E-commerce pet food and supplies retailer Chewy (NYSE: CHWY) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 4.8% year on year to $2.88 billion. Its non-GAAP profit of $0.20 per share was 12.8% below analysts’ consensus estimates.

Is now the time to buy Chewy? Find out by accessing our full research report, it’s free.

Chewy (CHWY) Q3 CY2024 Highlights:

- Revenue: $2.88 billion vs analyst estimates of $2.86 billion (4.8% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.20 vs analyst expectations of $0.23 (12.8% miss)

- Adjusted EBITDA: $138.2 million vs analyst estimates of $120.3 million (4.8% margin, 14.9% beat)

- Operating Margin: 0.9%, up from -0.4% in the same quarter last year

- Free Cash Flow Margin: 5.3%, up from 3.2% in the previous quarter

- Market Capitalization: $14.06 billion

Company Overview

Founded by Ryan Cohen who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

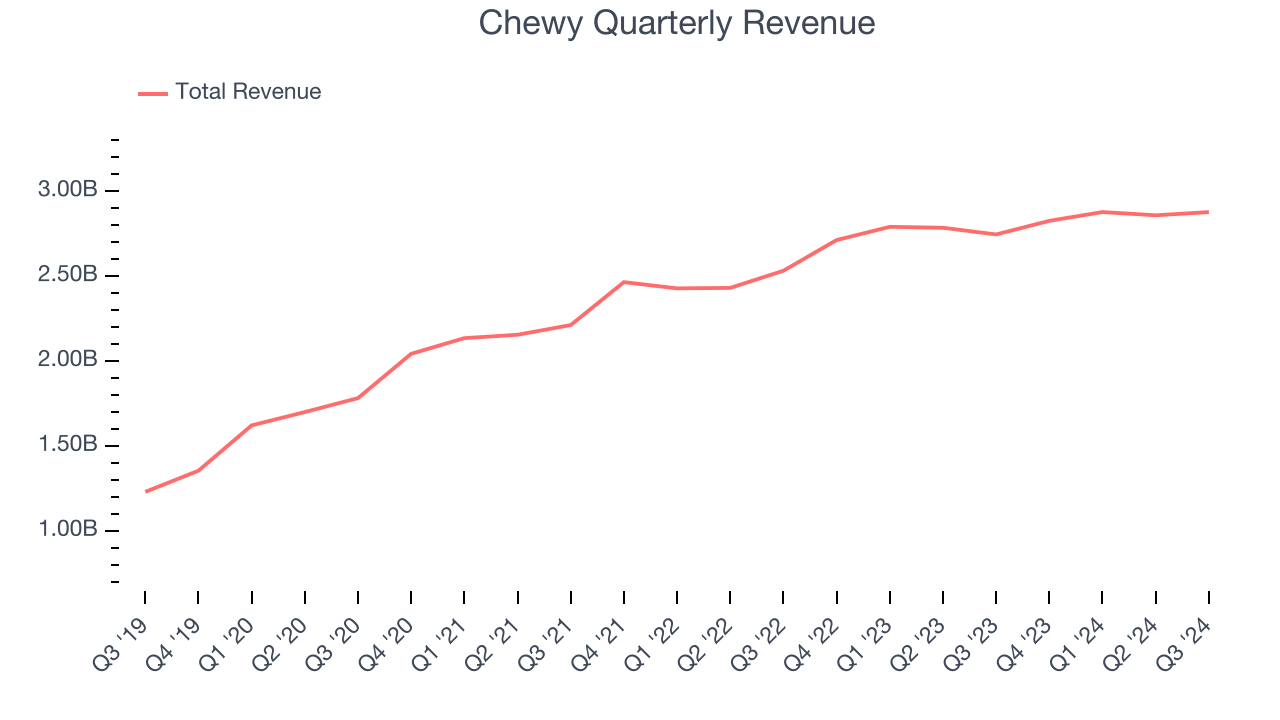

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Chewy grew its sales at a decent 10.2% compounded annual growth rate. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Chewy reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

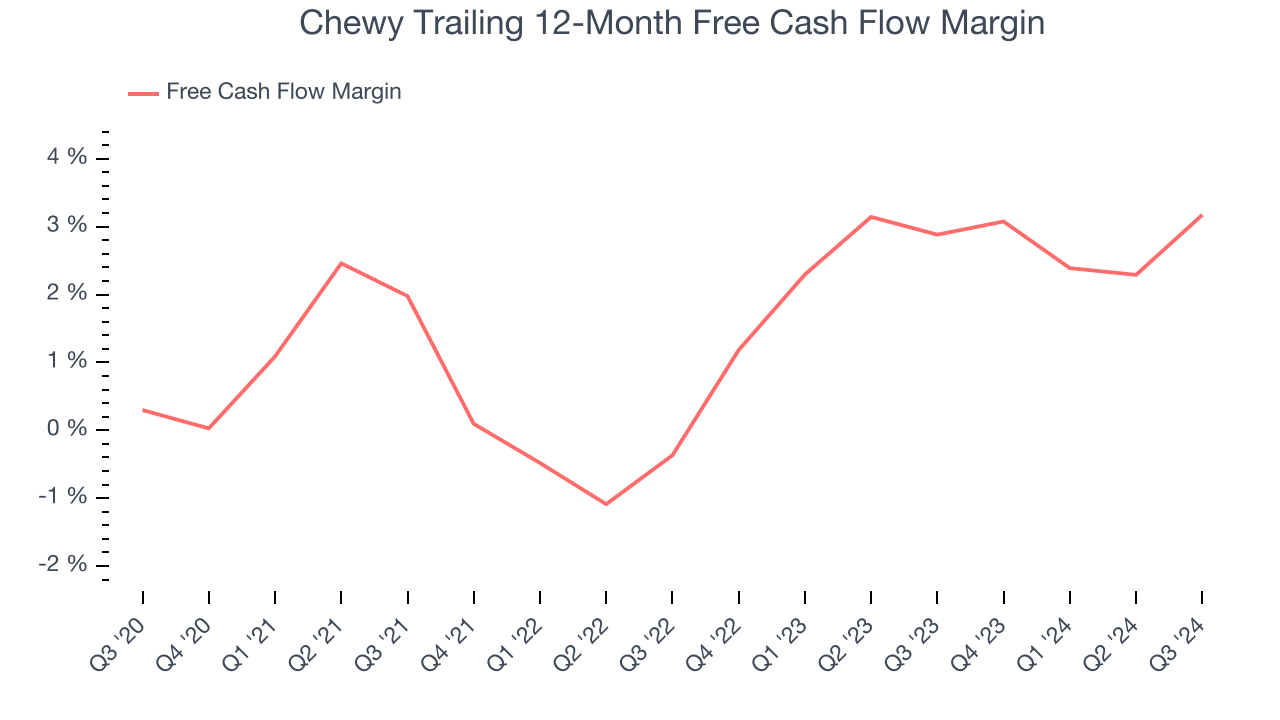

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Chewy has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, subpar for a consumer internet business.

Taking a step back, an encouraging sign is that Chewy’s margin expanded by 1.2 percentage points over the last few years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Chewy’s free cash flow clocked in at $151.8 million in Q3, equivalent to a 5.3% margin. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Chewy’s Q3 Results

Revenue beat by a bit, adjusted EBITDA beat by a more convincing amount, but EPS missed. Overall, this was a mixed quarter, and guidance was not given in the release. Shares traded down 1.4% to $33.11 immediately after reporting.

So do we think Chewy is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.