MicroStrategy (MSTR) shares closed comfortably in the green on Dec. 9 as Bitcoin (BTCUSD) – the world’s largest cryptocurrency by market cap – rallied ahead of the Federal Reserve’s rate decision.

BTC pushed past $94,000 this morning as investors grew more optimistic that the U.S. central bank will deliver a “hawkish cut” on Thursday.

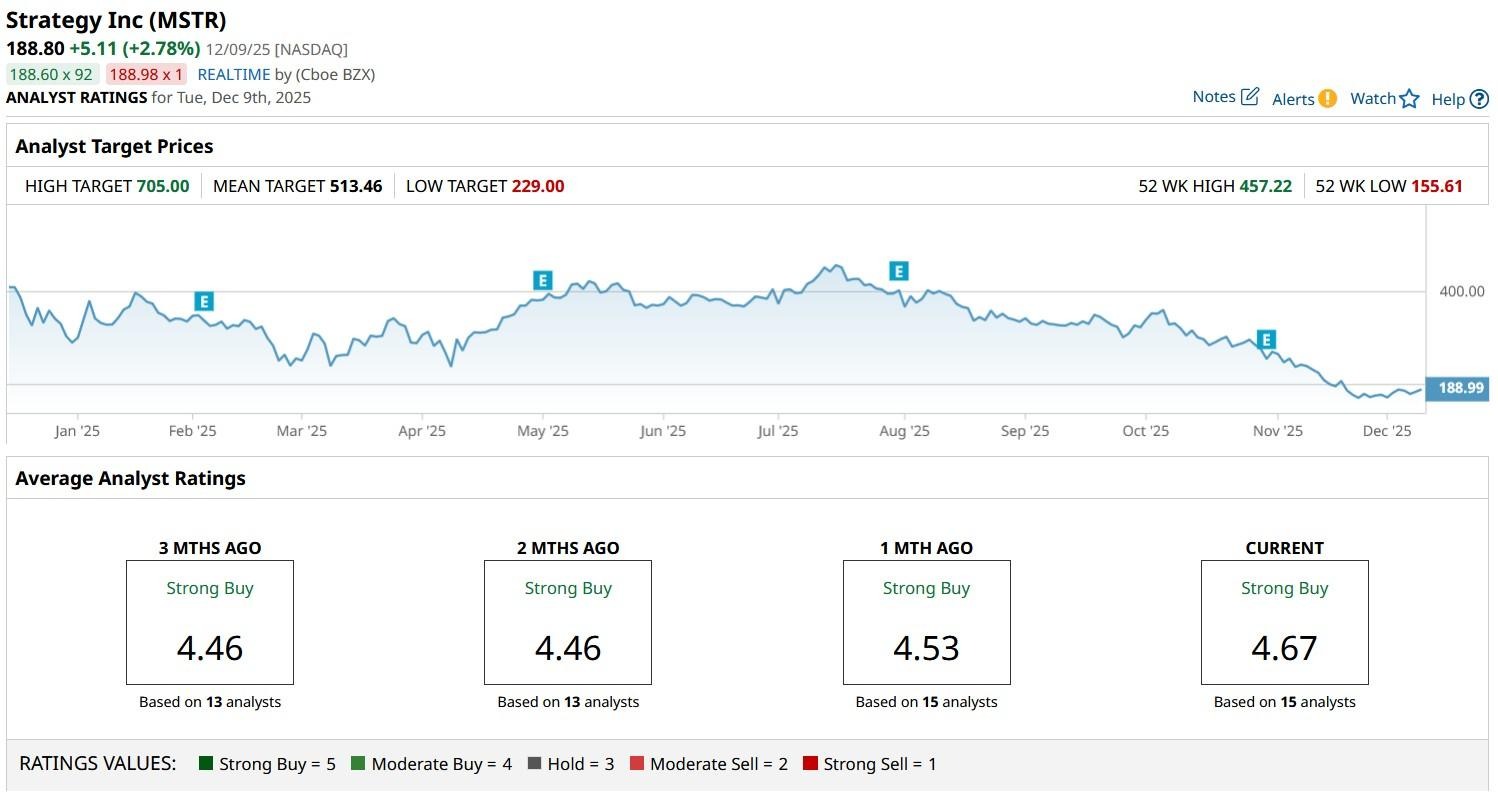

Despite today’s gain, MicroStrategy stock remains down over 50% versus its year-to-date high in mid-July.

Is It Worth Buying MicroStrategy Stock at Current Levels?

According to Jeremy Siegel, professor emeritus of finance at the Wharton School, the Federal Reserve will deliver a “hawkish cut” on Dec. 10.

A 25 basis-point reduction, as he projected in a CNBC interview this week, would likely improve investor appetite for risk-on assets, lifting sentiment across equities.

At the same time, lower short-term borrowing costs could fuel momentum in Bitcoin, which often rallies when monetary policy turns more accommodative.

This makes MSTR shares worth owning on the recent weakness because they stand to benefit from both stronger equity market dynamics as well as potential crypto gains.

In a way, MicroStrategy is positioned as a unique play on Fed easing.

BTC Rally to Drive MSTR Stock Higher in 2026

Standard Chartered’s senior analyst Geoff Kendrick continues to see BTC hitting $500,000 by the end of this decade, which makes for an additional reason to keep exposure to MicroStrategy shares.

In a research note on Tuesday, Kendrick dubbed the recent drawdown in BTC “normal,” adding the world’s largest cryptocurrency remains on track to hitting $150,000 in the coming year.

His revised forecast suggests potential upside of more than 55% in the crypto pioneer, which would almost certainly drive MSTR stock much higher given the company has over $60 billion worth of its on its balance sheet.

Note that options pricing also currently signals this crypto stock will exceed $240 in the first three months of 2026.

How Wall Street Recommends Playing MicroStrategy

What’s also worth mentioning is that Wall Street remains bullish as ever on MSTR shares heading into 2026.

The consensus rating on MicroStrategy stock currently sits at “Strong Buy” with the mean target of about $513 indicating potential for a more than 150% rally from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart