Apple (AAPL) is one of the most important stocks in the market, and that's perhaps an understatement. The world's most valuable company for most of the past two decades, Apple's price movements have historically driven a great deal of the overall market return for investors. As such, where this stock is headed for the remainder of 2026 could be a massive deal for markets overall.

However, given recent reports that the overall correlation of Apple's stock price movements (as measured by its beta) has sunk to a low of 0.2 is indicative that investors are starting to once again pick winners and losers in the AI race. Notably, this level is the lowest since 2006 - it was as high as 0.9 in May - suggesting that Apple is among the key companies in which investors are looking for less exposure right now.

Recent analyst notes and commentary around Apple's selloff, which now has AAPL stock down more than 8% from its recent all-time high, suggest that this selloff may be unwarranted. Let's dive into what analysts at Wedbush Securities suggest is driving this recent move lower, and why it may be time to buy the dip.

Apple Could Be the AI Beneficiary Investors Are Overlooking

This week, Wedbush's Dan Ives and other analysts suggested that future upgrades to Siri (with a number of key AI features included) could reverse. This comes as concerns amid market participants that Apple has been slow to join the AI party, which could ultimately be diminished once the company eventually gets its AI strategy right.

That's an interesting view, and one which encourages investors to think about the long game when it comes to Apple and its ability to integrate software (and AI technology) within a hardware ecosystem. If consumers believe that Apple's future AI integrations will result in the absolute best hardware in the market, a broader consumer base could strengthen the company's already-robust moat driven by customer loyalty, resulting in even faster growth in its cash flows.

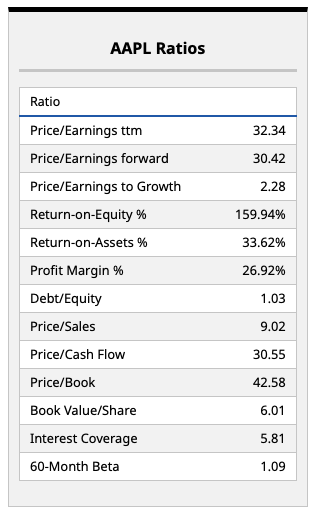

Looking at Apple's fundamentals above, it appears the recent dip has improved the stock's capital appreciation outlook. With a free cash flow yield of around 3.3% (and increasing probabilities of higher cash flows in the future, according to Ives and others), this is a stock that could have material upside based on a strengthening of its key fundamentals.

Now, that's not to say that Apple hasn't gotten more expensive in recent years, as growth has slowed from its historical levels and its valuation multiple has expanded alongside the market. And without a broad rollout of AI applications or integrations with its core hardware portfolio, some investors have rightly sought out other higher-growth investments right now.

Nevertheless, the company's forward multiple of 30.42 times earnings is reasonable, and there could be room for further upside driven by some slight valuation expansion (but mostly fundamental improvement). That's the base case a number of experts on Wall Street appear to be touting.

What Do Wall Street Analysts Think?

Dan Ives and Wedbush have an outperform rating on AAPL stock, with a hefty price target of $350 per share. That price target is indeed the highest on the Street, and suggests Apple could have 32% upside from today's levels.

Personally, I think that price target is a bit aggressive. I'm more closely aligned with the consensus mean target of $293.48 per share, which still implies more than 10% upside in this name over the next year. I'm not sure the macro backdrop and overall investor sentiment will support another 30%+ annual move in AAPL stock, but this bull market has a way of carrying on, with investors climbing the proverbial wall of worry. We'll see if that can continue from here.

On that note, I do think there's a reason why investors are remaining relatively cautious with Apple right now, and I'd expect that caution to hold for some time. Yet, bulls like Ives have been right, so investors may want to take a deeper look at his note and come to one's own conclusions around what Apple's projected forward performance will be. That's what makes markets, after all.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart