Visual discovery platform Pinterest (PINS) has been grabbing attention lately, but not in a good way. The stock has been hit with intense selling pressure after the company reported its fourth-quarter results this month. Pinterest delivered a revenue miss and paired it with weak guidance, a combination that quickly shook investor confidence. The social media company blamed its slower growth on the impact of tariffs, saying large retailers have reduced ad spending as trade pressures mount.

For context, large retailers are feeling the heat from President Donald Trump’s ongoing trade war, which has pushed up shipping costs and squeezed margins. As a result, many retailers are raising prices for customers, cutting the number of products they bring to market, implementing layoffs, and, importantly for Pinterest, pulling back on advertising spend. That ad slowdown is now directly hitting Pinterest’s growth.

Adding to concerns, Pinterest warned that tariffs are expected to further reduce ad spending in Europe and North America, with the impact likely to be “slightly more pronounced” in the current quarter. Nevertheless, with the stock now struggling to find footing after a disappointing Q4 report, should investors consider buying the dip in Pinterest, or is caution the smarter move for now?

About Pinterest Stock

Founded in 2010, California-based Pinterest is a visual search and discovery platform where users come to spark ideas, plan projects, and shop with intent, all within a positive and inspiration-driven online environment. Today, the platform connects over 600 million monthly active users worldwide, making it one of the largest hubs for creativity and commerce on the internet.

Currently valued at approximately $10.5 billion by market capitalization, shares of this social media platform have struggled to stay afloat on Wall Street. The stock’s weakness reflects a tough mix of soft financial guidance, tariff-related headwinds, less-than-stellar quarterly reports, and mounting competitive pressure from artificial intelligence (AI)-integrated platforms, as well as larger social media giants like TikTok and Instagram.

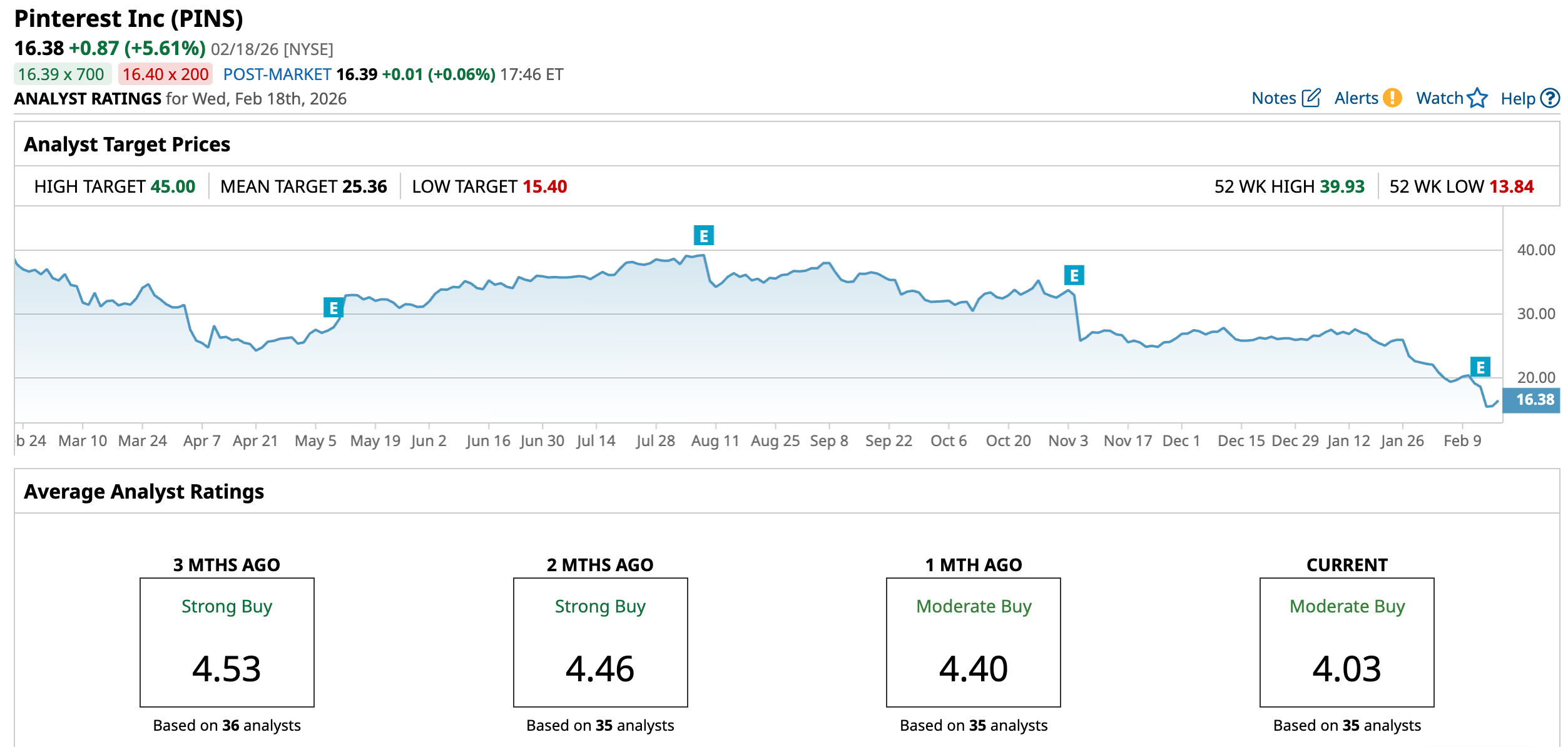

The numbers tell the story. After tumbling nearly 58.34% in 2025, the selloff has carried into 2026, with shares down another 36.73% so far. In comparison, the broader S&P 500 Index ($SPX) has climbed about 12.26% over the past year and is only marginally lower in 2026, underscoring the sharp lag of Pinterest amid the broader market.

Inside Pinterest’s Q4 Earnings Results

On Feb. 12, Pinterest unveiled its fiscal 2025 fourth-quarter results, and while growth remained intact, the report exposed enough weaknesses to rattle investors. The stock plunged almost 16.8% in the very next trading session. Revenue increased 14% year-over-year (YOY) to $1.32 billion, but it narrowly missed Wall Street’s $1.33 billion estimate.

Breaking it down geographically, revenue in the U.S. and Canada totaled $979 million, up 9%, with growth driven by retail, financial services, and telecom. In Europe, revenue climbed 25% on a reported basis to $245 million, fueled primarily by retail demand, though management admitted the performance fell short of internal expectations.

Profitability showed resilience. Adjusted EBITDA rose 15% YOY to $542 million. Adjusted earnings per share came in at $0.67, up 19.6% annually and largely in line with consensus estimates. In addition, Pinterest closed the year with a strong balance sheet, holding $2.5 billion in cash, cash equivalents, and marketable securities.

Reflecting on the quarter, CEO Bill Ready acknowledged during the earnings call that the company was “not satisfied” with its Q4 revenue performance, stating it does not reflect what Pinterest can deliver over time. Also, the CEO noted that the company absorbed an “exogenous shock” related to tariffs, which have disproportionately impacted ad spending from its top retail advertisers.

Looking ahead, the outlook did little to calm nerves. Pinterest expects first-quarter fiscal 2026 revenue between $951 million and $971 million, implying 11% to 14% YOY growth, below analyst expectations of $981.8 million. Adjusted EBITDA for Q1 2026 is projected in the range of $166 million to $186 million, also falling short of analysts’ forecast of $205.4 million.

Despite the top line miss and cautious outlook, there was one bright spot. Fourth-quarter global monthly active users (MAUs) jumped 12% YOY to 619 million, an all-time high for the platform.

How Are Analysts Viewing Pinterest Stock?

Wall Street wasted no time responding to Pinterest’s lackluster Q4 report. On Feb. 13, JPMorgan downgraded the stock from “Overweight” to “Neutral,” sharply cutting its price target to $20 from $36 following the company’s disappointing guidance. The firm pointed to mounting headwinds facing large retailers across the U.S., Canada, and Europe, as they grapple with tariff-driven margin pressure, challenges that could become even more pronounced in the first quarter of 2026.

Evercore ISI also turned more cautious, downgrading Pinterest from “Outperform” to “In Line” and assigning a $25 price target. The firm labeled the fourth-quarter results a “Miss & Lower” performance, signaling what it sees as weakening fundamentals for the social media platform.

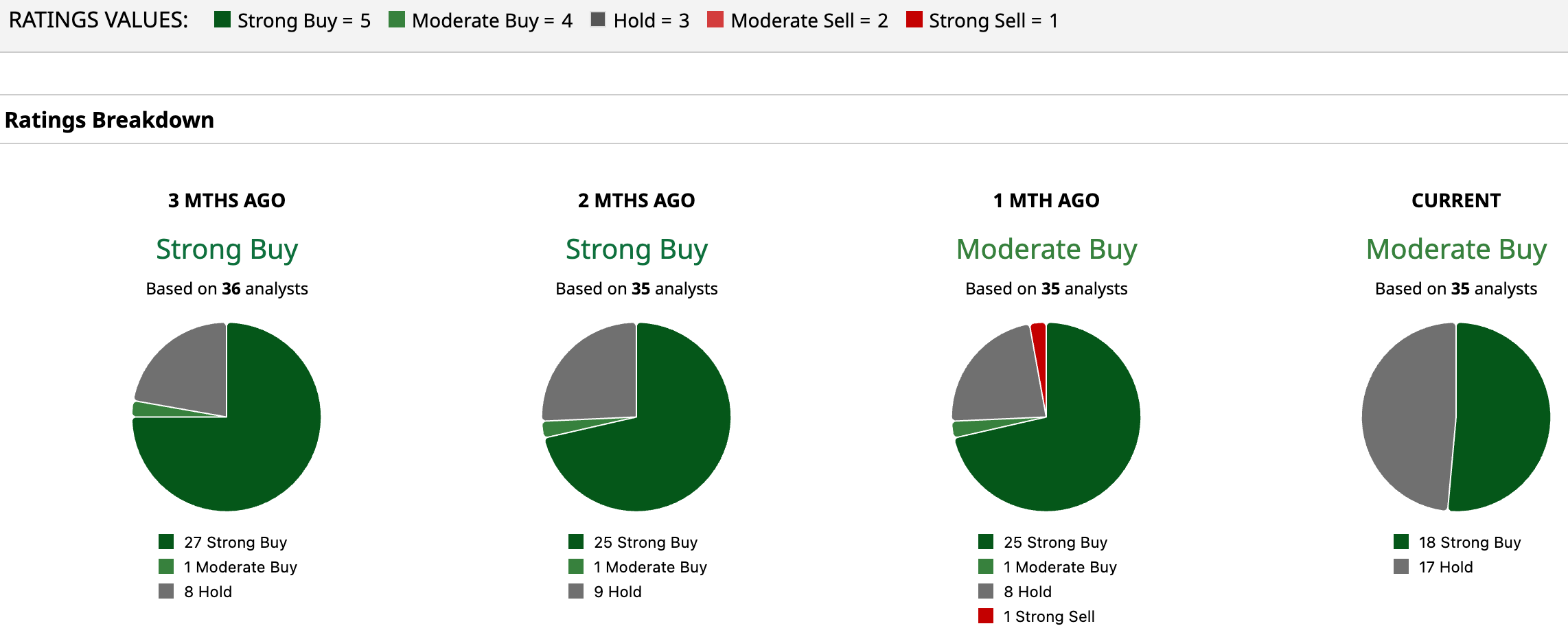

Even so, sentiment hasn’t turned entirely bearish. Pinterest still carries a consensus “Moderate Buy” rating on Wall Street. Of the 35 analysts covering the stock, 18 rate it a “Strong Buy,” while 17 recommend “Hold.” The average price target of $25.36 points to potential upside of 54.8%, and the Street-high target of $45 suggests the shares could rally as much as 174.7% from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart