Swords, Ireland-based Trane Technologies plc (TT) is a leading climate-innovation and industrial manufacturing company that designs, builds, and services energy-efficient Heating, Ventilation, Air-Conditioning (HVAC) systems and transport-refrigeration solutions. Valued at a market cap of $104.1 billion, the company focuses on sustainable, low-carbon technologies for buildings, homes, and cold-chain logistics, and operates primarily through its flagship brands Trane and Thermo King.

Shares of this industrial manufacturing company have outpaced the broader market over the past 52 weeks. TT has gained 26.6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 12.3%. Moreover, on a YTD basis, the stock is up 18.1%, compared to SPX’s marginal return.

However, zooming in further, TT has outperformed the State Street SPDR S&P Homebuilders ETF (XHB), which has surged 13.4% over the past 52 weeks and 16.2% on a YTD basis.

On Jan. 29, Trane Technologies posted its FY2026 Q4 earnings, and its shares dipped 8.1%. Its revenue of $5.14 billion rose 6% year over year, and adjusted continuing EPS improved 10% to $2.86, both above expectations. Performance was driven by solid commercial HVAC demand, which lifted organic bookings 22% and expanded backlog to a record $7.8 billion. Additionally, the company issued constructive FY 2026 guidance, projecting 6–7% organic revenue growth and EPS of $14.65–$14.85, indicating continued momentum.

For the current fiscal year, ending in December, analysts expect TT’s EPS to grow 13.1% year over year to $14.77. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

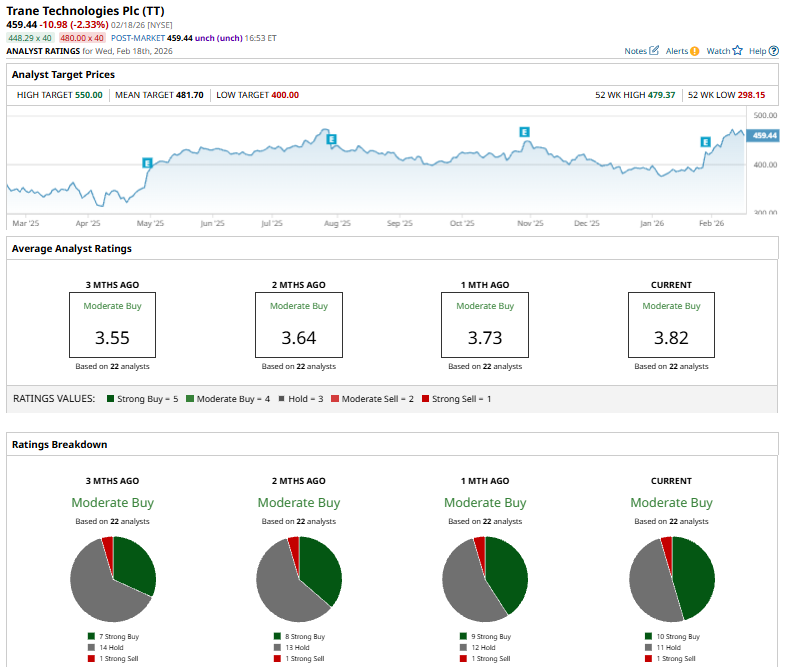

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on ten “Strong Buy,” 11 "Hold,” and one "Strong Sell” rating.

This configuration is slightly bullish than a month ago, with nine analysts suggesting a “Strong Buy” rating.

On Jan. 30, JPMorgan analyst Stephen Tusa maintained a “Neutral” rating on Trane Technologies while raising the price target to $460 from $434, signaling modest near-term valuation optimism without changing the overall stance on the stock.

The mean price target of $481.70 represents a 4.8% premium from TT’s current price levels. The Street-high target of $550 implies an upswing potential of 19.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart