TORONTO, ON / ACCESS Newswire / April 16, 2025 / BNB Chain's DeFi ecosystem thrives with a $5.32 billion TVL as of March 2025, yet lending lags at $1.855 billion - far below Ethereum's 50% lending share of $46 billion or Base's $1.2 billion of $2.9 billion. This gap highlights an underserved market on BNB Chain, craving better rates, collateral options, and security. Lista Lending, from Lista DAO, fills this void with a decentralized, flexible protocol built to maximize BNB Chain's DeFi potential.

On April 11, Lista DAO launched Lista Lending, the new lending platform for the BNB Chain LSDFi ecosystem-and the market response was immediate. The initial BNB supply of $10 million was fully borrowed within an hour. In just four days, deposits had surpassed $189 million, with borrowing amount peaking above US$120 million. CZ reposted the launch, showing support for the product.

What is Lista Lending?

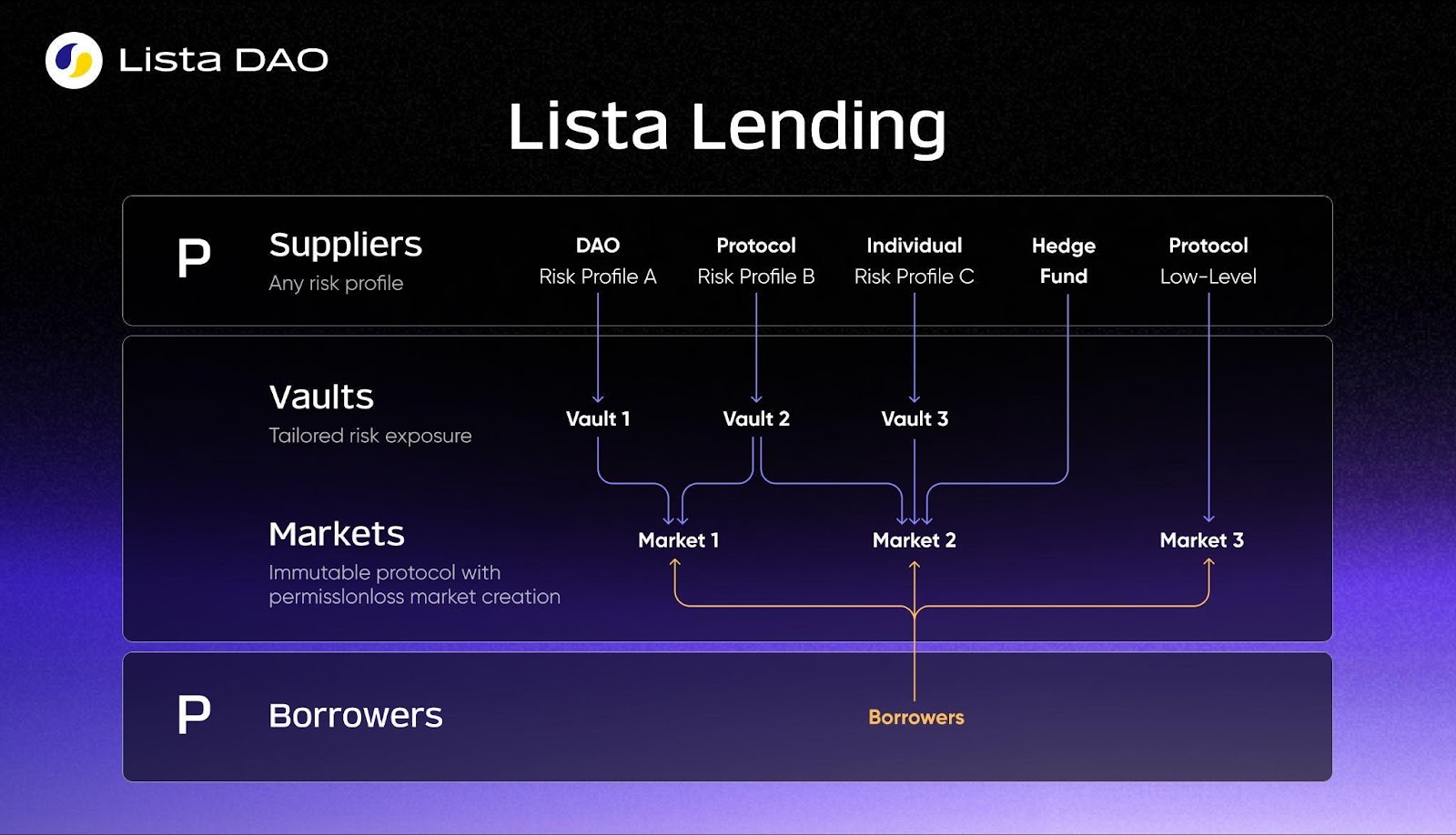

Lista Lending is a High-performance, Advanced and Open P2P lending on BNB chain. Built on an innovative P2P model and powered by advanced interest‑rate algorithms, it boosts capital efficiency, lowers borrowing costs, and offers stronger borrower protection.

The system is built around a dual-layer design vaults and markets. Suppliers deposit assets into vaults to earn interest, and those vaults route liquidity to different markets where borrowers can take over‑collateralized loans.

Vault Layer: Aggregates liquidity. Each vault supports one asset (eg.BNB) and allocates capital across multiple markets.

Market Layer: Permissionless creation of isolated lending markets (eg.BTCB/WBNB), each with its own parameters like liquidation thresholds and interest models.

Lista Lending now offers two vaults: BNB Vault and USD1 Vault.

BNB Vault holds over $169 million in deposits. Suppliers earn yield while borrowers can obtain WBNB by using BTCB, PT‑clisBNB, or solvBTC as collateral.

USD1 Vault brings WLFI's USD‑pegged stablecoin, USD1, to BNB Chain for the first time, opening a new on‑chain utility for the token.

Highlights of using Lista Lending:

When there is a Binance launchpool, BNB borrowing demand spikes because yields can hit ~29 % APY. With Lista Lending users can deposit BTCB, borrow BNB at rates as low as 2 %, and capture the Launchpool rewards-leaving plenty of spread for profit. Also supporting looping strategies for pt-clisBNB and more.

Why Lista Lending?

Current borrow rates on Lista Lending range from 0.58 % to 1.86 % across its markets. The interest rates are way lower than other protocols for lending on BNB chain, Lista Lending's consistently lower rates make it the more cost‑effective option.

Rethinking the Lending Model: From Pool-Based to P2P

Traditional lending protocols like Venus, Aave and Compound use pooled liquidity models, which lowers capital efficiency and concentrates risks. A single price shock could threaten all users.

This peer‑to‑peer model matches suppliers and borrowers directly, while a real‑time dynamic‑rate algorithm aligns interest with market supply and demand-delivering lower borrowing costs, higher deposit yields, and capital utilization of up to 90 %.

Lista Lending Security Measures

Also, Lista Lending has strong security measures such as the Multi-Oracle System, Upgradeable Contracts and more.

Multi-Oracle System

Lista Lending aggregates multiple data sources (Chainlink, Binance Oracle, and Redstone) to minimize price manipulation risks. Lista Lending leverages a multi-oracle system to ensure safer, more reliable price feeds. By pulling data from multiple sources, it cross-verifies asset values, reducing the risk of pricing errors or manipulation that could trigger unfair liquidations.

Upgradeable Contracts

With upgradeable smart contracts, Lista Lending can evolve over time, unlike static designs. This allows the team to roll out new features - like support for additional assets or advanced yield tools - fix bugs, or enhance performance as DeFi trends shift. It keeps the protocol competitive and responsive to users.

Other risk control measures such as 24-Hour Time-lock, Granular Permission Management, Reentrancy Protection, Audited Code & Ongoing Monitoring.

The core pillars of Lista DAO

Lista DAO is a BNB Chain native protocol-backed by Binance's YZi Labs and listed on Binance since June 2024-designed to power the BNBFi ecosystem through three integrated products:

lisUSD Stablecoin: Deposit collateral to mint lisUSD, a stablecoin providing scalable liquidity across the ecosystem.

slisBNB Liquid Staking: Liquid stake BNB to get slisBNB, a liquid token that unlocks staking rewards while enabling flexible use in lending or collateral

Lista Lending: A capital efficient P2P lending protocol through the use of curated vaults and isolated lending markets with different parameters rates.

Together, these pillars create a seamless DeFi stack-letting users mix and match stablecoin liquidity, liquid‑staking yields, and low‑cost lending strategies to unlock the full potential of BNBFi.

About Lista DAO

Lista DAO is the leading BNBFi protocol on BNB Chain, offering overcollateralized decentralized stablecoin (CDP), BNB LST, Lista Lending and innovative solutions that allow users to earn rewards from Binance Launchpool, Megadrop, and HODLer Airdrops. As the first to have DeFi BNB recognized for Binance Launchpool, Lista DAO has achieved a TVL growth of 896.92% year-to-date, reaching $1.1B, making it the fourth-largest protocol on BNB by TVL.

Contact:

Marketing

Kay

Lista DAO

zly@lista.org

SOURCE: Lista DAO

View the original press release on ACCESS Newswire