- LegalShield study reveals core problem: Older generations are unprepared to leave an inheritance, and their children are unprepared to receive it

- The largest wealth transfer in history is underway, with an estimated $84 trillion on the line

- LegalShield Provider Attorney: “The silence between generations jeopardizes far more than just financial assets.”

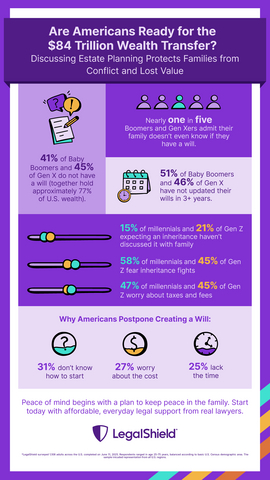

The largest private asset transfer in history is facing a significant hurdle, as a new LegalShield study reveals nearly half of Baby Boomers (41%) and Gen Xers (45%) do not have basic estate planning documents like a will.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250728589663/en/

LegalShield's annual Make-A-Will Month consumer survey finds Americans aren't having important conversations about estate planning, setting the stage for possible lost value and family conflict.

This lack of planning by older generations leaves their Millennial and Gen Z heirs with significant and possibly costly uncertainty as a historic $84 trillion wealth transfer builds momentum expected to carry beyond 2045.

This lack of planning also sets the stage for something most Millennials dread: family conflict.

"The greatest risk to this $84 trillion wealth transfer isn’t taxes – it’s silence," said Warren Schlichting, LegalShield CEO. "An estate plan is essential, combined with open dialogue. Without planning and conversation, Americans risk trading family fortune for family feuds."

The LegalShield survey of over 1,000 U.S. adults, conducted in June 2025, underscores the high stakes of this transfer, revealing that a clear majority of the next generation—including 63% of Millennials—is already counting on an inheritance.

The Single Biggest Issue? Silence

Even when estate plans exist, the study found a wall of silence can be just as damaging as having no plan at all.

- Nearly one in five (19%) Boomers and Gen Xers admit their family doesn't even know if they have a will.

- The silence is mutual: 42% of Millennials and Gen Zers expecting an inheritance have not discussed it with the person leaving it to them.

- A key result is anxiety: The top inheritance-related fear for Millennials is emotional, not financial. 58% of Millennials fear family conflict more than financial fears such as taxes.

The Compounding Problem: Procrastination

The study reveals a critical failure to plan among the generations holding the most wealth.

- 41% of Baby Boomers and 45% of Gen Xers—the two generations holding approximately 77% of U.S. private wealth according to the Federal Reserve—do not have a will.

- Among those with wills, many are dangerously out of date: 51% of Boomers and 46% of Gen Xers have not updated estate planning documents in more than three years.

Gen X: Caught in the Middle

The pressure is especially high for Gen Xers, who are caught in the unique position of expecting to inherit from their parents while also planning to leave wealth to their children. This "sandwich generation" role fuels their financial anxiety.

One more dimension adds to the unease: 78% of Gen Xers report uncertainty about the economy, making them more concerned about protecting their assets.

“The silence between generations jeopardizes far more than just financial assets,” said Wayne Hassay, a LegalShield provider attorney. “People think estate planning is only about who gets the house, but it's much more. It protects your kids, directs healthcare decisions, and handles digital assets. An attorney helps ensure no piece is missed, preventing a legal nightmare for your loved ones later on.”

Study Methodology: The LegalShield survey was conducted in June 2025 among 1,018 U.S. adults. The data was segmented by generation (Gen Z, Millennials, Gen Xers, Baby Boomers) to analyze attitudes and behaviors toward estate planning and the generational wealth transfer.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to hundreds of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250728589663/en/

Contacts

Media Contact:

Ashley Wilemon

ashley@ldww.co