With a market cap of $70.5 billion, CSX Corporation (CSX) is a leading rail-based freight transportation company operating across the United States and Canada, providing rail, intermodal, and trucking-related services for a wide range of industries. With a 20,000-mile rail network east of the Mississippi River and a fleet of about 3,500 locomotives, CSX plays a critical role in moving commodities, manufactured goods, and energy resources efficiently.

Shares of the Jacksonville, Florida-based company have slightly underperformed the broader market over the past 52 weeks. CSX stock has increased 14.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. However, shares of the company are up 4.5% on a YTD basis, outpacing SPX’s 1.8% rise.

Focusing more closely, shares of the freight railroad have lagged behind the State Street Industrial Select Sector SPDR ETF’s (XLI) 20.4% return over the past 52 weeks.

Despite reporting weaker-than-expected Q4 2025 EPS of $0.39 and revenue of $3.51 billion on Jan. 22, shares of CSX rose 2.4% the next day. Investors were also encouraged by the company’s 31.6% operating margin, which increased 30 basis points year-over-year, along with stronger intermodal volumes, higher merchandise pricing, and increased fuel surcharge revenue. These positives helped offset concerns around softer industrial demand and lower export coal volumes that weighed on quarterly results.

For the fiscal year ending in December 2026, analysts expect CSX’s EPS to grow 15.5% year-over-year to $1.86. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions.

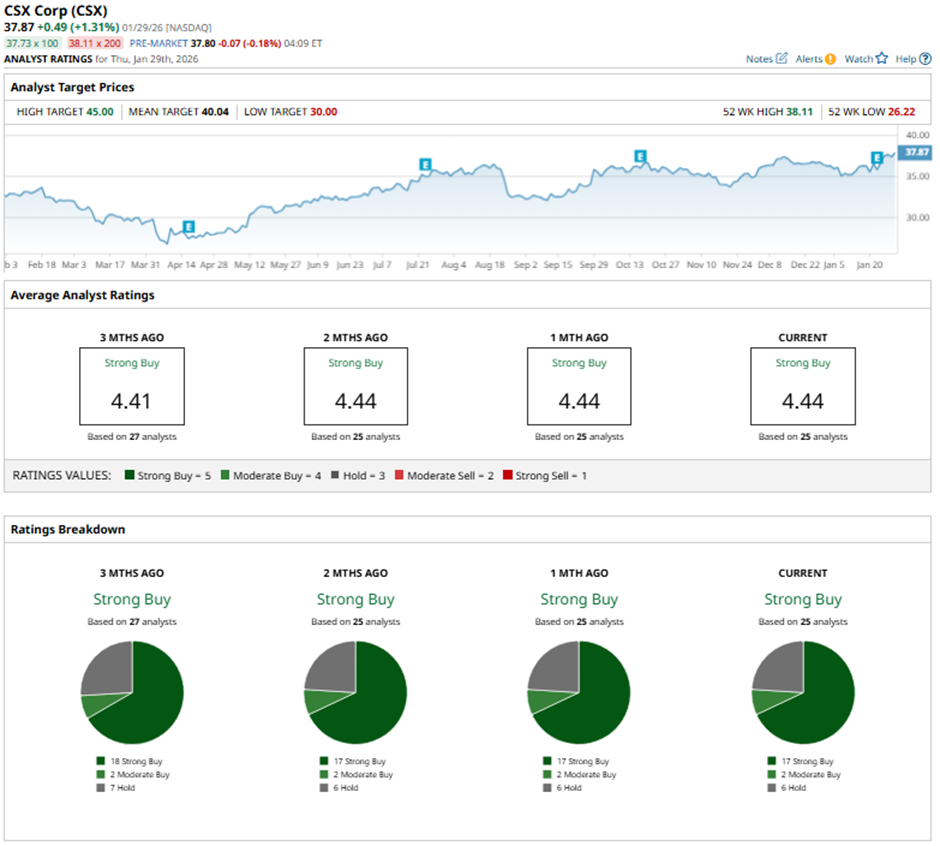

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” and six “Holds.”

This configuration is slightly less bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Jan. 23, Evercore ISI lowered CSX’s price target to $40 and maintained an “Outperform” rating.

The mean price target of $40.04 represents a 5.7% premium to CSX’s current price levels. The Street-high price target of $45 suggests a 18.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart