Technical Report Highlights:

Base Case shows US$66.2M post tax NPV5, 24.4% IRR, with a payback multiple of 1.9 at a US$2,300/oz gold price

Upside Case shows US$243.3M post tax NPV5, 168.4% IRR, with a payback multiple of 8.4 at a US$3,500/oz gold price

286k ounces of gold produced at an AISC of US$1,626 per AuEq ounce over a 6.1-year mine life with US$45M initial CAPEX

US$40M increase in base case post-tax NPV5 and US$9.4M reduction in initial capital expenditure from the previous technical report

La Colorada Indicated Mineral Resources grow by 62k ounces to 513k ounces, grading 0.79 grams per tonne

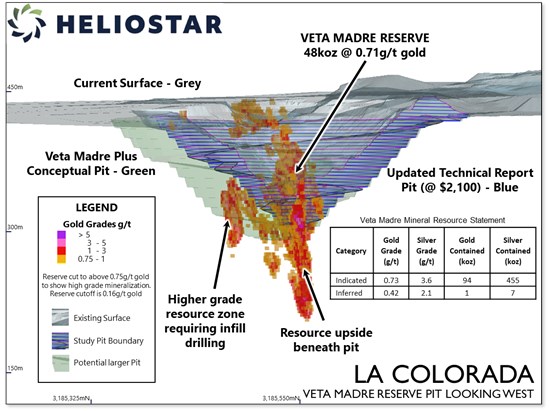

Expansion potential with Veta Madre Plus. Potential to convert up to 28k Indicated Mineral Resource ounces to Mineral Reserves to support a larger pit with drilling to be completed in Q4, 2025

Permits received in August and September 2025 to expand the leach pad at La Colorada

Vancouver, British Columbia--(Newsfile Corp. - October 17, 2025) - Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce the results of an updated study on the La Colorada Mine ("La Colorada"). This updated life of mine plan includes the results from the first two phases of drilling performed from November 2024 to March 2025 from the Company's ongoing ~20,000-metre drilling campaign.

Heliostar CEO, Charles Funk, commented, "Today's results show that the La Colorada mine can continue to be a high-margin, low CAPEX operation with a 6.1-year mine life. This updated study is focused on the open pits at La Colorada, demonstrating positive economics at conservative gold prices and a compelling opportunity at current gold prices. The Company aims to continue to maximize cash generation from stockpiles in the near term and internally fund capital requirements for open-pit production planned in 2027. Indicated gold resources grew significantly with higher or maintained resource grades at El Crestón and Veta Madre. Reserves remained almost unchanged with ounces defined by new drilling offset with more conservative pit wall angles at the El Crestón pit."

"Beyond this study, three clear growth opportunities exist - Veta Madre Plus, an expanded pit at El Crestón and the exploration potential of the larger land package. Veta Madre Plus will be tested with an infill drilling program this quarter that could quickly show the ability to expand the pit and add an additional 28k ounces of reserves. Should higher gold prices sustain, a larger pit at El Crestón may allow for steeper pit walls, increasing reserves. The exploration potential of La Colorada remains significant with open resources and compelling exploration targets across the property. These have been virtually untested over the last 10 years despite their proximity to permitted mine infrastructure - this will change in late 2025 and 2026."

The technical report supporting this news release will be available on SEDAR+ (www.sedarplus.ca) and on the Company's website (www.heliostarmetals.com) within the next 45 days. The La Colorada technical report that is the subject of this news release will be reported in United States dollars (USD or US$) unless otherwise noted.

La Colorada Mine Updated Technical Report

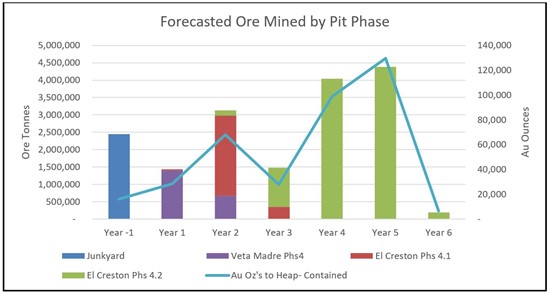

Mineral Resource and Mineral Reserve estimates, as well as a life-of-mine (LOM) plan, were updated for the 100% owned La Colorada Mine located in Sonora, Mexico. The LOM plan in the La Colorada technical report is based on production from three deposits staged sequentially: continued production from the Junkyard Stockpile, the Veta Madre pit expansion (Veta Madre), and the El Crestón pit expansion (El Crestón).

The study includes updated Mineral Resource and Mineral Reserve estimates for Veta Madre and El Crestón. The LOM plan indicates an overall Probable Mineral Reserve of 376.2k ounces of gold (a decrease of 0.8k ounces of gold compared to the previous technical report due to mining depletion), with Veta Madre having a forecast mine life of 1.3 years and El Crestón a forecast mine life of 4.6 years, respectively. The operation will have production rates up to the 13,000 t/d nameplate throughput capacity of the process plant at an estimated LOM average US$1,626 per AuEq ounce all-in sustaining cost (AISC).

The La Colorada technical report is anticipated in November 2025.

Key Highlights

| La Colorada - Mineral Reserve & Forecast Production Highlights | |

| Probable Mineral Reserves (kt) 1 | 17,117 |

| Gold Grade (g/t Au) | 0.68 |

| Contained Gold (koz Au) | 376.2 |

| Silver Grade (koz Ag) | 9.2 |

| Contained Silver (koz Ag) | 5,055.9 |

| Contained GEO (k GEO) 2 | 385.4 |

| Processing Rate (t/d average) 3 | 8,200 |

| Life of Mine (years) 4 | 6.1 |

| Annual Production (oz GEO per year, average 2025-2031) 4 | 46,106 |

- Probable Mineral Reserve.

- GEO - Gold Equivalent Ounces.

- Processing throughput rates vary over the life of the mine, up to the nameplate capacity of the process plant, about 13,000 t/d.

- Includes production from the Junkyard Stockpile from May 2025 onwards.

| La Colorada - Forecast Financial Highlights | |

| Average Cash Operating Costs (US$ per payable oz GEO) 1 | 1,533 |

| Average AISC (US$ per payable oz GEO) 1 | 1,626 |

| Total Initial Capital Cost (US$M) 2 | 44.5 |

| Total Sustaining Capital Cost (US$M) 2 | 12.5 |

| Total Life of Mine Capital Cost (US$M) 3 | 63.8 |

- Non-International Financial Reporting Standards (IFRS) measures. All-in sustaining costs (AISC) were first issued by the World Gold Council (WGC) in 2013, with an updated Guidance note issued in 2018.

- The initial capital cost reflects capital and capitalized investment before the first metals production from Veta Madre. Total sustainable capital cost of US$12.5 million is included for capitalized pre-strip before first metals production from El Crestón.

- Includes US$7.0 million reclamation expenditure at the end of the mine life.

| La Colorada Forecast Return Estimates based on Gold Price 1, 2 | |||

| US$2,300/oz 3 | US$3,500/oz 4 | ||

| IRR (%) | 24.4 | 168.4 | |

| NPV @ 5.0% discount (US$M) | 66.2 | 243.3 | |

| Payback (years) | 3.4 | 2.0 | |

- All other key parameters are set at base assumptions, including the 5% discount rate used. More detailed analysis will be presented in the full technical report.

- After tax return estimates.

- Base gold price assumption used in the La Colorada technical report.

- Comparison of the gold price of US$3,500 with reference to the US$4,110.82 London Bullion Market Association (LBMA) PM gold price on the trading day of October 15, 2025.

The study shows improved economics on the majority of the key metrics. The table below outlines the differences in the base case between the January 2025 technical report and the updated technical report. Drilling completed in 2024 and 2025 contributed additional indicated gold ounces (39k ounces at El Crestón and 30k ounces at Veta Madre). Reserves and LOM gold production have not materially changed due to recognition of faults in the El Crestón pit wall requiring more conservative pit wall designs. Resequencing production from the three deposit areas further improved the economics, increasing the NPV and the IRR in the updated technical report for La Colorada compared to the January 2025 technical report for the operation.

| Changes in Key Metrics | |||

| January 2025 Technical Report | Updated Technical Report | Change | |

| Gold Price | US$2,000 | US$2,300 | 15% |

| After Tax NPV5% | US$25.9M | US$66.2M | 155% |

| After Tax IRR | 11.9% | 24.4% | 105% |

| LOM Cash Flow | US$54.9M | US$105.5M | 92% |

| Payback multiple | 1.4x | 1.9x | 36% |

| Reserve gold ounces | 377 koz | 376.2 koz | -1% |

| Reserve gold grade | 0.65 g/t | 0.68 g/t | 5% |

| GEOs produced | 297 koz | 293 koz | -1% |

| Mine life | 6.5 years | 6.1 years | -6%* |

| Initial Capital Cost | US$53.9M | US$44.5M | -17% |

| Total Cash Costs (per GEO) | US$1,549 | US$1,602 | 3% |

| AISC (per GEO) | US$1,763 | US$1,626 | -8% |

The LOM plan outlines sequential exploitation of the three deposits beginning with continued mining from the Junkyard Stockpile through 2025, followed by exploitation from Veta Madre, then El Crestón through the following six years.

Figure 1 - Site Overview

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/270792_ff44e226847aeadb_001full.jpg

Note: Infrastructure in green, stockpiles in yellow and open pits in blue

Figure 2 - Ore Mined by Pit Phase

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/270792_figure2.jpg

Note: Figure prepared by Hard Rock Consulting, 2025

La Colorada Forecast Operating Cost Estimates

The mining method and process circuit at the La Colorada Mine remains unchanged for the proposed LOM plan compared to the January 2025 technical study. The exploitation of the three deposits benefits from the existing infrastructure at the mine, including the installed crushing and stacking equipment with a capacity of 13,000 tonnes per day. The expected operating performance and operating cost forecasts were compiled with the benefit of benchmarking current and historical performance at La Colorada, the industry standard processes being used at the mine informing the expected consumption quantities of key supplies, and commercial pricing for goods and services in Mexico.

Total Operating Cost Summary

| Operating Costs | Operating Cost (US$/oz AuEq) | Operating Cost (US$/t ore) | Operating Cost (US$/t mined) |

| Total mining | 1,087 | 18.64 | 2.11 |

| Total processing | 350 | 6.00 | |

| Total site general and administrative | 68 | 1.17 | |

| Refinery and transport | 28 | 0.48 | |

| Cash operating costs | 1,533 | 26.28 | |

| Production taxes | 46 | 0.78 | |

| Royalties | 23 | 0.39 | |

| Total cash costs | 1,602 | 27.46 | |

| Sustaining capital costs | 23 | 0.40 | |

| Total AISC | 1,626 | 27.86 |

La Colorada Forecast Capital Cost Estimates

The Junkyard Stockpile is currently in production and requires only working capital.

The initial capital cost for Veta Madre is estimated at US$44.5M, including US$11.9M capital for leach pad expansion and US$30.1M mining capitalized pre-stripping costs until first metal production.

The initial sustaining capital cost for El Crestón is estimated at US$12.5M for mining pre-stripping costs until first metal production. Additional pre-stripping is required to fully exploit the El Crestón deposit, comprising both capitalized and expensed pre-stripping costs shown in the technical report to be ongoing during ore production from Veta Madre. With additional pre-stripping expenses at El Crestón, a maximum negative cash flow of US$117.6M is projected at the base gold price assumption and US$46M at the upside case of US$3,300/oz.

The LOM plan includes US$6.9M for reclamation work at the end of the mine life.

Forecast Capital Cost Summary

| Capital Costs | Initial (US$M) | Sustaining (US$M) | Total LOM (US$M) |

| Mine pre-production development | 30.1 | 12.5 | 42.6 |

| Contractor mobilization | 0.2 | 0.0 | 0.2 |

| Slope radar system | 0.5 | 0.0 | 0.5 |

| Leach pad expansion | 11.9 | 0.0 | 11.9 |

| Total direct costs | 42.7 | 12.5 | 57.0 |

| Owner costs and reclamation | 0.00 | 6.9 | 6.9 |

| Indirects and contingency | 1.8 | 0.0 | 1.8 |

| Total indirect costs | 1.8 | 6.9 | 8.7 |

| Total | 44.5 | 19.3 | 63.9 |

La Colorada Economic Analysis

The economic analysis shows a base case after-tax net present value at a discount rate of 5% of US$66.2M, an after-tax internal rate of return of 24.4%, and a payback period of 3.4 years at US$2,300/oz gold. The forecast mine life is 6.1 years in the study. Approximately 374.9k ounces of gold are projected to be mined, with 286.3k ounces of gold recovered and sold.

Summary Economic Results

| Project Valuation Overview | Units | After Tax | Before Tax |

| Total cashflow | US$ M | 105.5 | 162.6 |

| NPV @ 5.0% (base case) | US$ M | 66.2 | 108.5 |

| Internal rate of return | % | 24.4 | 33.1 |

| Payback period | Years | 3.4 | 3.3 |

| Payback multiple | 1.9 | 2.4 | |

| Total initial capital | US$ M | 44.5 | 44.5 |

Metal Prices

The gold market has experienced significant upward price movement in the past few years. The gold price is about 80% above the base case gold price used in the study.

The sensitivity analysis presents gold price scenarios up to US$4,100/oz Au to understand the potential impact of continued gold price movement. From the base case price of US$2,300/oz, a change in the average gold price of 10% (US$230/oz Au) would change the NPV5% by approximately US$34M.

With ongoing exploitation of the Junkyard Stockpile during 2025, the project will generate revenues from sales based on current gold prices, which are expected to be significantly higher than the base case gold price used in the study.

The LOM plan and Mineral Reserves estimates are most sensitive to changes in the gold price and gold grade. Since silver is projected to contribute only about 4% to the revenues, LOM variations in the silver price have a limited impact on the cashflow forecast. The LOM plan and Mineral Reserves estimates are less sensitive to operating cost changes and least sensitive to changes in capital costs.

Gold Price Sensitivity Analysis

| Au Price (US$/oz Au) | Net Cash Flow (US$M) | After-Tax NPV @ 5.0% Discount Rate (US$ M) | IRR (%) | Payback Period (years) | Payback Multiple |

| 500 | -444.25 | -364.85 | - | - | 0.0 |

| 800 | -335.58 | -280.57 | - | - | 0.0 |

| 1100 | -227.32 | -196.62 | - | - | 0.0 |

| 1400 | -120.04 | -113.37 | -29.0% | - | 0.0 |

| 1700 | -12.88 | -30.20 | -2.6% | 6.0 | 0.0 |

| 2000 | 50.44 | 21.07 | 10.6% | 3.8 | 1.3 |

| 2300 | 105.45 | 66.21 | 24.4% | 3.4 | 1.9 |

| 2600 | 160.45 | 111.05 | 41.4% | 3.0 | 2.8 |

| 2900 | 215.46 | 155.36 | 62.5% | 2.6 | 4.5 |

| 3200 | 270.46 | 199.36 | 91.9% | 2.3 | 6.6 |

| 3500 | 325.47 | 243.35 | 168.4% | 2.0 | 8.4 |

| 3800 | 380.47 | 287.35 | - | 0.7 | 10.4 |

| 4100 | 435.48 | 331.35 | - | 0.5 | 12.8 |

Note: Dash indicates values have exceeded the limits of parameters calculated using the economic model

Commentary by Company on Next Steps, Funding and Additional Opportunities

The mining of the Junkyard Stockpile will continue through the remainder of 2025. The Company expects to mine additional stockpile material already identified ahead of production from the Veta Madre Pit.

The total Mineral Reserve in the study is 374.9k ounces of gold, including the Junkyard Stockpile, Veta Madre and El Crestón.

The Veta Madre Mineral Reserve can be exploited subject to receiving a Change of Land Use (CUS) permit, which the Company expects to receive in late 2025. The El Crestón expansion is expected to be sequenced into the schedule in 2027.

In August and September 2025, the Company received approvals of modifications to two existing environmental permits; the modifications authorize the expansion of the current leach pad to include an additional 9.6Mt of capacity. This is forecast to be sufficient to mine and process material from stockpiles included in the mining sequence and the Veta Madre pit. An additional leach pad expansion is planned for the processing of material from the El Crestón expansion and will require an amendment of an existing environmental permit.

Since the development plan for La Colorada represents a continuation of the historical operations, minimal capital investment is required for new equipment and facilities; however, pre-stripping at Veta Madre and El Crestón will need to be funded. The Company expects this to come from a combination of cash generated from the operations and potentially additional non-dilutive project financing if required.

A number of opportunities at La Colorada will become a focus for the Company upon submission of the updated technical report

Stockpiles have the potential to fund stripping costs at Veta Madre. Drilling and analysis of their financial viability is ongoing and expected to be completed in Q4, 2025

28k Indicated Mineral Resource ounces at Veta Madre are not included in the mine plan. Infill drilling of these areas is planned for 2025, and the company is targeting converting these to reserves that would support a larger pit, known as the Veta Madre Plus pit

A larger pit at El Crestón may allow for steeper pit walls, increasing resource to reserve conversion at this deposit

Drilling beneath the current pit boundary at El Crestón revealed widths and grades of gold mineralized veins that maybe amenable to underground mining. The Company will further explore extensions of high-grade mineralization at depth at El Crestón and Gran Central in late 2025 and 2026

Outside the boundaries of the Mineral Resource estimate, several exploration targets remain largely unexplored. These include fault offsets from known mineralization, consistent gold-in-soil anomalies above 0.2 g/t, and areas with undrilled rock chip samples exceeding 1 g/t gold in zones of strong alteration. Further prospecting, geophysics, drill targeting and drilling are planned for the remainder of 2025 and 2026.

The La Colorada concession area covers 10,085ha and has seen very limited exploration beyond the immediate areas where Mineral Resources have been estimated.

Figure 3 - Veta Madre Plus Opportunity

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/270792_ff44e226847aeadb_003full.jpg

Mineral Resource Estimates

Mineral Resources were estimated at La Colorada for three deposits: El Crestón, Veta Madre and the Junkyard Stockpile, and are summarized in the following table. Mineral Resources have an effective date of April 30, 2025 and are reported in situ, using the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (2014 CIM Definition Standards).

Mineral Resources Statement

| Classification | Zone | Tonnes (kt) | Gold Grade (g/t) | Silver Grade (g/t) | Contained Gold Metal (koz) | Contained Silver Metal (koz) |

| Indicated | El Creston | 13,678 | 0.91 | 13.0 | 402 | 5,721 |

| Veta Madre | 3,915 | 0.74 | 3.6 | 94 | 452 | |

| Junkyard | 2,620 | 0.21 | 7.2 | 18 | 602 | |

| Total | 20,213 | 0.79 | 10.4 | 513 | 6,776 | |

| Inferred | El Creston | 34 | 0.40 | 19.1 | 0 | 21 |

| Veta Madre | 94 | 0.44 | 2.1 | 1 | 6 | |

| Junkyard | 1,017 | 0.46 | 38.7 | 15 | 1,264 | |

| Total | 1,144 | 0.45 | 35.1 | 17 | 1,291 |

Notes to accompany Mineral Resource table:

- Mineral Resources are reported insitu, using the 2014 CIM Definition Standards, and have an effective date of April 30, 2025. The Qualified Person for the estimate is Mr. David Thomas, P.Geo., of Mine Technical Services.

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resource estimates for El Crestón and Veta Madre use the end-of-month October 2024 topography. Mineral Resource estimates for the Junkyard use the end-of-month April 2025 topography.

- Mineral Resources at El Crestón and Veta Madre are constrained by a conceptual pit shell using the following assumptions: a gold price of US$2,400/oz Au; a silver price of US$29/oz Ag; a rock mining cost of US$2.44/t mined; a backfill mining cost of US$1.75/t mined; a crushing and leaching cost of US$1.84/t processed; at El Crestón a process cost of US$4.84/t processed and at Veta Madre a process cost of US$3.72 $/t; a general and administrative cost of US$1.12/t processed; a selling cost of US$0.88/t processed; at El Crestón a gold metallurgical recovery of 78% and a silver metallurgical recovery of 19% were used. Pit slope angles varied from 22º (pad) to 35-42º (pit). At Veta Madre, a gold metallurgical recovery of 67% and a silver metallurgical recovery of 5.0% were used. Pit slope angles averaged 45°.

- Junkyard Mineral Resources are reported using the following assumptions: a gold price of US$2,400/oz Au; a silver price of US$29/oz Ag; a stockpile rehandle cost of US$1.30/t mined; a crushing and leaching cost of US$1.72/t processed; a process cost of US$3.10/t processed; a general and administrative cost of US$1.15/t processed; a selling cost of US$0.66/t processed; a gold metallurgical recovery of 66%; and a silver metallurgical recovery of 27%.

- Mineral Resources are reported at gold equivalent cut-offs of 0.15 g/t AuEq at El Crestón and Junkyard and 0.13 g/t AuEq at Veta Madre. Gold equivalents are calculated using AuEq = (Au + Ag/equivalency factor), where equivalency factor = ((Au price in US$/g * Au recovery) / (Ag price in US$/g * Ag recovery)). This results in Au:Ag ratios of 1:339.75, 1:1,108.97 and 202.3 respectively.

- Totals may not sum due to rounding.

Mineral Reserve Estimates

Mineral Resources were converted to Mineral Reserves for El Crestón, Veta Madre and the Junkyard Stockpile. Mineral Reserves have an effective date of April 30, 2025, are presented at the point of delivery to the process plant, and are reported using the 2014 CIM Definition Standards.

The Mineral Reserve estimate is based on the operation of the existing crusher and conveyor system having a nameplate throughput capacity of about 13,000 t/d, and continued operation of the heap leach and carbon-in-circuit (CIC) process circuit and refinery to process ore from the three deposits. The Mineral Reserve estimate is presented in the following table.

Mineral Reserves Statement

| Classification | Zone | AuEq Cut-off (g/t) | Tonnes (kt) | Gold Grade (g/t Au) | Silver Grade (g/t Ag) | Contained Gold (koz) | Contained Silver (koz) |

| Probable | El Crestón | 0.165 | 12,596 | 0.77 | 10.61 | 312.2 | 4,295.3 |

| Veta Madre | 0.167 | 2,072 | 0.71 | 3.1 | 47.9 | 207.4 | |

| Junkyard Stockpile | 0.149 | 2,449 | 0.20 | 7.0 | 16.1 | 553.2 | |

| Total | 17,117 | 0.68 | 9.19 | 376.2 | 5,055.9 |

Notes to accompany Mineral Reserves table:

- Mineral Reserves are reported using the 2014 CIM Definition Standards.

- Mineral Reserves have an effective date of April 30, 2025. The Qualified Person for the estimate is Mr. Jeffery Choquette, PE, of Hard Rock Consulting.

- A 0.165 g/t AuEq cut-off is used for reporting the Mineral Reserves at El Crestón, and a 0.167 g/t AuEq cut-off is used for reporting Mineral Reserves at Veta Madre. Cut-offs were calculated based on a gold price of US$2,100/oz Au, silver price of US$25/oz Ag, processing costs of US$6.68/t for El Crestón and US$5.56/t for Veta Madre, general and administrative costs of US$1.12/t, refining and selling costs of US$0.88/t, gold recovery of 78% for El Crestón and 67% for Veta Madre and a silver recovery of 19% for El Crestón and 5% for Veta Madre. The AuEq cut-off for Junkyard is 0.149 g/t AuEq based on metal prices of US$2,100/oz Au, and US$25/oz Ag, processing costs of US$4.82/t, general and administrative costs of US$1.15/t, refining and selling costs of US$0.66/t, gold recovery of 66% and a silver recovery of 27%. The AuEq calculation uses the formula AuEq = (Au + Ag/equivalency factor), where equivalency factor = ((Au price in US$/g * Au recovery) / (Ag price in US$/g * Ag recovery)).

- Mineral Reserves are reported within the ultimate reserve pit design. An external dilution factor of 14% was factored into the Mineral Reserves estimates.

- Tonnage and grade estimates are in metric units.

- Mineral Reserve tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Qualified Persons

The technical report for the La Colorado Mine will be prepared for Heliostar Metals Inc. by Mr. Todd Wakefield, RM SME, Mr. David Thomas, P.Geo., Mr. Jeffrey Choquette, P.E., Mr. Carl Defilippi, RM SME, and Ms. Dawn Garcia, CPG. Each of these Qualified Persons has reviewed and approved the technical information contained in this news release in their area of expertise and is independent of the Company.

Qualified Persons with respect to this News Release

Gregg Bush, P.Eng. and Mike Gingles, the Company's Qualified Persons, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information not derived from the updated technical reports and included in this news release in the Company Overview, Commentary by the Company on Relevant Matters and Commentary by the Company on Next Steps and Permitting sections for each property and have approved the disclosure herein.

Data Verification

In addition, the Qualified Persons for the updated technical report verified the data in the reports in their areas of expertise and concluded that the information supported Mineral Resource and Mineral Reserve estimation and could be used in mine planning and economic analysis. The verification completed by each Qualified Person is discussed in each technical report and included site visits, and could include data audits, suitability of data for use in estimation and mine planning, quality assurance and quality control checks, review of available technical and economic study data, review of data collection and evaluation methods, review of production data including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts.

The Company's Qualified persons verified the information that was not derived from the technical reports. The data verification included site visits, data audits, review of available study data, review of data collection and evaluation methods, review of production data, including reconciliation where available, review of actual cost data for operations, and review of third-party inputs to forecasts, and consideration of the Company's plans for the projects.

About Heliostar Metals Ltd.

Heliostar aims to grow to become a mid-tier gold producer. The Company is focused on increasing production and developing new resources at the 100% owned La Colorada and San Agustin mines, and on developing the Ana Paula, Cerro del Gallo and San Antonio deposits in Mexico.

FOR ADDITIONAL INFORMATION, PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things, timing and economics of mineral production, ability to expand production, resources, and exploration potential.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding exploration and mining activities; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

This news release includes certain non-International Financial Reporting Standards (IFRS) measures. The Company has included these measures, in addition to conventional measures conforming with IFRS, to provide investors with an improved ability to evaluate the project and provide comparability between projects. The non-IFRS measures, which are generally considered standard measures within the mining industry albeit with non-standard definitions, are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Cash costs (Cash Costs) are a common financial performance measure in the gold mining industry but with no standard meaning under IFRS. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate each project's economic results in the technical reports and each project's potential to generate operating earnings and cash flow. All-in Sustaining Costs (AISC) more fully defines the total costs associated with producing precious metals. The AISC is calculated based on guidelines published by the World Gold Council (WGC), which were first issued in 2013. In light of new accounting standards and to support further consistency of application, the WGC published an updated Guidance Note in 2018. Other companies may calculate this measure differently because of differences in underlying principles and policies applied. Differences may also arise due to a different definition of sustaining versus growth capital. Note that in respect of AISC metrics within the technical reports because such economics are disclosed at the project level, corporate general and administrative expenses were not included in the AISC calculations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270792