Valued at a market cap of $41.1 billion, Keysight Technologies, Inc. (KEYS) provides electronic design and test solutions. The Santa Rosa, California-based company’s technologies serve a diverse set of end markets, including telecommunications, aerospace and defense, automotive, semiconductor, and industrial applications.

This tech company has outperformed the broader market over the past 52 weeks. Shares of KEYS have soared 29.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, on a YTD basis, the stock is up 18%, compared to SPX’s marginal rise.

Zooming in further, KEYS has also outpaced the State Street Technology Select Sector SPDR ETF (XLK), which gained 16.4% over the past 52 weeks and dropped 2.1% on a YTD basis.

On Feb. 18, shares of KEYS rose 2.3% after the company unveiled a new suite of scale-up validation solutions aimed at helping AI data center operators tackle increasing bandwidth, latency, and interoperability challenges as computing clusters grow more dense and complex. The portfolio supports both emerging and established interconnect standards, facilitating quicker deployment of high-performance and energy-efficient AI infrastructure.

For fiscal 2026, ending in October, analysts expect KEYS’ EPS to grow 16.6% year over year to $7.16. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

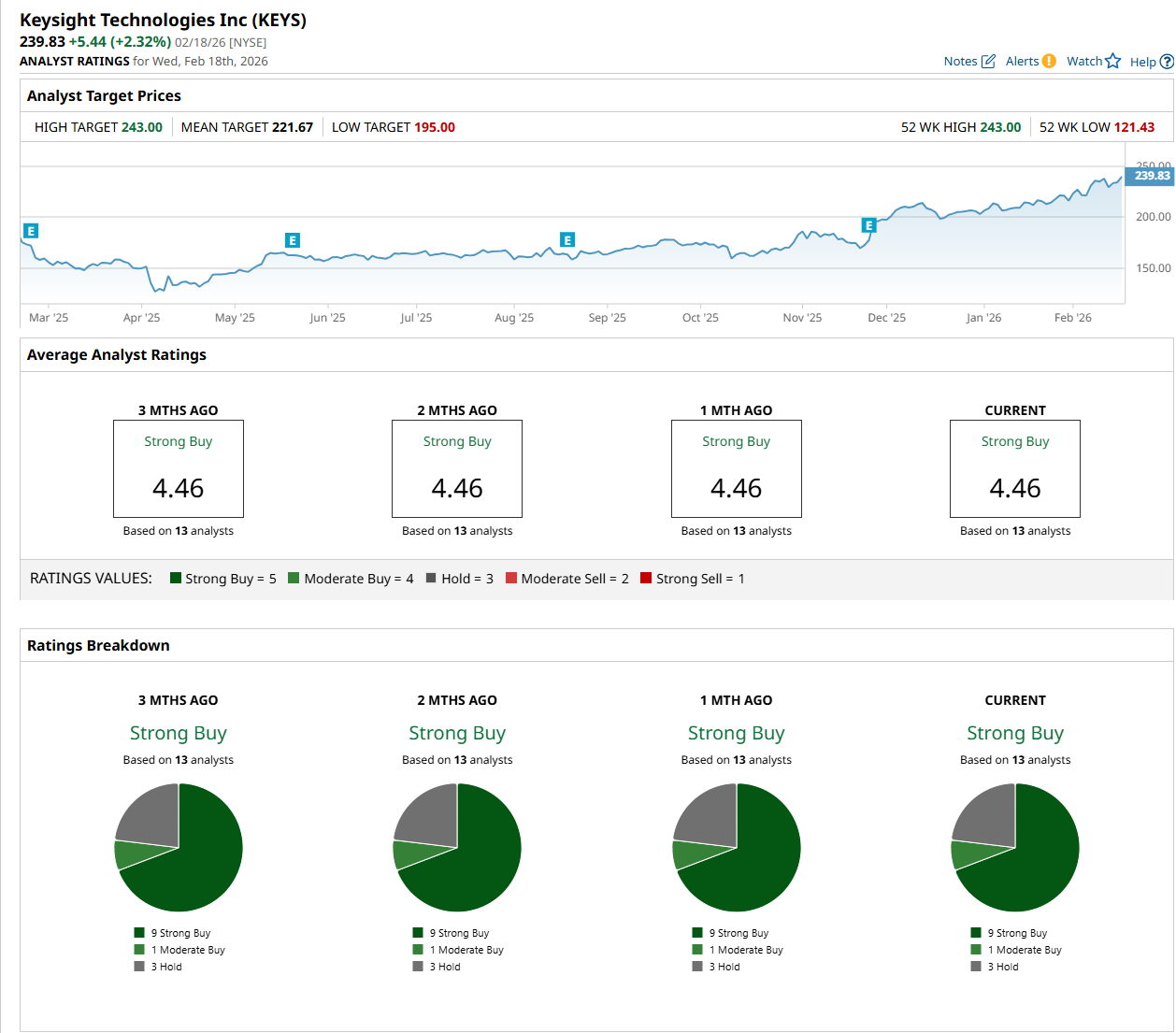

Among the 13 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on nine “Strong Buy,” one "Moderate Buy,” and three “Hold” ratings.

The configuration has remained consistent over the past three months.

On Feb. 18, JPMorgan Chase & Co. (JPM) maintained an "Overweight" rating on KEYS and raised its price target to $255, indicating a 6.3% potential upside from the current levels.

While the company is trading above its mean price target of $221.67, its Street-high price target of $243 suggests a 1.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart