PayPal (PYPL) stock has significantly underperformed the broader index over the past year, declining by more than 45% from its 52-week high. Year-to-date (YTD), PYPL stock has dropped about 29%. While the company grew revenue, transaction margin dollars, and EPS in 2025 — reflecting the strength of its increasingly diversified platform — the outlook for 2026 remains challenged.

The weakness in branded checkout and ongoing investment to support growth is likely to weigh on PayPal’s profitability in the short term. Moreover, heightened competition, macro challenges, and execution gaps remain a drag.

Factors Hurting PayPal’s Growth

PayPal has long been the leader in the digital payments space, consistently delivering mid-single-digit growth in total payment volume (TPV) over the past several years. However, its dominance has been eroding.

For instance, in the most recent fourth quarter, online branded checkout TPV rose 1% on a constant-currency basis, reflecting a sharp deceleration from 5% growth in Q3. This slowdown in a core engine of the business reflects multiple challenges, including macroeconomic and competitive headwinds as well as operational pressures, which are likely to hurt the company’s near-term outlook.

The most immediate drag has come from the U.S. retail environment. PayPal’s merchant base is heavily exposed to discretionary spending categories, and softness among lower- and middle-income consumers has translated into weaker transaction growth across its retail portfolio. While softer discretionary spending reflects broader macro constraints, it also exposes the company’s execution gaps. During high-volume retail periods, PayPal has not captured incremental share.

Internationally, PayPal is also facing challenges. Germany, one of PayPal’s largest markets, has cooled. Growth moderation there reflects macroeconomic softness and heightened competition from alternative payment methods.

Compounding these geographic pressures is a slowdown in previously high-growth verticals. Categories such as travel, ticketing, crypto, and gaming had been robust contributors through late 2024 and into much of 2025. As growth in these segments has normalized, the mix shift dampens aggregate TPV expansion.

Beyond external factors, management has acknowledged operational issues. Execution missteps have magnified macro and competitive pressures.

To reaccelerate growth, PayPal is increasing targeted investment across its portfolio. Management expects these initiatives to create a roughly three-percentage-point headwind to transaction-margin dollar growth. The strategic focus includes scaling new consumer experiences, improving checkout presentation, broadening payment choices, and expanding into new channels.

Approximately two-thirds of the incremental spend is directed at branded checkout and Buy Now, Pay Later (BNPL), with the remainder supporting initiatives such as loyalty features within Venmo and emerging agent-driven commerce use cases.

While the company is prioritizing long-term growth, these investments are likely to hurt margins in the near term. Lower transaction margin growth and pressure on EPS in 2026 are likely to limit the upside in PayPal stock.

Is PayPal Stock a Buy Now?

PayPal is navigating a challenging transition period reflecting slowing branded checkout growth, rising competitive intensity, softer consumer spending, and margin pressure from stepped-up investments. While revenue, transaction margin dollars, and EPS have grown to date, the near-term outlook indicates that EPS growth will moderate in 2026.

Nonetheless, several areas of the business remain strong. Venmo continues to perform well and is on pace to surpass $2 billion in revenue ahead of management’s expectations. Enterprise payments returned to double-digit volume growth in Q4, signaling renewed momentum, while PayPal's BNPL offering is expanding rapidly. In addition, emerging channels such as agentic commerce could contribute meaningfully to growth. PayPal is also focusing on driving productivity across the organization and allocating resources to the high-return opportunities, which will support its growth in 2026.

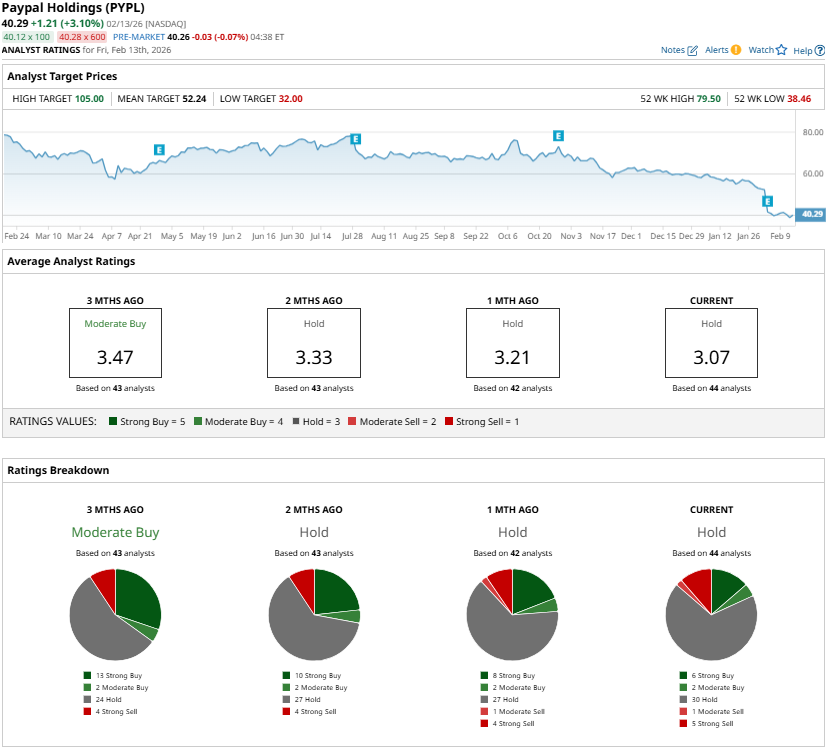

Meanwhile, Wall Street maintains a “Hold” consensus rating on PYPL stock. That implies that the stock’s risk and reward remain well balanced at present.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Pentagon Could Blacklist Alibaba. Does That Make BABA Stock a Buy Now?

- The Shocking, Futuristic Reason Why Elon Musk Is Stopping Production of 2 Tesla Models

- A Utility Stock with Steady Earnings and a Dividend Higher Than a 30 Year T-Bill

- 1 Data Center Stock That Billionaire Philippe Laffont Is Buying Now