Bank software company nCino (NASDAQ: NCNO) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 13.8% year on year to $138.8 million. On the other hand, next quarter’s revenue guidance of $140.5 million was less impressive, coming in 2.3% below analysts’ estimates. Its non-GAAP profit of $0.21 per share was 31.3% above analysts’ consensus estimates.

Is now the time to buy nCino? Find out by accessing our full research report, it’s free.

nCino (NCNO) Q3 CY2024 Highlights:

- Revenue: $138.8 million vs analyst estimates of $137.4 million (13.8% year-on-year growth, 1% beat)

- Adjusted EPS: $0.21 vs analyst estimates of $0.16 (31.3% beat)

- Adjusted Operating Income: $28.04 million vs analyst estimates of $21.55 million (20.2% margin, 30.1% beat)

- Revenue Guidance for Q4 CY2024 is $140.5 million at the midpoint, below analyst estimates of $143.8 million

- Adjusted EPS guidance for the full year is $0.76 at the midpoint, beating analyst estimates by 11.9%

- Operating Margin: 0%, up from -10.6% in the same quarter last year

- Free Cash Flow Margin: 3.7%, similar to the previous quarter

- Market Capitalization: $4.80 billion

"We are very pleased with our third quarter results, once again exceeding expectations for both revenues and non-GAAP operating income," said Pierre Naudé, Chairman and CEO at nCino.

Company Overview

Founded in 2011 in North Carolina, nCino (NASDAQ: NCNO) makes cloud-based operating systems for banks and provides that software-as-a-service.

Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

Sales Growth

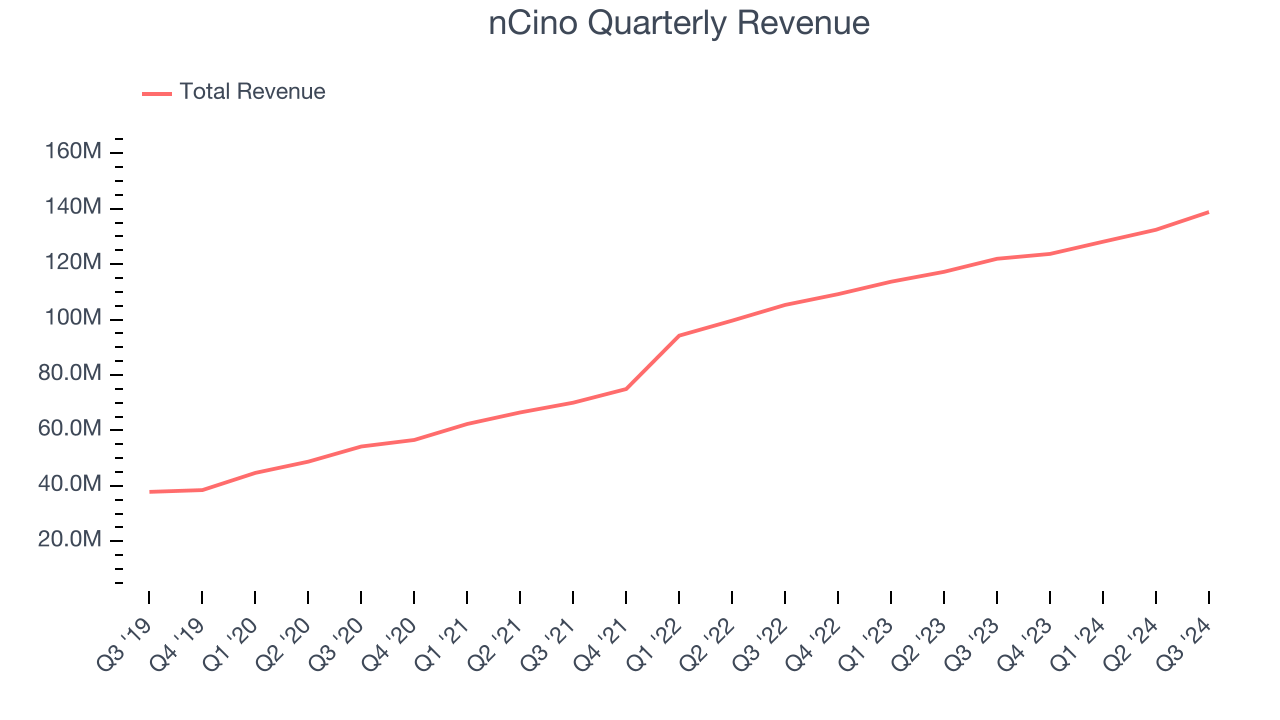

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, nCino’s sales grew at a solid 27% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, nCino reported year-on-year revenue growth of 13.8%, and its $138.8 million of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 13.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and indicates the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

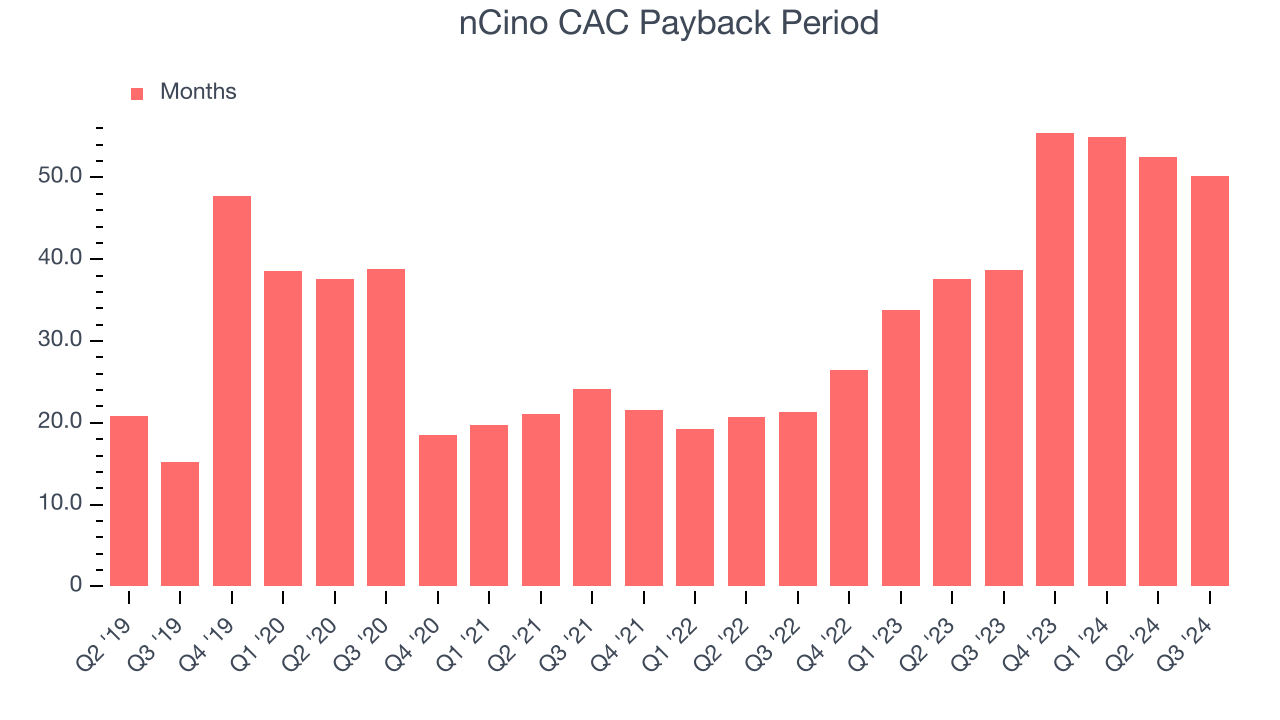

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for nCino to acquire new customers as its CAC payback period checked in at 50.2 months this quarter. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from nCino’s Q3 Results

We liked that nCino’s revenue narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its full-year revenue guidance was only in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 11.8% to $37.50 immediately after reporting.

So do we think nCino is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.