Advanced Micro Devices (AMD) has spent the past year riding the AI wave, powered by growing demand for its Instinct accelerators and EPYC data-center processors. The chipmaker just posted another strong quarter, with revenue jumping 34% year-over-year (YoY) as data center sales climbed 39%.

Still, Wall Street wasn’t impressed. After reporting fourth-quarter results and issuing guidance that topped consensus, AMD shares dropped more than 23% in a sharp post-earnings selloff last week. That pullback quickly caught the attention of Cathie Wood.

Wood’s Ark Invest stepped in on Feb. 4, buying more than 141,000 AMD shares across five ETFs, effectively buying the dip as the stock slid.

With AMD still expanding its AI footprint and analysts expecting estimate revisions ahead, the big question now is simple: Does this selloff create an opportunity for everyday investors, too?

AMD at a Glance

AMD is a top-tier chipmaker that is famous for high-performance CPUs and GPUs. Its “adaptive computing” platforms power everything from data centers to PCs and gaming consoles. Its recent innovations, Ryzen CPUs, Radeon GPUs, etc., have helped it gain market share against rivals Intel (INTC) and Nvidia (NVDA). In short, AMD is a high-growth tech player whose chips run many of today’s AI/cloud workloads.

AMD has been busy signing major deals, which could serve as important catalysts for the company’s next phase of growth in AI and cloud computing. In late 2025, AMD announced a multi-year 6 GW GPU pact with OpenAI. Under this deal, OpenAI will deploy AMD’s next-gen Instinct GPUs, and AMD’s CFO said it should generate “tens of billions” in revenue. These partnerships, plus deals in cloud/hyperscale data centers, underscore AMD’s role in AI infrastructure alongside Nvidia. They also strengthen AMD’s long-term story and likely help explain why Cathie Wood’s Ark chose to buy on the dip. Big AI commitments mean large future market potential.

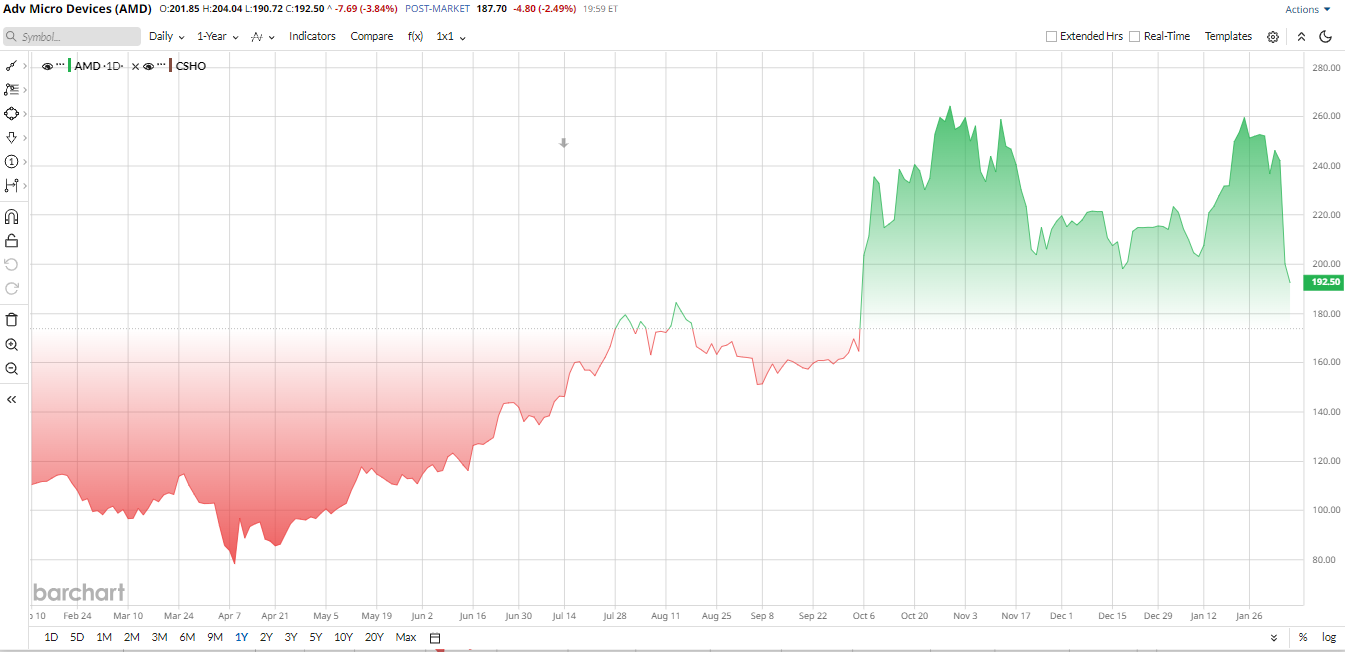

That optimism showed up clearly in AMD’s share price last year. AMD stock surged sharply in 2025, ending the year up roughly 75% over the past 52 weeks. This outperformance came on booming AI and cloud forecasts; investors bid up AMD on its new data center chips and partnerships. However, in early 2026, the stock has pulled back on profit-taking and broader tech volatility.

With the rally now cooling, valuation has come back into focus. AMD’s valuation looks mixed. Its forward price/earnings ratio of 30x is well above semiconductor peers, implying it trades at a premium. Conversely, its PEG ratio is actually below the industry median of 1x. In short, AMD isn’t “cheap”; much of its future growth is already priced in. The stock is expensive on an earnings basis but carries correspondingly high growth expectations.

Cathie Wood Buys the Dip

The earnings-driven selloff put AMD in “buy zone” contention. AMD’s Q4 report beat projections, yet shares plunged 9%, erasing about $30 billion of market cap. Then Cathie Wood acted: on Feb. 4, Ark’s tech ETFs collectively bought 141,108 AMD shares for $28.3 million.

In practical terms, $28 million of buying is tiny against AMD’s $300 billion valuation, so any direct price impact is minimal. Still, Ark’s move is a confidence vote in AMD’s long-term AI roadmap. For now, it’s more headline than catalyst. Ultimately, AMD’s stock will hinge on the execution of its AI strategy and meeting future guidance.

AMD Beats Q4 Earnings Estimates

AMD’s results for fiscal Q4 2025 were robust, which easily topped analysts' forecasts. Revenue hit a record $10.27 billion in fiscal Q4 2025, up 34% YoY, with data center sales around $5.38 billion, rising 39%. Client and gaming revenue also jumped about 37%. Gross margins moved into the mid-50s, at 54%, while non-GAAP EPS came in at $1.53, roughly 40% higher than a year ago. Free cash flow was a standout at about $2.1 billion, nearly double last year, and the company finished the quarter with roughly $10.6 billion in cash and short-term investments.

AMD is spending to scale. Capital expenditures for fiscal 2025 were about $974 million versus $636 million a year earlier, as the firm expands capacity and R&D. Management called 2025 a “defining year,” and CFO Jean Hu flagged record operating income and free cash flow alongside rising strategic investments.

Looking ahead, AMD guided Q1 2026 revenue to about $9.8 billion plus or minus $300 million, implying roughly a 5% sequential decline but about 32% growth versus last year, with gross margin near 55%. The company warned of a double-digit decline in semi-custom SoC sales as the console cycle cools, yet it expects AI GPU demand to pick up later in 2026 with new Instinct MI450 chips.

Wall Street’s Take on AMD Stock

Wall Street remains split on AMD stock’s outlook. Morgan Stanley recently lowered its price target to $255 with an “Equal-Weight” rating after the earnings report, noting that AMD still needs to prove large-scale AI demand.

On the bullish side, analysts see more upside. Wells Fargo’s Aaron Rakers keeps a “Buy” rating with a $345 target, pointing to “insatiable” data center demand. Jefferies’ Blayne Curtis also takes a constructive view, while KeyBanc’s John Vinh raised his target to $300 with an “Overweight” rating based on strong cloud orders.

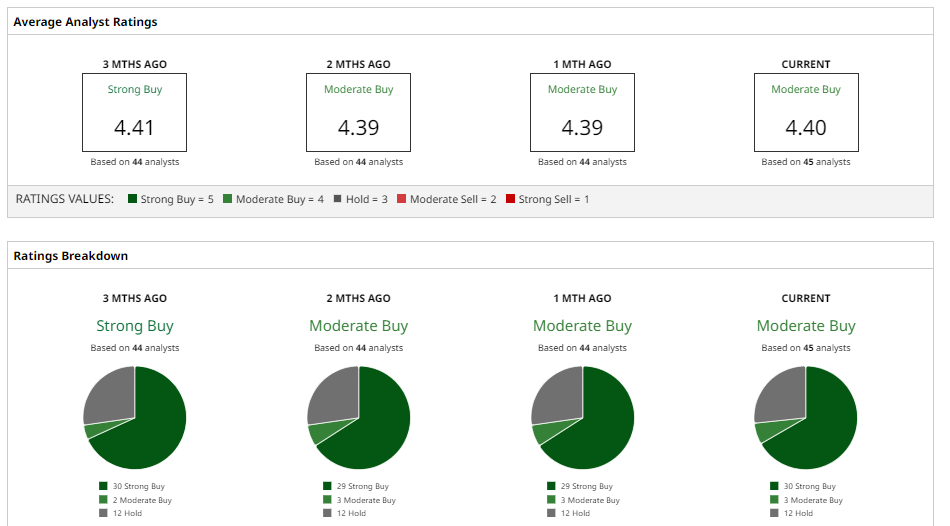

Overall, analysts are positive, with a “Strong Buy” consensus with 30 “Strong Buy” and three “Moderate Buy” ratings versus 12 “Hold” ratings and a 12-month average price target around $288, roughly 50% above current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart