The consumer-discretionary sector has been under pressure amid economic uncertainty, as inflation and tariffs squeeze margins. Many pet and subscription-based retailers have seen choppy trading. In this environment, a surprise takeover bid for Bark (BARK) quickly grabbed traders’ attention.

On Jan. 9, Bark disclosed a non-binding $0.90 per-share go-private proposal from an insider group led by CEO and Executive Chairman Matt Meeker. The all-cash offer represents a sizable premium to recent prices and sent BARK shares surging more than 30% on Monday, putting the dog-focused consumer brand firmly back on traders’ radar.

With more than 10% of the float sold short and a special committee now reviewing the bid, BARK could be setting up for further volatility and potentially much sharper moves ahead.

About Bark Stock

Bark is a dog-first consumer brand built around toys, treats, and subscription services like BarkBox and Super Chewer, plus distribution through Target (TGT), Chewy (CHWY), and Amazon (AMZN). The company leans on data-driven product design and “experience” plays, from playstyle-specific toys to BARK Air, a 2022 airline experience for dogs, to deepen customer engagement and lift lifetime value.

Last October, Bark added a meaningful Subscriber Perks package, roughly $1,500 of annual benefits for BarkBox members, a clear push to boost subscriber value and monetization. The biggest market mover came on Jan. 9, 2026, when Great Dane Ventures floated a preliminary take-private proposal. The premium offer sent shares up 25% and put Bark squarely in play.

That volatility masks a rough 2025. Shares fell as growth slowed, demand softened, and costs rose, leaving BARK down about 50% over the past year. However, Monday’s 30% rally marked the start of a strong 2026 rebound amid takeover chatter, with investors now watching whether private capital could reset strategy and margins.

Valuation looks compelling. BARK trades at roughly 0.31× price/sales versus a 1.15× specialty-retail median, and price/book is near multi-year lows at 1.6×. Those trough multiples suggest upside if Bark can stabilize subscriber growth and improve margins, but weak profitability and rising costs are the key risks.

Take-Private Proposal and Short Interest

On Jan. 9, the board of Bark stated that it had a preliminary, non-binding, all-cash take-private deal with Great Dane Ventures, which consists of an investor group that also includes CEO Meeker, at a price of $0.90 per share. It was very high compared to past prices. The special committee, constituted within the board, has been formed to look at the offer and any other proposals. Debt to equity is high, approximately 10% of Bark's float quickly.

Since the number of short shareholders is so large, any sustained increase would pressure them to buy back the shares, which would multiply the increase many times over, a classic short squeeze. In case the take-private transaction collapses or is postponed, the stock can continue to be volatile.

Until the next moment, the deal of buying out is making traders move. Analysts indicate that BARK stocks are underpriced and highly beta, which increases stock volatility when short dealers rush to cover their short positions.

Bark Delivers Mixed Q2

Bark beat on revenue guidance but missed on earnings. In Q2, revenue was $107 million, down about 15% year-over-year (YoY). The decline was driven by fewer subscription orders; direct-to-consumer sales fell 20%, though commerce retail revenue grew 5.6% to $24.8 million. Gross margin dipped to 58% amid higher tariffs and input costs. The net loss widened to $10.7 million vs. a $5.3 million loss in the prior year. Free cash flow was negative $19.9 million, and cash on hand was $63.4 million.

However, the positive in this quarter was that the company repaid a $45 million convertible note, leaving it debt-free and extending its credit facilities to enhance financial flexibility. As CEO Matt Meeker noted, “We repaid our $45 million convertible note… making BARK debt-free, and extended our $35 million line of credit… We’re delivering on our plan to diversify our top line and remain disciplined on profitability.”

Looking ahead, Bark provided lower revenue guidance for the upcoming quarter, signaling continued market softness, with revenue expected to be between $101 million and $104 million and adjusted EBITDA between a loss of $5 million and $1 million. The company did not give full-year targets due to tariffs and macro uncertainties. Even so, management is focused on cost discipline and diversification.

What Do Analysts Say About BARK Stock?

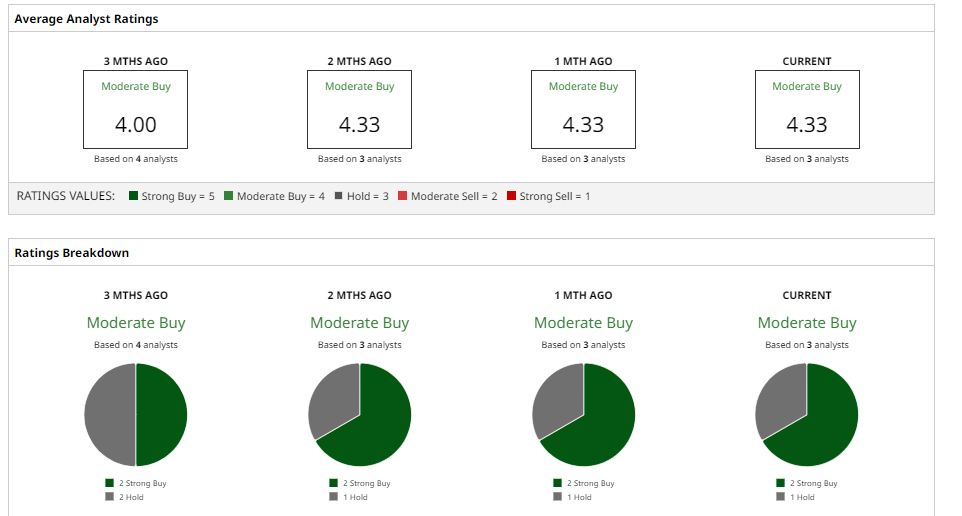

Analyst sentiment around Bark remains divided, but the setup is increasingly interesting. Canaccord Genuity turned more cautious after Bark’s Q4 shortfall, cutting its price target to $2 and reiterating a “Hold” rating, largely due to tariff-related cost pressures and a still-fragile consumer backdrop.

Lake Street Capital Markets and Jefferies, on the other hand, consider the risk-reward profile to be better. Lake Street maintains a “Buy” rating and a target of $3, while Jefferies maintains a higher target of $4. Those targets reflect about a 150 to 400% increase in stock price as compared to the current price of the stock.

The overall rating and consensus is a “Moderate Buy” and an average price target of $2.33, which means the stock has a potential upside of about 195%.

It is important to note that tariffs and ineffective discretionary spending are also real headwinds that constrain near-term earnings visibility, such as with skeptics. Nonetheless, as BARK continues to trade below its estimated FY26 sales and near historical lows, bulls believe it might be oversold.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Just Upgraded This 1 Lesser-Known Tech Stock. Should You Buy Shares Now?

- China Just Banned Broadcom’s Cybersecurity Solutions. What Does That Mean for AVGO Stock?

- As Mark Zuckerberg Unveils Meta Compute, Should You Buy, Sell, or Hold META Stock?

- After Apple Deal, Is Google — Not OpenAI — Now the Premier AI Stock?