Customer experience software provider Sprinklr (NYSE: CXM) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 7.7% year on year to $200.7 million. Guidance for next quarter’s revenue was better than expected at $200.5 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.10 per share was 25.1% above analysts’ consensus estimates.

Is now the time to buy Sprinklr? Find out by accessing our full research report, it’s free.

Sprinklr (CXM) Q3 CY2024 Highlights:

- Revenue: $200.7 million vs analyst estimates of $196.4 million (7.7% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.08 (25.1% beat)

- Adjusted Operating Income: $23.28 million vs analyst estimates of $19.71 million (11.6% margin, 18.1% beat)

- Revenue Guidance for Q4 CY2024 is $200.5 million at the midpoint, above analyst estimates of $196.6 million

- Management lowered its full-year Adjusted Operating Income guidance to $76.9 million at the midpoint, a 5.1% decrease

- Operating Margin: 3.9%, down from 7.1% in the same quarter last year

- Free Cash Flow Margin: 2.4%, down from 8.4% in the previous quarter

- Market Capitalization: $2.09 billion

“Sprinklr’s third quarter results delivered a 12% non-GAAP operating margin and positive free cash flow,” said Rory Read, Sprinklr’s President and CEO.

Company Overview

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Customer Experience Software

The Internet has given customers more choice on whom to conduct business with and has also given them the power to easily share their experiences with other customers. These twin dynamics effectively have increased pressure on companies to both improve their customer service and also monitor their brand reputation online, driving the need for customer experience software offerings.

Sales Growth

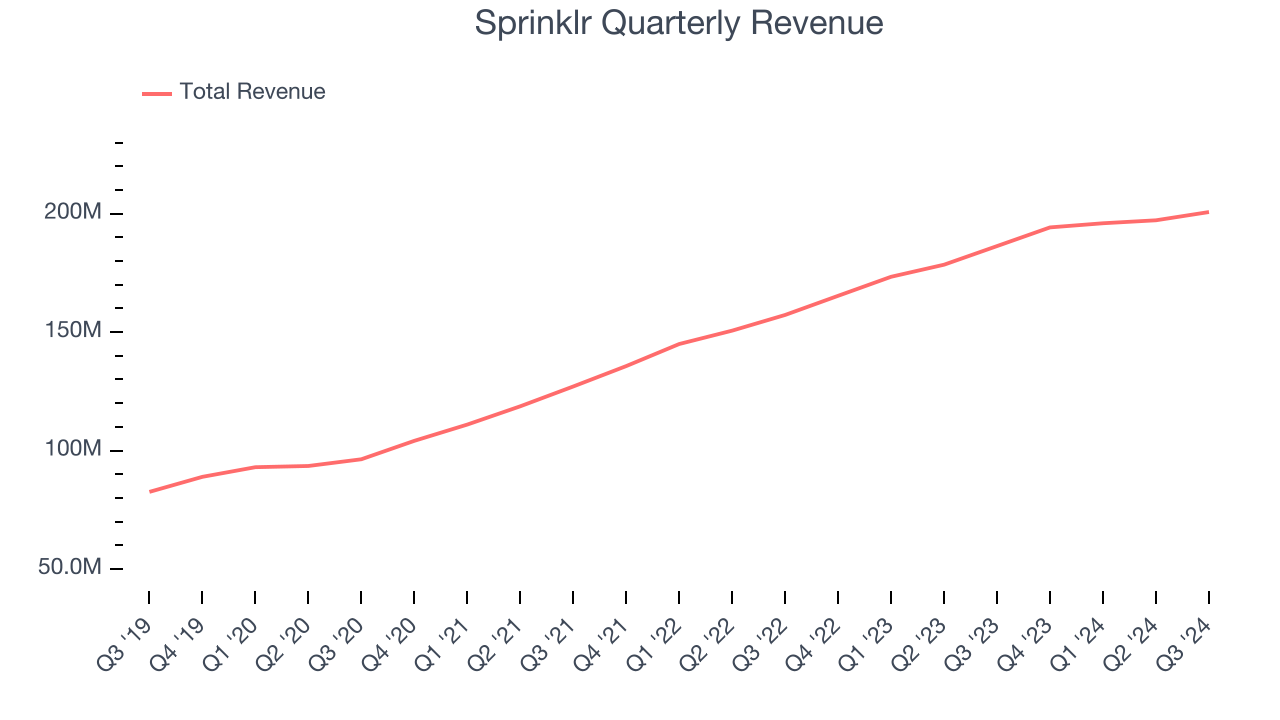

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Sprinklr grew its sales at a 19.6% annual rate. Although this growth is solid on an absolute basis, it fell slightly short of our benchmark for the software sector.

This quarter, Sprinklr reported year-on-year revenue growth of 7.7%, and its $200.7 million of revenue exceeded Wall Street’s estimates by 2.2%. Company management is currently guiding for a 3.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Sprinklr to acquire new customers as its CAC payback period checked in at 151 months this quarter. The company’s inefficiency indicates its product offering can be replicated by its competitors and that it must continue investing to grow.

Key Takeaways from Sprinklr’s Q3 Results

It was encouraging to see Sprinklr’s revenue in the quarter beat and also to see its revenue guidance for next quarter beat analysts’ expectations. On the other hand, its full-year operating income guidance was lowered, showing that the growth is less profitable than expected. The market seems to be focusing more on the topline successes, though, and the stock traded up 8.9% to $9.40 immediately following the results.

Is Sprinklr an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.