Norwalk, Connecticut-based EMCOR Group, Inc. (EME) provides mechanical and electrical construction, industrial infrastructure, energy systems, and building and facilities services for commercial, industrial, utility and public-sector clients. It is valued at a market cap of $35.7 billion.

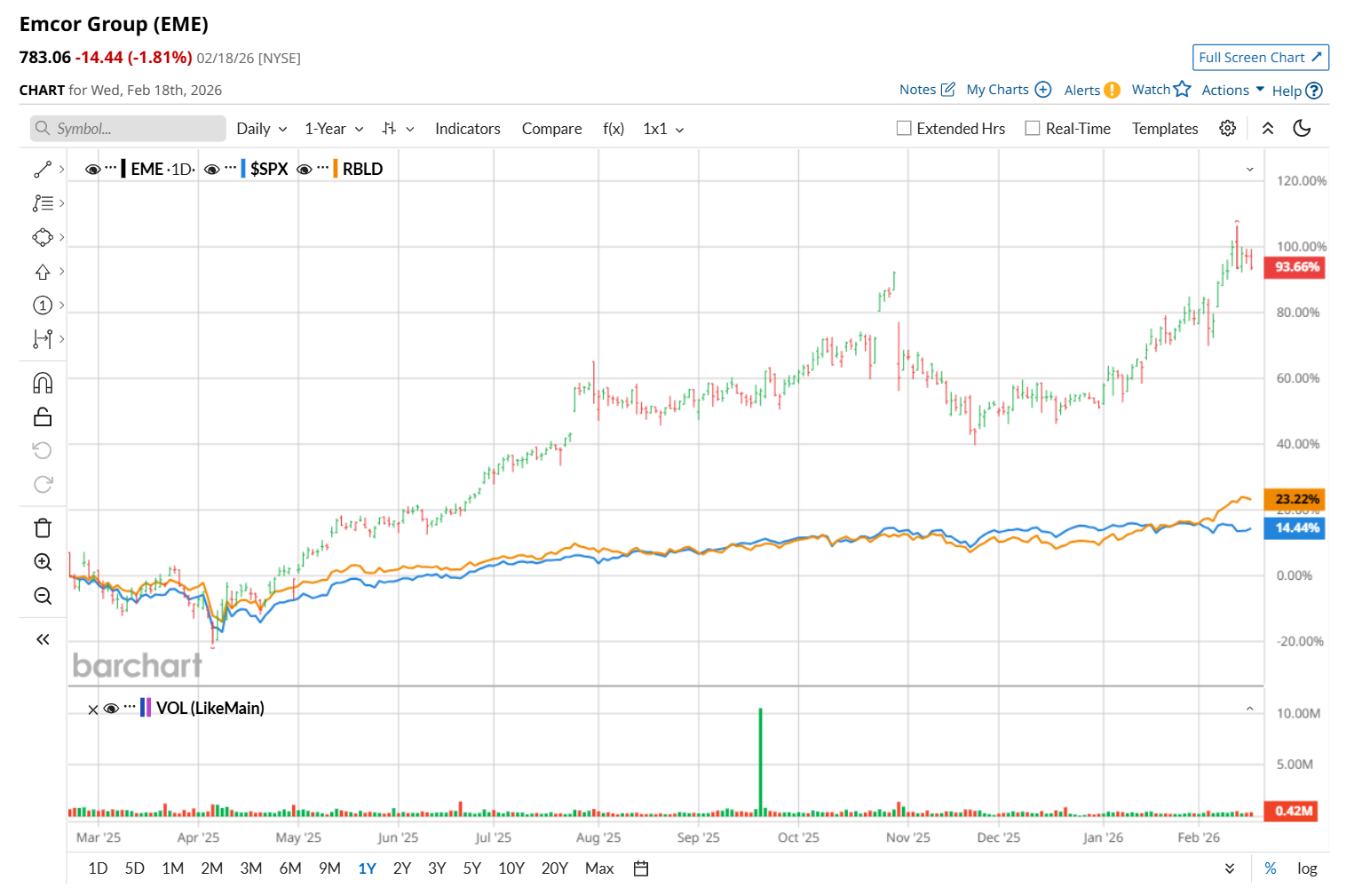

This industrial company has significantly outperformed the broader market over the past 52 weeks. Shares of EME have soared 80.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a YTD basis, the stock is up 28%, compared to SPX’s marginal rise.

Zooming in further, EME has also outpaced the First Trust Alerian U.S. NextGen Infrastructure ETF (RBLD), which surged 20.4% over the past 52 weeks and 12.7% on a YTD basis.

On Jan. 2, shares of EMCOR Group climbed 4.4% after the company announced a significant boost to its quarterly dividend, increasing it to $0.40 per share from $0.25. The hike signaled management’s confidence in the company’s financial strength and long-term outlook, boosting investor sentiment.

For the current fiscal year, ending in December, analysts expect EME’s EPS to grow 17.3% year over year to $25.25. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

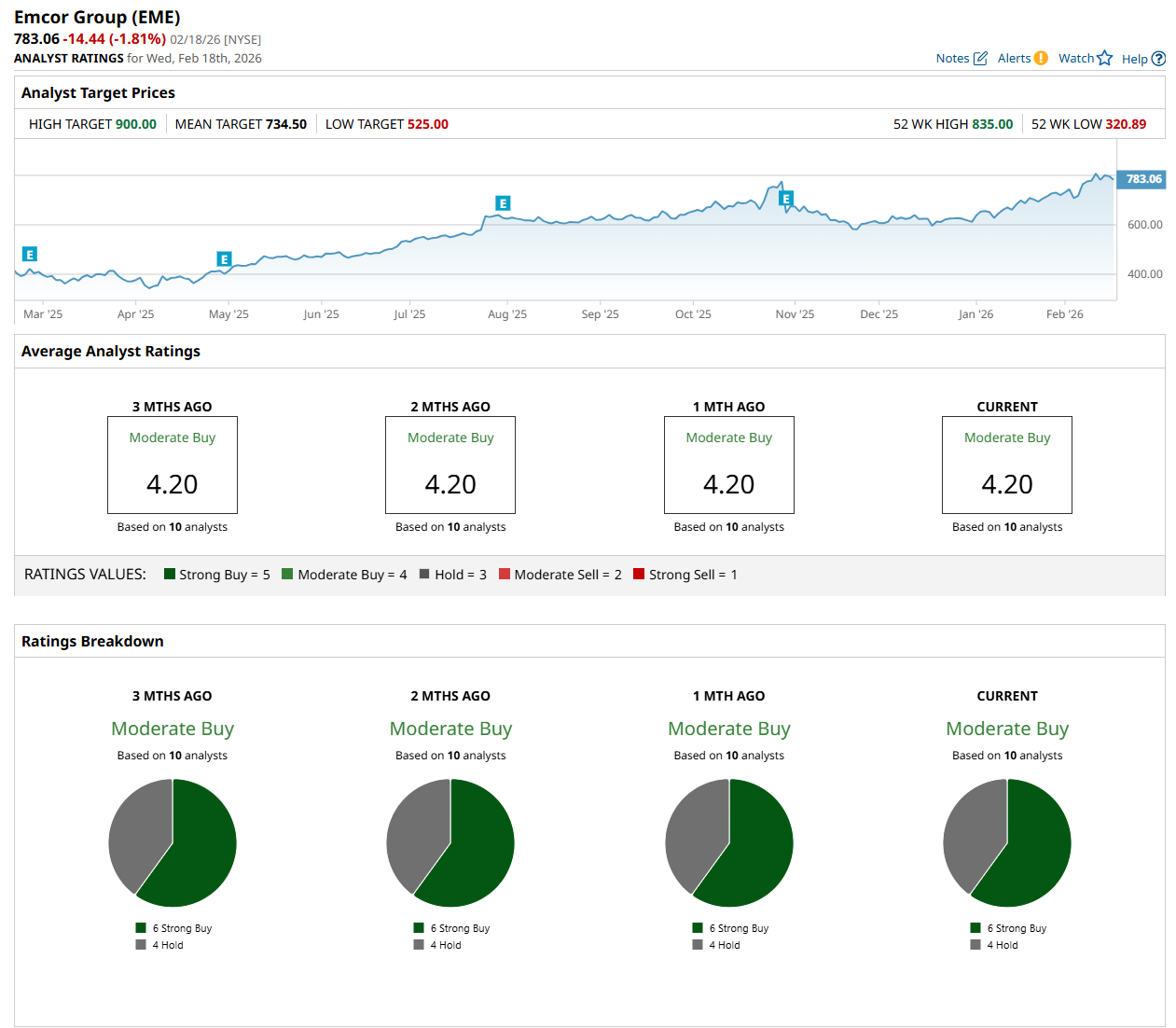

Among the 10 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on six “Strong Buy” and four "Hold” ratings.

The configuration has remained consistent over the past three months.

On Jan. 26, Stifel Financial Corp. (SF) analyst Brian Brophy maintained a "Buy" rating on EME and raised its price target to $754.

While the company is trading above its mean price target of $734.50, its Street-high price target of $900 suggests a 14.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart