With a market cap of $56.9 billion, Monolithic Power Systems, Inc. (MPWR) is a global designer and supplier of semiconductor-based power electronics solutions serving markets such as data centers, automotive, industrial, communications, and consumer electronics across the U.S., Asia, and Europe. It specializes in DC-to-DC and AC-to-DC power management ICs sold through a broad network of distributors, OEMs, and design manufacturers worldwide.

Shares of the Kirkland, Washington-based company have surpassed the broader market over the past 52 weeks. MPWR stock has surged 69% over this time frame, while the broader S&P 500 Index ($SPX) has risen 11.8%. Moreover, shares of the company have increased 29.1% on a YTD basis, compared to SPX's marginal gain.

Looking closer, the chipmaker stock has exceeded the State Street Technology Select Sector SPDR ETF's (XLK) 15.7% return over the past 52 weeks.

Shares of Monolithic Power Systems jumped 6.4% following its Q4 2025 report on Feb. 5 as adjusted EPS came in at $4.79 and revenue of $751.2 million, both topped forecasts. Investors were further encouraged by strong profitability, with adjusted operating income of $269 million, up from $220.7 million a year earlier, and solid execution reflected in a 55.5% adjusted gross margin. The rally was reinforced by upbeat Q1 2026 revenue guidance of $770 million to $790 million.

For the fiscal year ending in December 2026, analysts expect MPWR's EPS to grow 32.9% year-over-year to $17. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

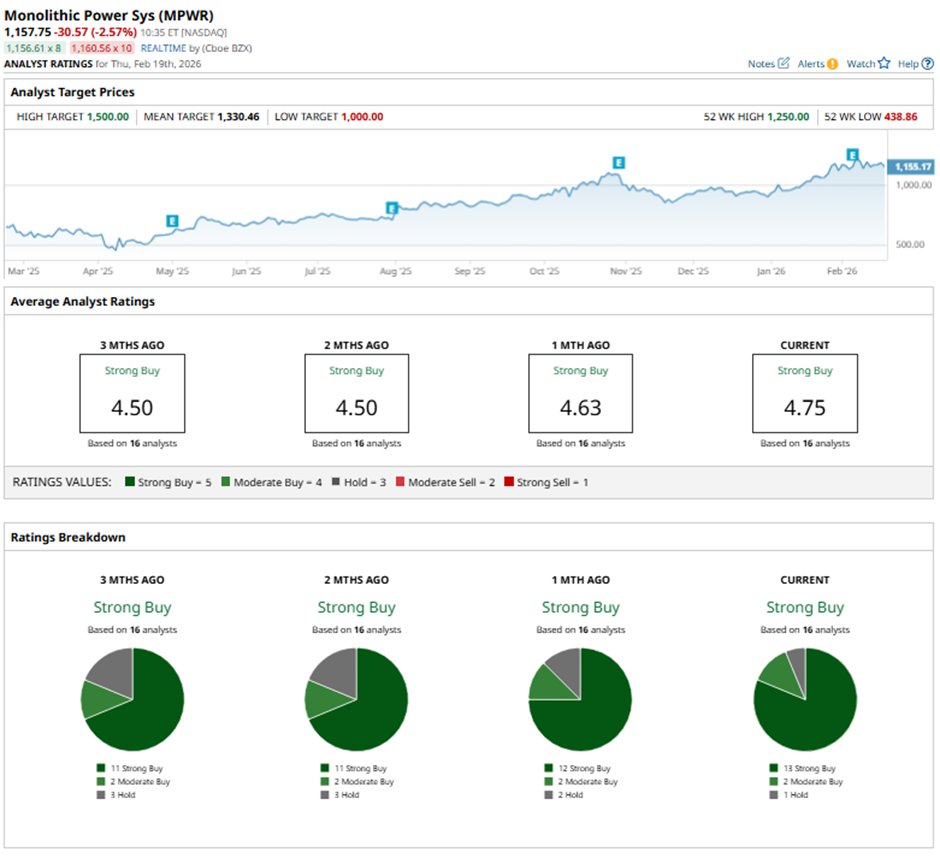

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buy” ratings, two “Moderate Buys,” and one “Hold.”

On Feb. 7, Truist Financial analyst William Stein reiterated a “Buy” rating on Monolithic Power Systems, maintaining a price target of $1,396.

The mean price target of $1,330.46 represents a 14.9% premium to MPWR’s current price levels. The Street-high price target of $1,500 suggests a 29.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart