American Airlines Group (AAL) is the world's largest airline by passengers carried and flights operated. As the parent of American Airlines and regional partners like Envoy, Piedmont, and PSA, it flies nearly 6,800 daily flights to 350+ destinations. It focuses on premium cabins, loyalty programs like AAdvantage, and innovations like Wi-Fi and lounges for better travel experiences.

Formed in 2013 through the merger of AMR Corporation and US Airways Group, it's headquartered in Fort Worth, Texas. American Airlines Group operates primarily in the U.S. but serves over 60 countries across North America, Latin America, Europe, Asia-Pacific, and the Caribbean via its global network.

American Airlines Stock Lags

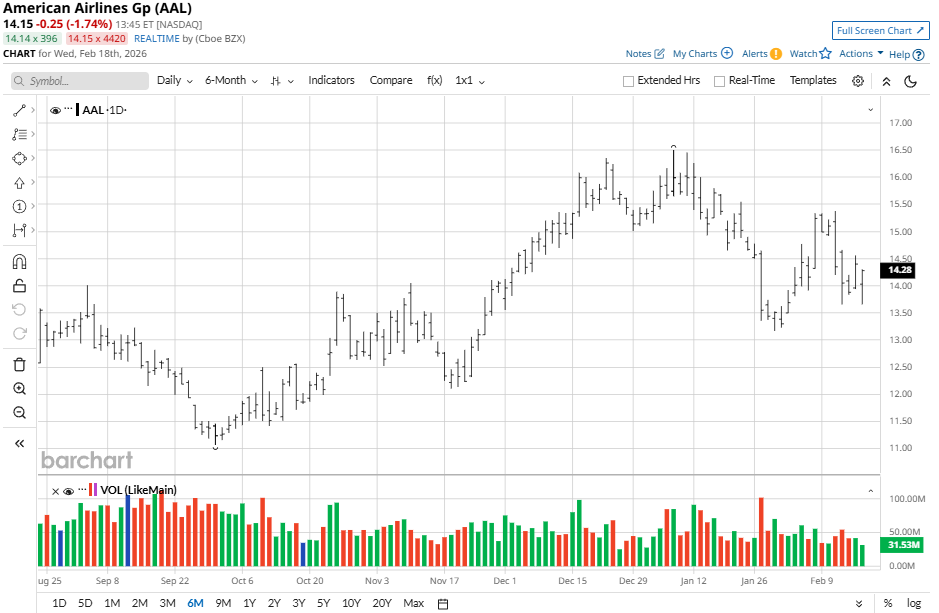

American Airlines stock comes under some bearish pressure as it slips 6% in the last five days and 12% in a month, reflecting broader airline sector pressure. The stock does recover in a quarter with a 14% rise but goes into the red again in a 52-week time period with a negative 16% report while also being 16% off its 52-week high.

Versus the Nasdaq Composite ($NASX), the stock underperforms with the index slipping just 3% in a month while gaining 12% in a year, lagging tech-driven gains while airlines face fuel and demand volatility.

American Airlines Results

American Airlines reported Q4 2025 results on Jan. 27, 2026, hitting a record revenue of $14.0 billion, up 2.5% year-over-year (YoY) despite a $325 million hit from a government shutdown. Adjusted EPS came in at $0.16, missing analyst estimates of $0.38 by 58% (GAAP EPS $0.15), while full-year revenue reached a historic $54.6 billion with adjusted EPS of $0.36.

Passenger revenue drove growth, with premium cabins outpacing the main cabin by 7 points YoY, and managed corporate revenue rose 12%. Total debt dropped $2.1 billion in 2025 to under $40 billion. Specific cash reserves, free cash flow, and margins weren't detailed, but unit revenue would have been positive without the shutdown. Early 2026 bookings show double-digit systemwide gains.

American projects Q1 revenue growth of 7-10% versus last year, with available seat miles up 3-5% and CASM (excluding fuel/profit sharing/specials) up 3-5%, expecting an adjusted loss per share of ($0.10) - ($0.50). Full-year 2026 adjusted EPS guidance is $1.70-$2.70, with free cash flow over $2 billion, fueled by premium demand and debt reduction.

Appaloosa Boosts Bet on American Airlines

Appaloosa Management, led by David Tepper, significantly increased its stake in American Airlines Group during Q4, acquiring 4.9 million shares to reach over 14 million total. This move highlights confidence in airlines amid premium travel demand, despite weather disruptions and government shutdowns.

The hedge fund also added to Big Tech, buying 399,431 Alphabet (GOOG) (GOOGL) shares (up 28.79%), 230,000 Meta (META) shares, and more Microsoft (MSFT), while trimming financials like Citizens Financial (CFG), Comerica, and Truist (TFC).

Should You Bet on AAL Stock?

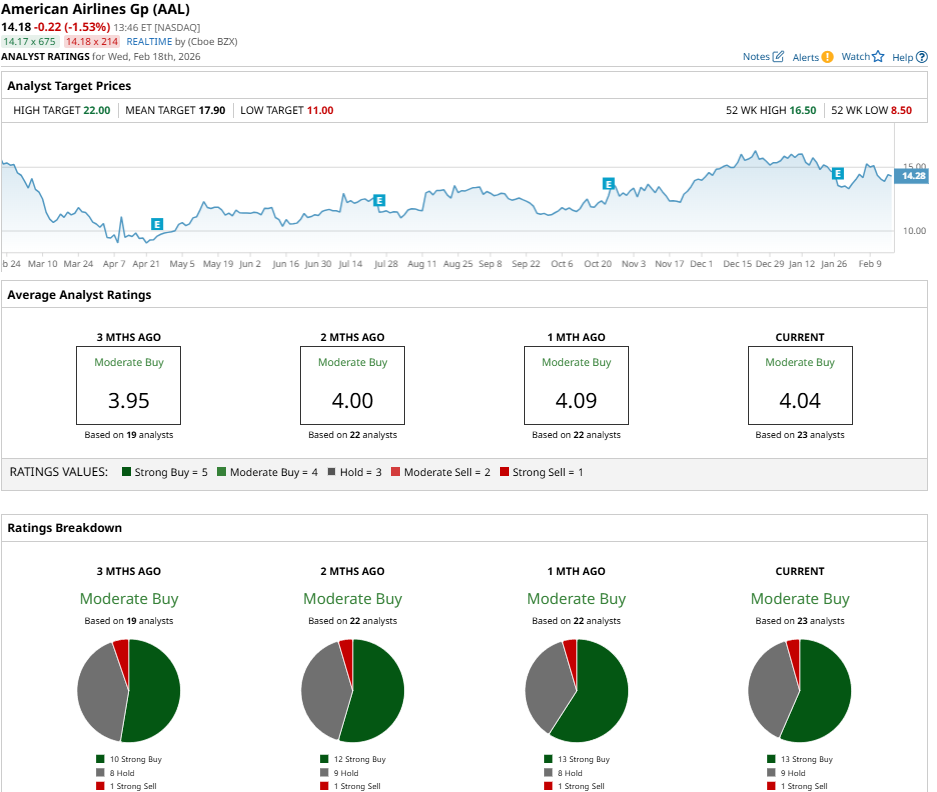

Recent pressure on American Airlines has presented investors with an opportunity, which is recognized by analysts who have a consensus “Moderate Buy” rating on AAL stock with a mean price target of $17.90, reflecting an upside potential of 26% from the market price.

The stock has been rated 23 times so far, with 13 “Strong Buy” ratings, nine “Hold” ratings, and one “Strong Sell” rating from analysts.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart