Super Micro Computer (SMCI) shares closed 2.4% higher on Tuesday, Nov. 18 after the company launched a full-stack artificial intelligence (AI) factory cluster built on Nvidia’s (NVDA) Blackwell chips.

The solution that also features Nvidia’s Spectrum-X Ethernet and Supermicro’s own systems aims to simplify enterprise AI deployment at scale, with configurations ranging from 4 to 32 nodes and up to 256 GPUs.

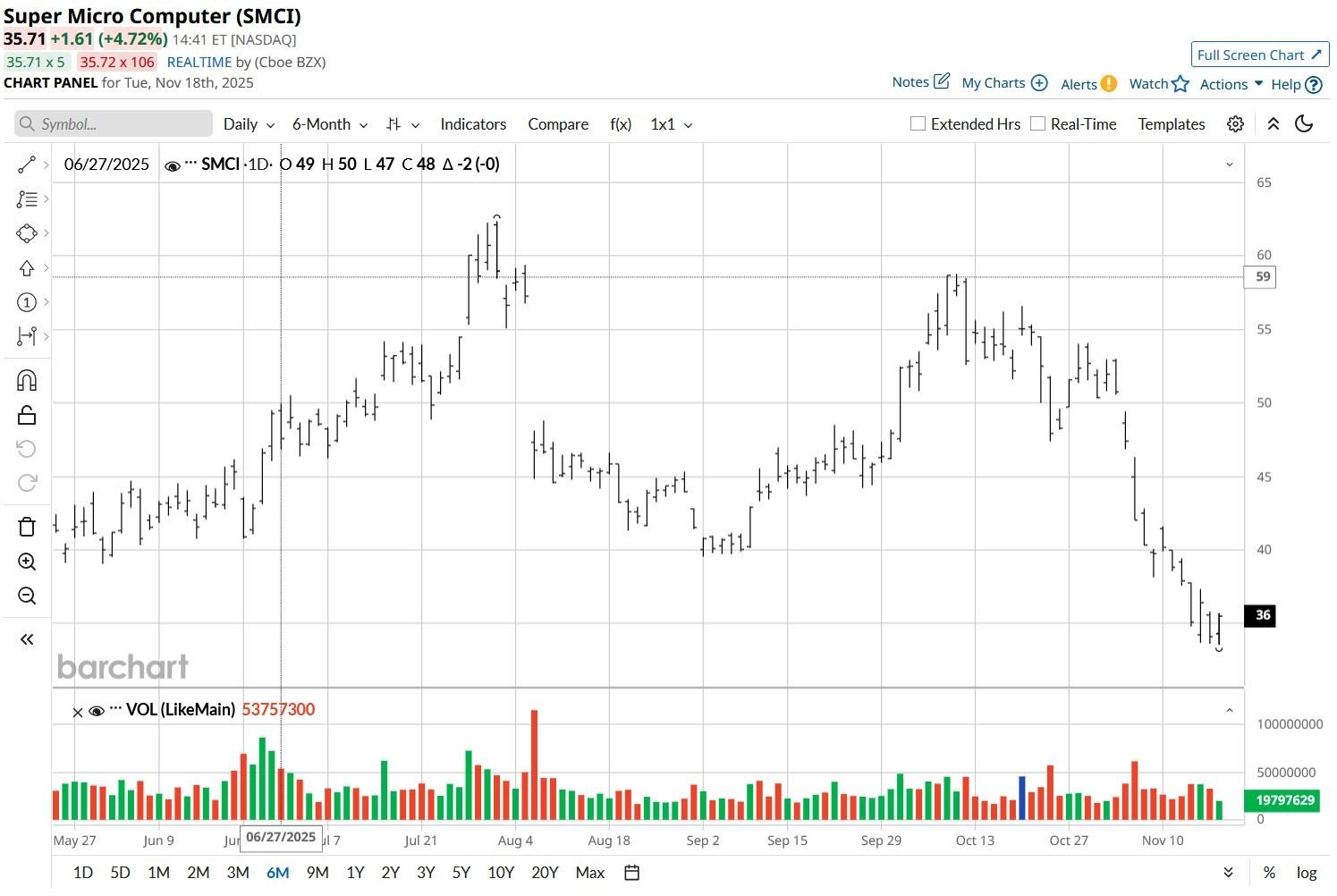

SMCI stock has been in a sharp downtrend ever since it reported the preliminary financials for its Q1. The AI server specialist is down more than 40% versus its October high.

What the New AI Factory Means for SMCI Stock

Supermicro’s new artificial intelligence factory cluster positions it as a major enabler of enterprise AI adoption.

Meanwhile, the integration of Nvidia’s software stack and networking improves overall performance and compatibility of its full-stack solution as well.

With demand for AI infrastructure surging, Supermicro’s modular, scalable offerings could attract orders from cloud providers, research labs, and Fortune 500 firms.

The launch could drive Supermicro shares higher over time as it reinforces the Nasdaq-listed firm’s reputation for rapid GPU integration, potentially expanding its market share in the AI server space.

Supermicro Shares Remain Unattractive for 2026

Despite the launch of a full-stack AI factory cluster, SMCI shares aren’t worth buying heading into 2026 mostly due to lingering concerns of subpar internal financial controls.

Its reliance on Nvidia architecture introduces vendor concentration risk, and the artificial intelligence factory model, while promising, is still unproven at scale.

Additionally, Supermicro faces margin pressure from rising component costs and competition from the likes of Dell (DELL) and HPE (HPE). That’s why insiders have primarily sold Super Micro shares over the past 12 months.

From a technical perspective, the AI server company is trading well below all of its major moving averages (50-day, 100-day, 200-day) – reinforcing that the bears remain fully in control.

How Wall Street Recommends Playing Super Micro Computer

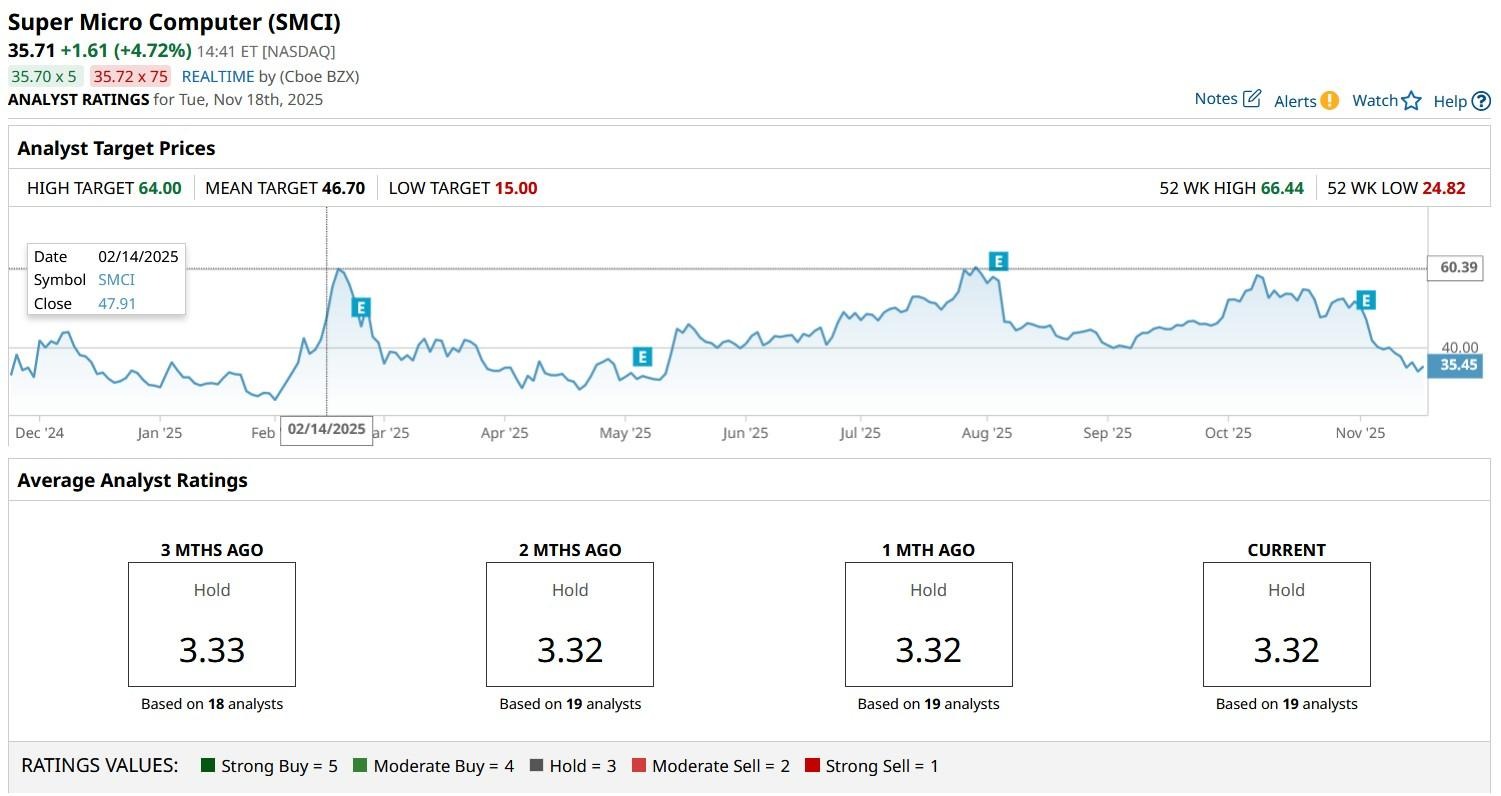

Wall Street analysts aren’t particularly constructive on SMCI stock either.

The consensus rating on Supermicro shares currently sits at “Hold” only with price targets going as low as $15, indicating potential “downside” of another 55% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart