With a market cap of $53.4 billion, L3Harris Technologies, Inc. (LHX) is a leading global provider of mission-critical solutions for government and commercial customers, operating across four segments: Space & Airborne Systems, Integrated Mission Systems, Communication Systems, and Aerojet Rocketdyne. The company delivers advanced technologies ranging from satellite payloads and ISR systems to tactical radios and space propulsion.

Shares of the Melbourne, Florida-based company have outpaced the broader market over the past 52 weeks. LHX stock has returned 16.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. Moreover, shares of the company have soared 35.7% on a YTD basis, compared to SPX’s 12.5% gain.

Focusing more closely, shares of the technology and communications company have outperformed the Industrial Select Sector SPDR Fund’s (XLI) 7.9% rise over the past 52 weeks and a 13.7% YTD increase.

LHX shares rose 3.2% on Oct. 30 as the company reported stronger-than-expected Q3 2025 adjusted EPS of $2.70 and revenue of $5.66 billion. Investors also responded positively to the company’s record $6.7 billion in orders and its eighth consecutive quarter of adjusted segment operating margin expansion, with margins reaching 15.9%. Additionally, L3Harris raised its 2025 guidance and highlighted major new opportunities, including the $2.2 billion Korea AEW&C award.

For the fiscal year ending in December 2025, analysts expect L3Harris’ adjusted EPS to decrease 18.9% year-over-year to $10.63. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

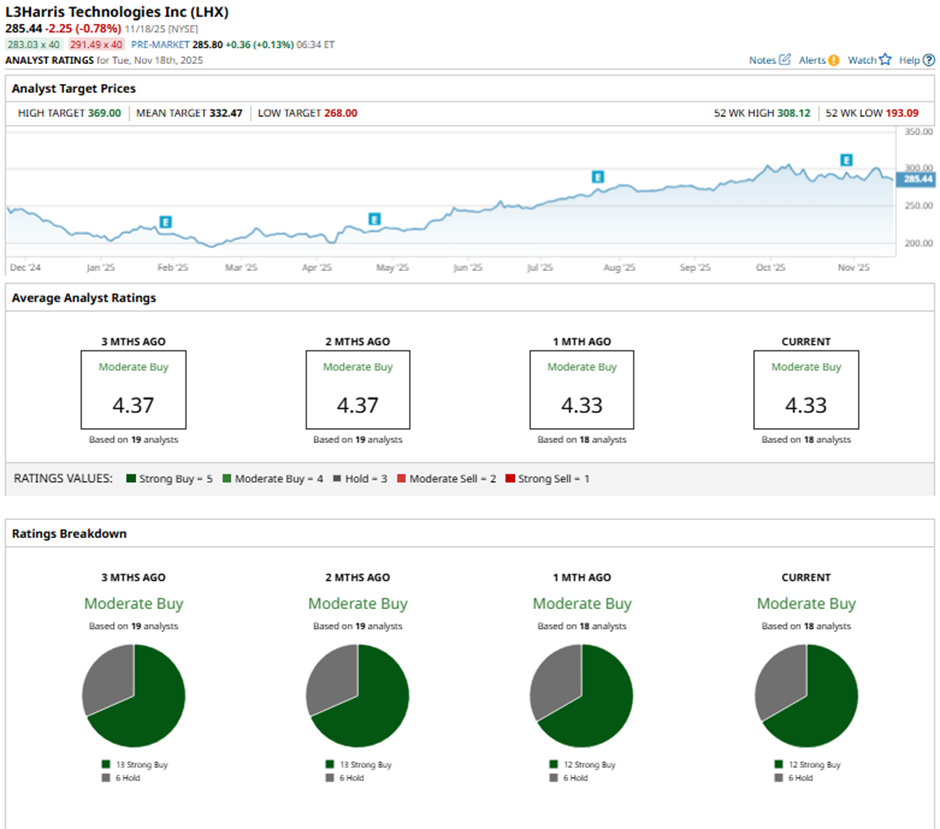

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings and six “Holds.”

This configuration is slightly less bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Nov. 12, Ronald Epstein of Bank of America Securities reiterated a “Buy” rating on L3Harris Technologies and maintained a $350 price target.

The mean price target of $332.47 represents a 16.5% premium to LHX’s current price levels. The Street-high price target of $369 suggests a 29.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart