New warnings from government regulators aren’t stopping consumers from using BNPL—Capterra research shows usage is actually increasing and in some cases uplifting younger, marginalized communities by giving them access to responsible loans

Buy now, pay later (BNPL) is surging with consumers despite mounting scrutiny from government regulators. Some experts say BNPL is taking advantage of financially illiterate shoppers; however, data shows that consumers understand the risks and can cover payments. In Capterra’s 2022 Buy Now, Pay Later Survey, nearly all (95%) of shoppers say they’re confident they can make their next payment on time and 65% said they’d be more likely to purchase from a business offering BNPL.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221214005240/en/

(Graphic: Business Wire)

Despite acknowledging the Consumer Financial Protection Bureau’s (CFPB) multiple risk advisories, most shoppers (57%) are more likely to use BNPL in the future. And as the U.S. slips into a forecasted recession, 56% of shoppers say they’d be more likely to use BNPL during uncertain economic times, compared to only 18% that say they’d be less likely. The top three risk factors shoppers assess include hidden interest, credit score damage, and late fees.

Beyond the risks, Capterra’s research supports using BNPL for smaller, manageable purchases. Over half (53%) of shoppers only spend between $50 to $250 per BNPL transaction. And more than two-thirds of shoppers feel that businesses communicate all details of their BNPL programs, leading to more financially literate customers who make payments on time.

BNPL marketing can be deceptive, so it's important that businesses provide transparency upfront by clearly outlining terms and conditions beyond simply linking to the BNPL vendor website at checkout. Customers who discover unexpected consequences later might blame the business for their financial woes and be deterred from returning.

“Responsible payment offerings are of utmost importance for businesses using BNPL, especially because users are primarily younger and minority groups who are more likely to have no credit history,” says Max Lillard, senior finance analyst at Capterra. "When implemented correctly, business can help customers access previously gated financial opportunities, and in some cases, help them build credit.”

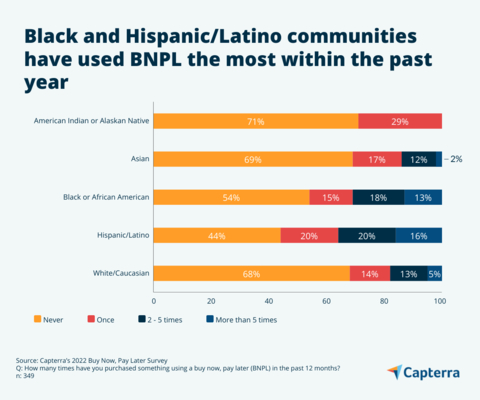

The CFPB found that minority groups and low-income consumers are the core demographic of BNPL services. Capterra’s research came to similar conclusions. Black or African American (46%) and Hispanic/Latino communities (56%) were more likely to use this lending option at least once within the past year, compared to other demographics. Nearly half (45%) of Millennials, 33% of Gen Z, and 33% of Gen Xers financed at least one purchase using BNPL.

As BNPL expands beyond retail purchases to services, utilities, and travel, there is a significant risk of consumers getting in over their heads and going further into debt. To help prevent customers from experiencing financial burden, businesses must assess which BNPL services are the most ethical, offer the best benefits for shoppers, and adhere to all current compliance measures.

To evaluate BNPL software, check out Capterra’s payment processing shortlist which ranks software according to user reviews and proprietary data. For full survey findings, including the most-used BNPL platforms, please visit Capterra.com.

About Capterra

Capterra is the leading software reviews and selection platform that connects businesses to the right technology. Compare software, read and leave reviews, and access objective insights that empower business growth. For more information, visit Capterra.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221214005240/en/

Contacts

Evan Mimms

PR@capterra.com