Increased Vehicle Complexity Introduces New Challenges: Claims for Vehicles with Advanced Driver-Assistance Systems (ADAS) 13.5% Higher on Average

The nationwide surge in used vehicle prices has given an unexpected boost to auto insurance customers who experience a total loss—their vehicles might be worth more than they thought. This phenomenon of higher replacement values, combined with advancements in straight-through-processing (STP), has driven customer satisfaction with auto insurance claims to a record high in the J.D. Power 2021 U.S. Auto Claims Satisfaction Study,℠ released today. Despite these gains, however, the industry is facing new challenges with increased vehicle complexity thanks to the growth of advanced driver assistance systems (ADAS), which are contributing to rising severity cost.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211028005116/en/

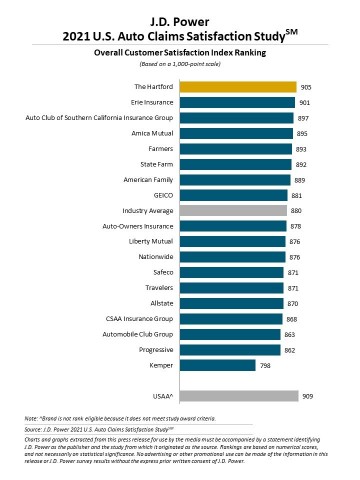

J.D. Power 2021 U.S. Auto Claims Satisfaction Study (Graphic: Business Wire)

“The auto insurance industry has been investing heavily in streamlining the claims process and those investments are starting to pay off in the form of faster cycle times and record levels of satisfaction,” said Tom Super, head of property and casualty insurance intelligence at J.D. Power. “The challenge now will be continuing to drive service improvements as vehicle prices normalize and claim severity continues to increase. Those carriers with more sophisticated claimant triage will be better positioned to navigate the growing cost and complexity ahead.”

Following are key findings of the 2021 study:

- Record-high customer satisfaction: Overall satisfaction with the auto insurance claims process increases to a record-high 880 (on a 1,000-point scale), up eight points from 2020. This is the fourth consecutive year of improvement in auto claims satisfaction, which has been driven by year-over-year increases in performance across five of six factors measured in the study: first notice of loss; claim servicing; estimation process; repair process; and settlement. Growth in settlement, first notice of loss and estimation process factors were the primary drivers of the overall increase in satisfaction.

- STP investments paying off: Claims that can be processed via a low-touch experience in which the entire process from first notice of loss to a direct repair shop resulted in the highest levels of satisfaction (915) in the study. By contrast, claimants who had to interact more manually and with three or more representatives during the claims process had the lowest levels of customer satisfaction.

- ADAS features add complexity, cost: Among claimants with low- to mid-severity claims, 66% indicated that their vehicle was equipped with ADAS features. Claims associated with ADAS-equipped vehicles are about 13.5% higher on average than non-ADAS-equipped vehicles.

-

Claimant profile predictive of claims outcomes: Claimants whose at-fault status is in dispute have the lowest overall customer satisfaction scores. Claimants who are the most price-sensitive can still experience a positive claims process, in which case their likelihood to renew can be heavily influenced.

Study Ranking

The Hartford ranks highest in overall customer satisfaction with a score of 905. Erie Insurance (901) ranks second and Auto Club of Southern California Insurance Group (897) ranks third.

The redesigned 2021 U.S. Auto Claims Satisfaction Study is based on responses from 7,345 auto insurance customers who settled a claim within the past six months prior to taking the survey. The study excludes claimants whose vehicle incurred only glass/windshield damage or was stolen, or who only filed a roadside assistance claim. The study was fielded from November 2020 through September 2021.

For more information about the U.S. Auto Claims Satisfaction Study, visit

https://www.jdpower.com/resource/jd-power-us-auto-claims-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021140.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211028005116/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com