareholders of GXO Logistics would probably like to forget the past six months even happened. The stock dropped 20.1% and now trades at $43.61. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy GXO Logistics, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about GXO Logistics. Here are three reasons why you should be careful with GXO and a stock we'd rather own.

Why Is GXO Logistics Not Exciting?

With notable customers such as Nike and Apple, GXO (NYSE: GXO) manages outsourced supply chains and warehousing for various companies.

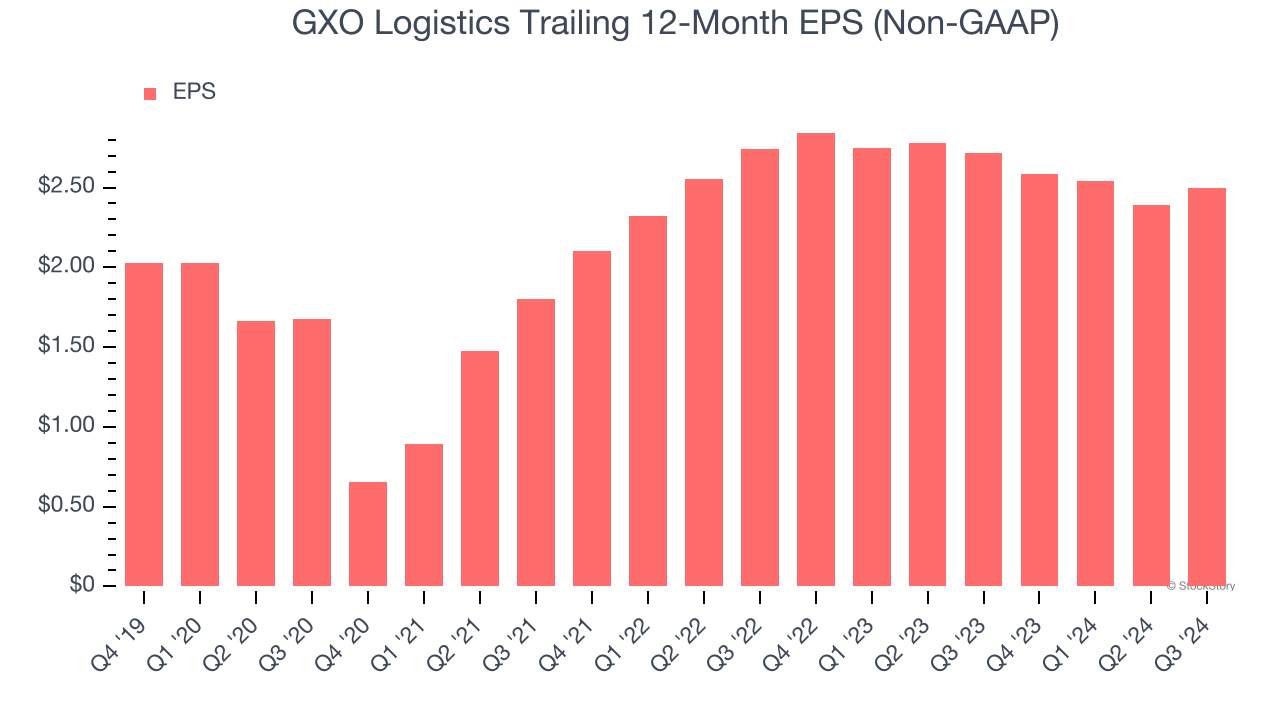

1. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for GXO Logistics, its EPS declined by 4.5% annually over the last two years while its revenue grew by 12.1%. This tells us the company became less profitable on a per-share basis as it expanded.

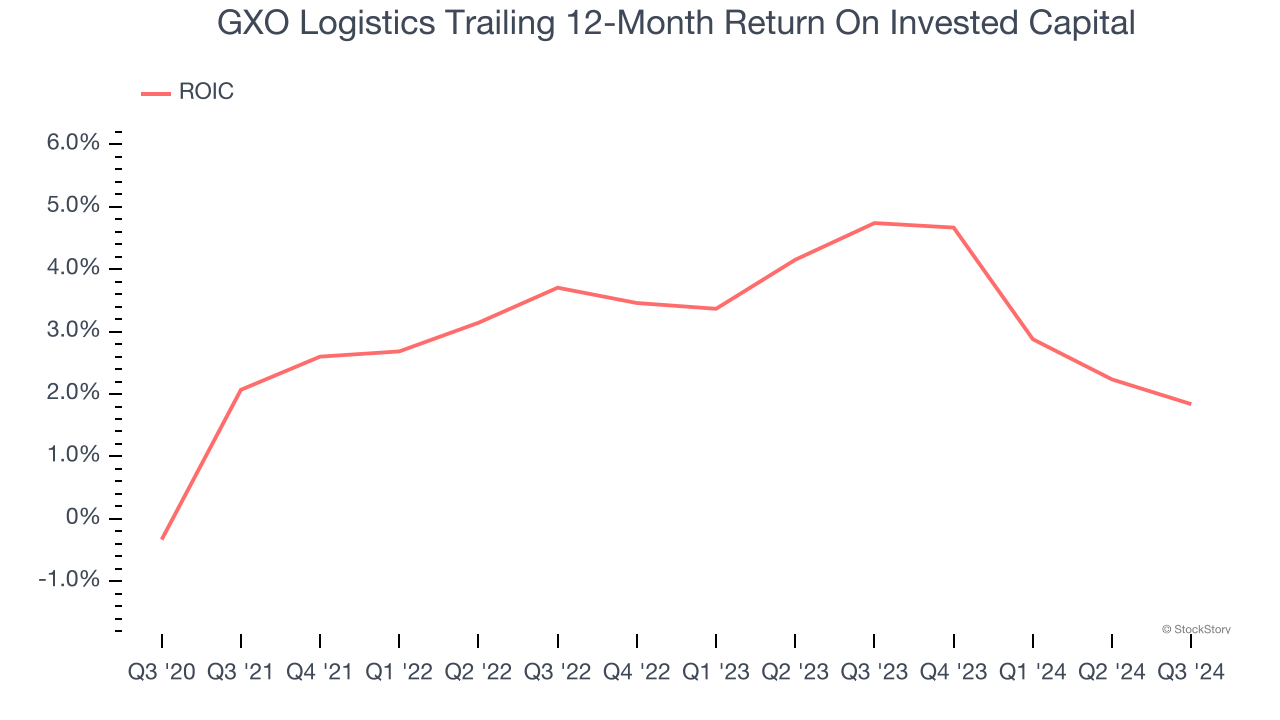

2. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

GXO Logistics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.4%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

GXO Logistics’s $5.53 billion of debt exceeds the $548 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $757 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. GXO Logistics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope GXO Logistics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

GXO Logistics’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 13.6× forward price-to-earnings (or $43.61 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d recommend looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than GXO Logistics

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.