Data centers are the backbone of today’s cloud- and AI-driven economy, and stocks that supply the power, cooling, and racks that keep those servers running have become some of the market’s hottest plays. Investors chasing durable growth are rewarding companies that combine essential hardware with services and software that boost uptime and efficiency.

One such name drawing smart-money interest is Vertiv (VRT). Billionaire investor Philippe Laffont’s Coatue-backed fund (Coatue Management) disclosed a new stake in Vertiv in Q4, a move that underlines why growth investors are eyeing this niche. Vertiv pairs mission-critical power and advanced cooling hardware with analytics and lifecycle services, bolstered lately by the PurgeRite acquisition and strategic collaborations, including work with Nvidia (NVDA) on next-gen cooling for AI rigs.

Moreover, a strong backlog, margin expansion, and robust cash flow from recent quarters give the company visible growth, which explains why a marquee buyer just added the stock to its pocketbook.

Here’s a closer look at why Vertiv could be the data center holding billionaire investors are piling into.

Vertiv Rides the AI Wave

Vertiv is a global leader in “critical digital infrastructure.” The company designs and sells hardware, from uninterruptible power supplies and batteries to advanced cooling systems and racks, for data centers, telecom networks, and edge computing facilities.

The company is leaning heavily into AI. Its $1 billion acquisition of PurgeRite, a specialist in fluid-purging and coolant services for high-density data centers, strengthens Vertiv’s liquid-cooling capabilities, key for powering AI server farms. On the innovation front, last year, Vertiv partnered with Nvidia under the DOE’s COOLERCHIPS program to co-design an 800-volt DC power and cooling system for next-generation AI chips. CEO Alberto Albertazzi said, “We have combined our leadership in power and cooling solutions with Nvidia’s cutting-edge platforms to support AI infrastructure deployment globally.” These moves position Vertiv squarely at the heart of the booming AI data center market.

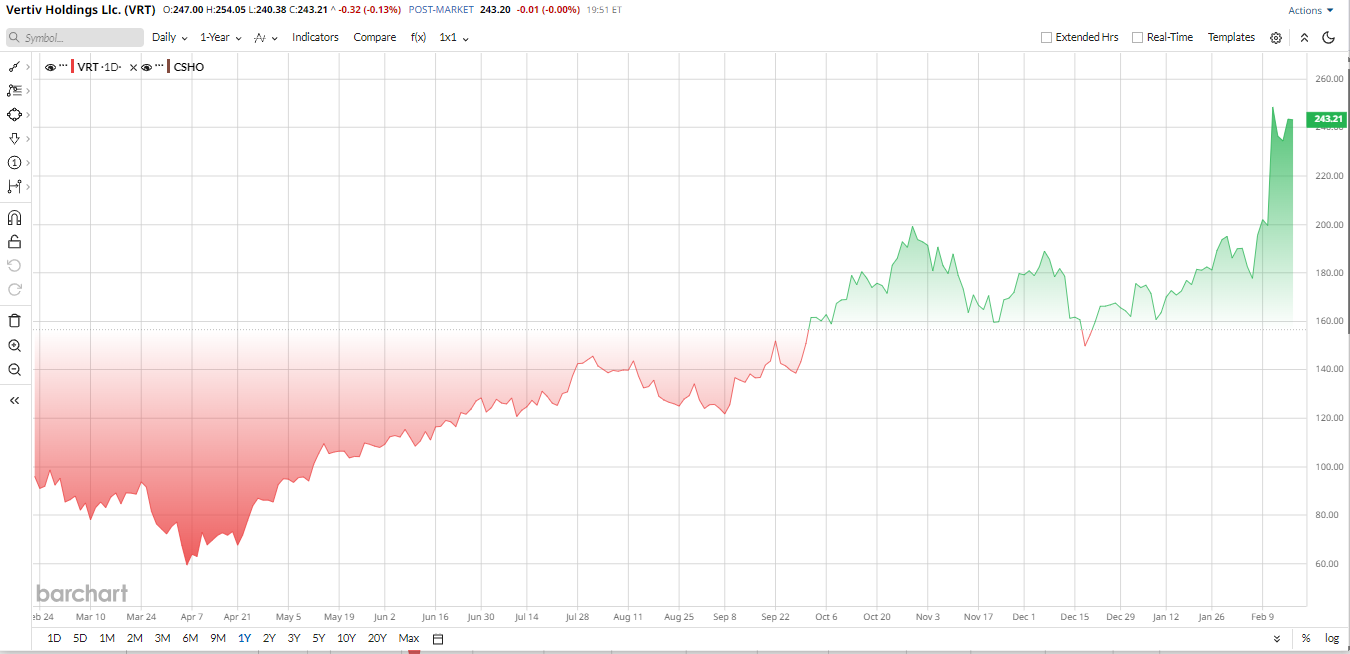

Vertiv shares have surged roughly 125% over the past year, with about 50% gains year-to-date (YTD). Investors cheered the company’s blowout Q4 2025 results, pushing the stock well above its 50-day moving average. Analysts credit the rally to robust AI-driven demand and a record backlog of orders.

However, that momentum comes at a cost. Vertiv now trades at a forward P/E near 40×, well above the electrical-equipment sector median of 25×. Still, with analysts projecting 43% EPS growth in 2026, the stock’s PEG sits near 1.0, suggesting investors are paying a premium that roughly aligns with its rapid growth outlook.

Coatue’s New Position and Implications

In its latest 13F filing, Coatue disclosed it bought about 828,947 shares of Vertiv in Q4, roughly a $134 million stake, 0.34% of the portfolio. This reported buy doesn’t change Vertiv’s fundamentals, but it is a clear vote of confidence from a prominent growth fund.

When a well-known investor adds a position, it tends to spark interest from others. In this case, Coatue’s move highlights Vertiv’s AI/data-center growth story as mainstream investors chase infrastructure plays.

For Vertiv, the long-term impact is mainly psychological; having a marquee buyer underlines management’s positive outlook and may help attract further investors. In the short term, any fund buying pressure can give the stock more lift.

Vertiv Reports Strong Q4 Sales

Vertiv’s Q4 2025 results reported last week were very strong. The company generated $2.88 billion in net sales, a 23% increase from Q4 2024, 19% on an organic basis. Demand exploded; Vertiv said organic orders were up 252% year-over-year (YoY), boosting its backlog to $15 billion, more than double the prior year’s.

Growth was broad-based. In the Americas region, sales grew about 46% organically in Q4, driven by hyperscale cloud and telecom expansions. Asia grew relatively slowly by about 9% while EMEA was down mid-single digits, but overall, every major customer segment contributed to the surge.

On the bottom line, Vertiv earned $1.36 in adjusted EPS, a 37% gain over Q4 2024. That topped the roughly $1.29 consensus estimate by about $0.10. EPS soared even more, as 2024 included one-time charges. Vertiv also reported healthy service growth: life-cycle services orders increased 25% in Q4, helped by the recent PurgeRite deal.

Cash flow and guidance show solid improvement. Operating cash flow in Q4 was $1.005 billion, more than double the prior year, and adjusted free cash flow was $910 million. With that cash, Vertiv spent about $1 billion on strategic acquisitions, notably PurgeRite, but still ended the quarter with $2.6 billion in liquidity and net debt of only 0.5× EBITDA.

CEO Giordano Albertazzi highlighted the quarter’s execution: “Our fourth quarter performance demonstrates Vertiv’s leadership position in an increasingly complex…data center market,” and noted that the “record backlog provides clear visibility” for future growth.

For 2026 guidance, Vertiv expects net sales of around $13.25 to $13.75 billion, about a 27 to 29% increase, and adjusted EPS of roughly $5.97 to $6.07, implying another year of roughly 40% plus EPS growth.

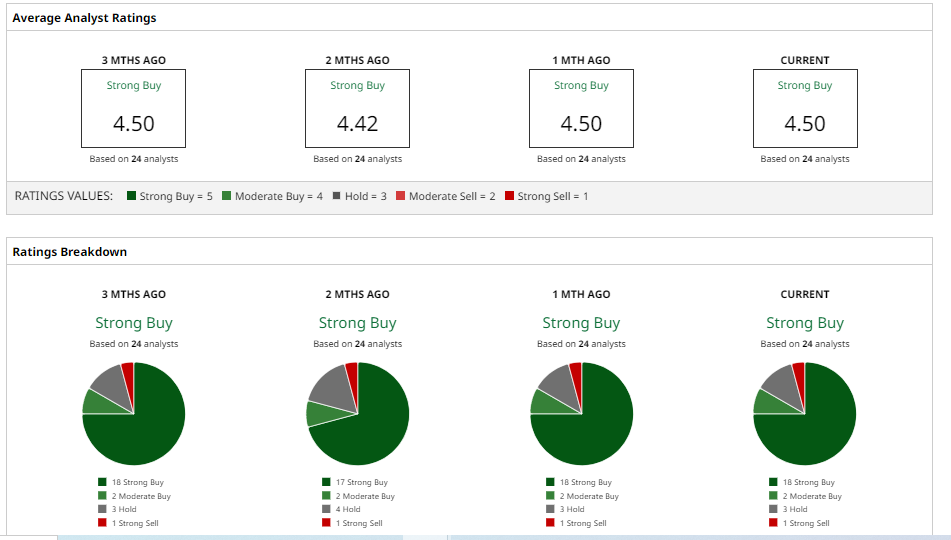

Analysts Opinion of VRT Stock

Wall Street has been very much favorable toward Vertiv. Numerous companies raised their price targets following the company's strong quarter.

Goldman Sachs increased its target to $277, up from $204, and maintained a “Buy” rating based on strong Q4 orders and a strong position in data center infrastructure.

Morgan Stanley raised its target to $285 from $200 and maintained an “Overweight” rating, commending Vertiv as an industry leader in innovation and a sustainable growth base.

Similarly, J.P. Morgan increased its price target to $305, the highest compared to its previous $225 objective, and rated it “Overweight.”

Overall, analysts have given VRT stock a consensus “Strong Buy” rating, citing that Vertiv has a massive backlog and autonomous demand, which justifies its high valuation. In most cases, the highs are seen as indicative of actual growth rather than hype. The 12-month consensus of $255.16 is forecast to have a modest 3% upside over its current level, indicating that the 12-month peak is in the 250 range. Recent positive news suggests further gains as prices soar.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart