Valued at a market cap of $55.9 billion, Phillips 66 (PSX) is a diversified U.S. energy manufacturing and logistics company based in Houston, Texas. It operates across midstream infrastructure, refining, chemicals, marketing and specialty products, and renewable fuels, with a growing focus on advancing lower-carbon energy solutions.

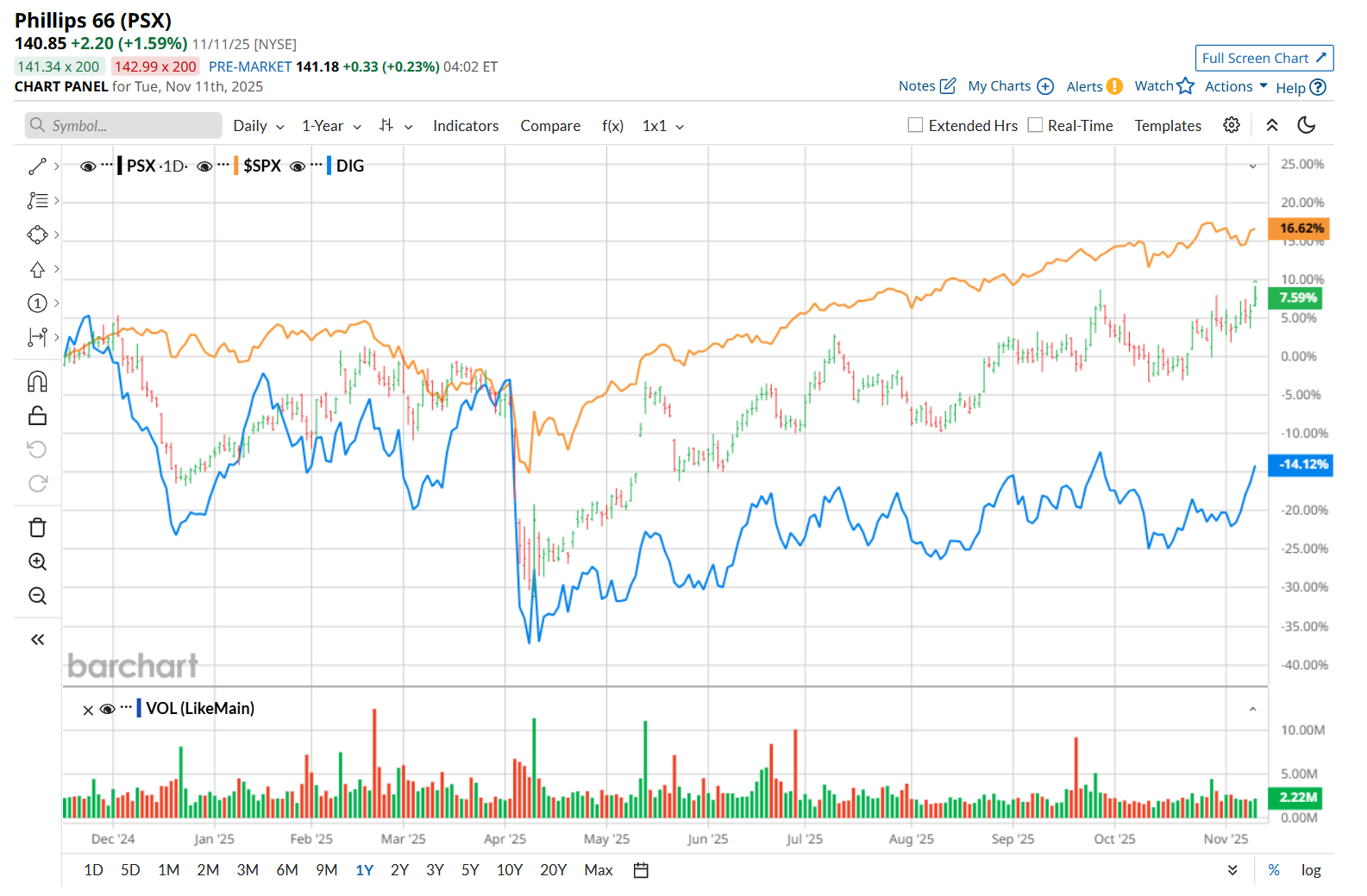

This energy company has lagged behind the broader market over the past 52 weeks. Shares of PSX have gained 10.1% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.1%. Nonetheless, on a YTD basis, the stock is up 23.6%, outpacing SPX’s 16.4% return.

Zooming in further, PSX has also outperformed the ProShares Ultra Energy’s (DIG) 13.6% downtick over the past 52 weeks and 5.1% YTD rise.

On Oct. 29, shares of PSX surged 3.3% after its Q3 earnings release. The company’s adjusted EPS of $2.52 grew 5.9% from the year-ago quarter, handily surpassing consensus expectations of $2.07. Moreover, its adjusted EBITDA of $2.6 billion increased 3.7% year-over-year, while its cash flow from operations climbed 39.4% from the same period last year to $1.2 billion. The upbeat performance was primarily driven by robust earnings growth in its chemicals segment, which operated at over 100% utilization and delivered solid returns despite a challenging market environment.

For the current fiscal year, ending in December, analysts expect PSX’s EPS to decline 8% year over year to $5.66. The company’s earnings surprise history is mixed. It exceeded consensus estimates in three of the last four quarters, while missing on another occasion.

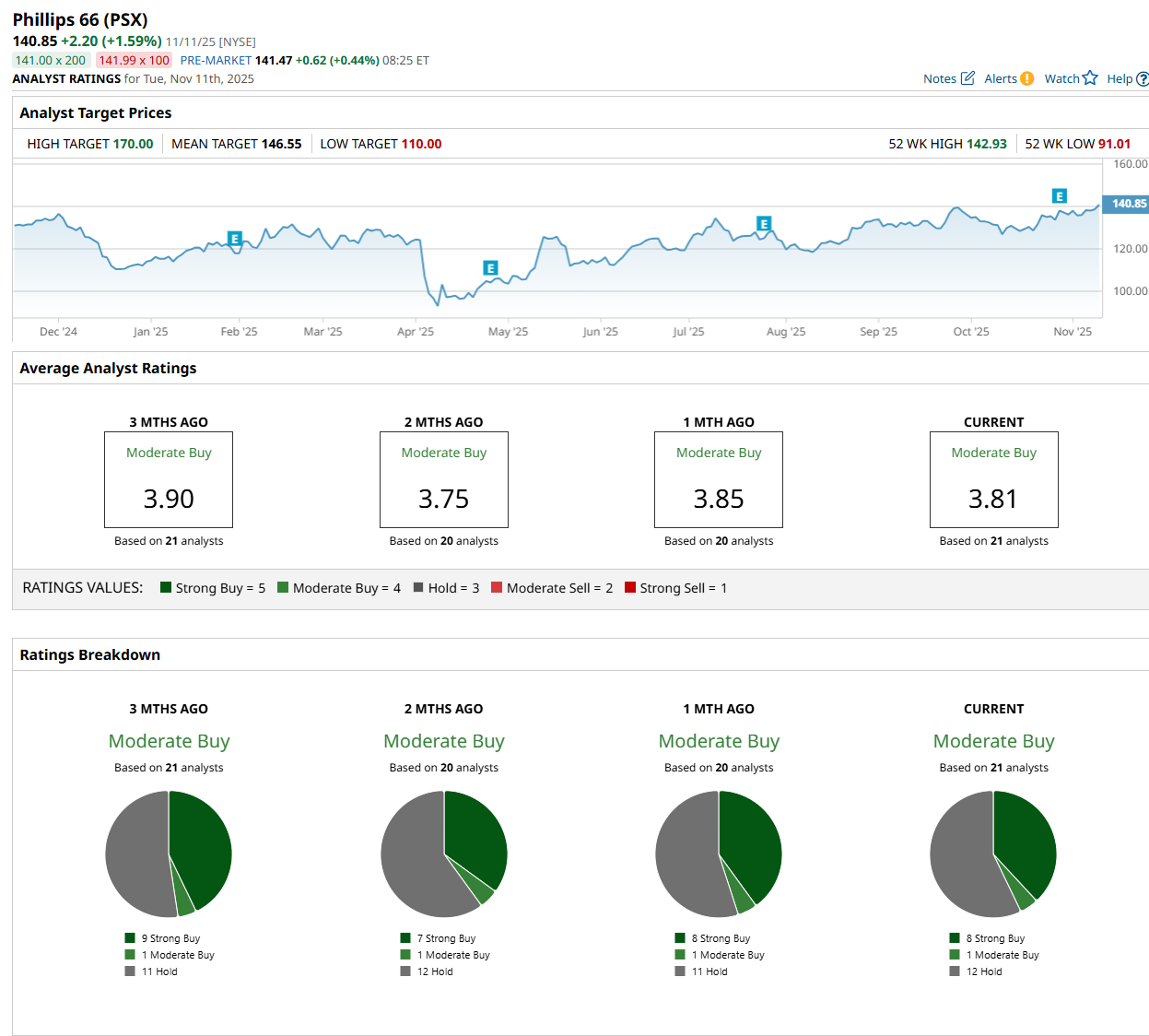

Among the 21 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 12 "Hold” ratings.

This configuration is slightly more bullish than two months ago, with seven analysts suggesting a “Strong Buy” rating.

On Nov. 3, Freedom Holdings Corp. (FRHC) analyst Sergey Pigarev downgraded Phillips 66 to “Hold” and set a price target of $138.

The mean price target of $146.55 represents a 4% premium from PSX’s current price levels, while the Street-high price target of $170 suggests an ambitiious 20.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Palantir Gets 6M Shares of Surf Air Mobility Stock, Is PLTR or SRFM a Better Buy?

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap