With a market cap of $547.6 billion, Johnson & Johnson (JNJ) is a global healthcare company engaged in the research, development, manufacturing, and sale of a wide range of medical products worldwide. Through its Innovative Medicine and MedTech segments, the company delivers therapies and technologies spanning immunology, oncology, cardiovascular care, neuroscience, surgery, orthopaedics, vision care, and other critical healthcare areas.

Shares of the New Brunswick, New Jersey-based company have outperformed the broader market over the past 52 weeks. JNJ stock has climbed 50.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, JNJ stock has returned 9.8% on a YTD basis, compared to SPX's 1.8% rise.

Looking closer, shares of the world's biggest maker of health care products have also outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 5.6% return over the past 52 weeks.

Despite beating estimates with Q4 2025 adjusted EPS of $2.46 and revenue of $24.56 billion, Johnson & Johnson shares slipped marginally on Jan. 21. Key concerns included the expected “hundreds of millions of dollars” impact from a U.S. drug pricing deal and about $500 million in tariffs on its medical devices business, even as the company forecast strong 2026 sales of $99.5 billion - $100.5 billion.

Additionally, lingering talc litigation uncertainty, highlighted by a court recommendation allowing certain expert testimony, and weaker-than-expected declines in blockbuster Stelara sales weighed on investor sentiment despite the strong quarter.

For the fiscal year ending in December 2026, analysts expect JNJ’s adjusted EPS to grow nearly 7% year-over-year to $11.54. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

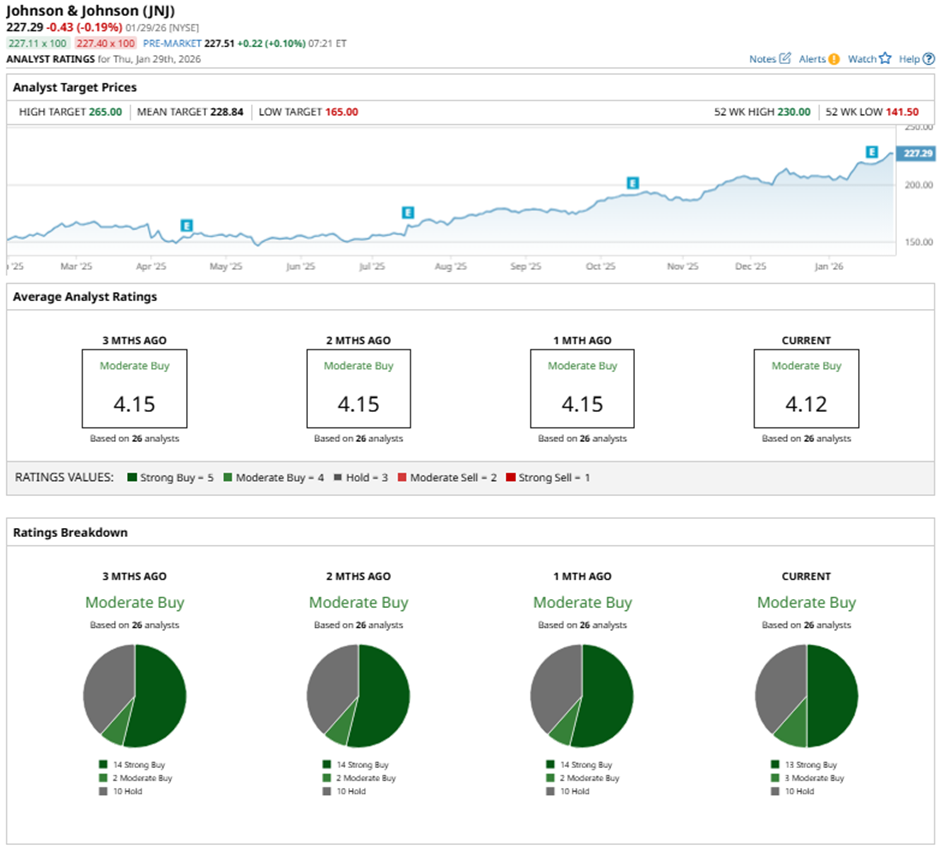

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and 10 “Holds.”

This configuration is slightly less bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Jan. 28, Morgan Stanley upgraded Johnson & Johnson's rating to “Overweight” and raised its price target to $262.

The mean price target of $228.84 represents a marginal premium to JNJ’s current price levels. The Street-high price target of $265 implies a modest potential upside of 16.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir Stock Is Now Oversold. Should You Buy the Dip in PLTR Before Feb. 2?

- Silver Price Predictions: Why JPMorgan Warns Silver Will Crash Back to $50 in 2026

- Stock Index Futures Slip as Trump Picks Warsh for Fed Chair

- This High-Yield Dividend Stock Is in Turbulent Water. Is the 6%+ Payout Worth It?